A Company Bought A Computer For 1500

Onlines

Mar 04, 2025 · 6 min read

Table of Contents

The $1500 Computer: A Deep Dive into ROI, Depreciation, and Business Impact

A seemingly simple transaction – a company purchasing a computer for $1500 – actually unravels into a complex web of financial implications, strategic decisions, and potential long-term impacts. This seemingly small expenditure can significantly affect a company's bottom line, productivity, and overall success. This article will explore the multifaceted aspects of this seemingly simple purchase, delving into its financial ramifications, its impact on productivity, and the strategic considerations involved.

The Financial Implications: More Than Just the Purchase Price

The initial $1500 cost is just the tip of the iceberg. Several other financial considerations must be factored in to accurately assess the true cost of ownership:

-

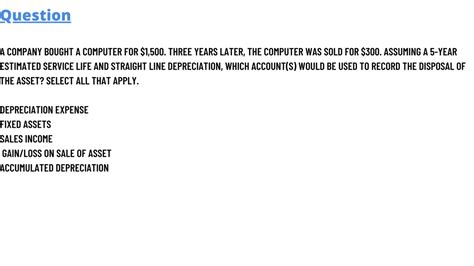

Depreciation: The computer's value will decrease over time. The Internal Revenue Service (IRS) offers several depreciation methods, such as straight-line depreciation (equal depreciation each year) or accelerated depreciation (higher depreciation in the early years). Understanding the depreciation schedule is crucial for accurate financial reporting and tax planning. For a $1500 computer, the depreciation schedule will significantly influence the reported asset value on the balance sheet over its useful life. Choosing the right depreciation method can optimize tax liabilities.

-

Maintenance and Repairs: Unexpected repairs and maintenance can significantly add to the total cost. This includes things like software updates, virus protection subscriptions, hardware repairs, and potential data recovery costs. Budgeting for these unforeseen expenses is crucial to prevent unexpected financial strain. A realistic estimate for maintenance and repair costs should be incorporated into the overall cost analysis of the computer.

-

Software Licenses: The cost of essential software (operating systems, productivity suites, specialized applications) should be factored into the total cost of ownership. These costs can quickly add up, especially if the company requires advanced or specialized software. The initial $1500 investment is only a part of the total investment required for the computer to be fully functional and productive.

-

IT Support: The company may require internal IT support or outsourcing to manage the computer, troubleshoot problems, and ensure optimal performance. The cost of IT support, whether internal or external, is a critical aspect of the overall cost calculation.

-

Opportunity Cost: The $1500 could have been invested elsewhere in the business. This opportunity cost represents the potential return on investment that was forgone by purchasing the computer. A thorough cost-benefit analysis should weigh the potential benefits against other investment opportunities.

Boosting Productivity: The Intangible ROI

While the financial aspects are quantifiable, the impact on productivity is often more challenging to measure but equally important. A new computer can lead to:

-

Increased Efficiency: A faster and more reliable computer can significantly improve employee efficiency. Tasks that previously took hours may now be completed in minutes. This increased efficiency translates into higher output and potentially reduced labor costs.

-

Reduced Errors: A modern computer with updated software is less prone to malfunctions and errors. This reduction in errors can save time and resources that would otherwise be spent correcting mistakes.

-

Improved Collaboration: With cloud-based services and collaboration tools, a new computer can enhance communication and teamwork. This improved collaboration can lead to more innovative solutions and more efficient project completion.

-

Access to Advanced Technology: A new computer provides access to the latest technologies, empowering employees with advanced tools and software that can significantly enhance their productivity and creativity. This access to cutting-edge tools can provide a competitive advantage.

-

Enhanced Employee Morale: Providing employees with modern, reliable equipment can boost morale and job satisfaction. Happy employees are generally more productive and engaged.

Strategic Considerations: Aligning the Purchase with Business Goals

The purchase decision shouldn't be made in isolation. It should align with the company's overall strategic goals:

-

Long-Term Investment: The computer is a long-term investment, not just a short-term expense. Its useful life will span several years, during which time it will contribute to the company's productivity and profitability.

-

Technological Alignment: The computer's specifications should align with the company's technological needs and future requirements. Investing in a computer that meets current and future needs is crucial for avoiding premature obsolescence.

-

Security: The computer's security features should be considered to mitigate potential data breaches and cyberattacks. Investing in robust security measures is crucial for protecting sensitive company data.

-

Scalability: The company should consider whether the chosen computer is scalable to accommodate future growth and increased workload. This ensures that the investment remains valuable as the company expands.

-

Sustainability: The environmental impact of the computer's lifecycle should also be considered. Companies are increasingly prioritizing sustainable technology choices. Choosing energy-efficient models is a responsible decision.

Measuring the Return on Investment (ROI): A Holistic Approach

Measuring the ROI of a $1500 computer is not simply a matter of comparing the initial investment to the direct financial return. It requires a more holistic approach, considering:

-

Quantifiable Metrics: Track increased productivity, reduced errors, and improved efficiency using quantifiable metrics. This could involve measuring task completion times, error rates, or sales figures. These metrics provide concrete data to demonstrate the return on investment.

-

Qualitative Assessment: Assess the qualitative impact, such as improved employee morale, enhanced collaboration, and better access to technology. These intangible benefits, while harder to measure, are equally important.

-

Long-Term Perspective: The ROI will not be immediately apparent. The benefits will accrue over the computer's lifespan. A long-term perspective is necessary to accurately assess the return on investment.

-

Comparative Analysis: Compare the performance and cost of the new computer to the previous system. This comparison will highlight the improvements in efficiency and productivity.

-

Benchmarking: Compare the investment and return against industry benchmarks. This comparison can provide insights into the efficiency of the purchase decision.

Beyond the Numbers: The Wider Business Context

The purchase of a $1500 computer has ramifications that extend beyond the immediate financial and operational considerations. It contributes to the company's overall image and brand perception:

-

Employee Perception: Providing employees with modern and efficient tools demonstrates the company's commitment to its workforce and fosters a positive work environment.

-

Client Perception: Using up-to-date technology can project a professional and efficient image to clients, which can enhance brand reputation and customer confidence.

-

Competitive Advantage: Access to cutting-edge technology can provide the company with a competitive advantage in the marketplace, allowing it to produce better results faster.

-

Technological Advancement: Investing in modern equipment enables the company to stay abreast of technological advancements and adapt to the ever-changing landscape of business.

-

Future-Proofing: Choosing a computer that is compatible with future software and hardware upgrades reduces the risk of premature obsolescence and protects the company's investment.

Conclusion: A Strategic Asset, Not Just an Expense

The $1500 investment in a computer is far more than simply an expenditure; it's a strategic investment in the company's future. By carefully considering the financial implications, potential productivity gains, and alignment with business goals, companies can ensure that this seemingly small purchase yields significant returns. A thorough understanding of depreciation, maintenance costs, and the intangible benefits of enhanced productivity is essential for maximizing the ROI. Ultimately, the success of the investment depends on effectively integrating the new technology into the company's overall operational strategy and measuring its impact over the long term. The $1500 computer, when properly integrated and managed, can become a powerful tool contributing to the company’s overall success. By adopting a comprehensive and strategic approach, the company can turn this seemingly small expense into a valuable asset that fuels growth and profitability for years to come.

Latest Posts

Latest Posts

-

Symbols In The Novel Lord Of The Flies

Mar 04, 2025

-

Records Are Considered Lost When The Following Conditions Are True

Mar 04, 2025

-

Catcher In The Rye List Of Characters

Mar 04, 2025

-

What Is The Awards Exploration Tool

Mar 04, 2025

-

What Do You Call A Potato Who Reads The News

Mar 04, 2025

Related Post

Thank you for visiting our website which covers about A Company Bought A Computer For 1500 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.