All Of The Following Entities Regulate Variable Life Policies Except

Onlines

Mar 26, 2025 · 5 min read

Table of Contents

All of the Following Entities Regulate Variable Life Policies Except…

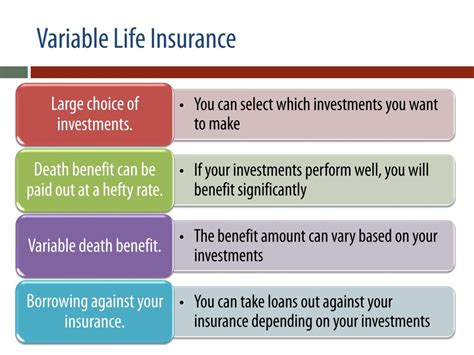

Variable life insurance policies, with their investment-driven cash value component, are complex financial instruments. Understanding the regulatory landscape surrounding these policies is crucial for both insurers and consumers. This article delves into the entities involved in regulating variable life insurance, clarifying which ones don't have direct oversight.

The Key Regulatory Players in the Variable Life Insurance Ecosystem

Several entities play a crucial role in overseeing the sale and operation of variable life insurance policies. Their responsibilities are interconnected, ensuring consumer protection and market stability. Let's examine the main players:

1. State Insurance Departments: The Primary Regulators

Individual state insurance departments hold the primary responsibility for regulating insurance companies within their respective jurisdictions. This means each state has its own set of rules and regulations concerning the sale, marketing, and administration of variable life insurance policies. These regulations cover various aspects, including:

- Solvency: Ensuring the insurance company has sufficient assets to meet its policy obligations. State departments conduct regular financial examinations to assess the insurer's financial strength and ability to pay claims.

- Product Approval: Reviewing and approving the policy forms, prospectuses, and other marketing materials before they can be offered to consumers. This ensures that the policy is appropriately designed, clearly explained, and does not contain misleading information.

- Sales Practices: Monitoring the sales activities of insurance agents and brokers to prevent unethical or misleading sales practices. This includes ensuring that agents provide consumers with accurate and complete information about the policy's features, risks, and costs.

- Consumer Complaints: Investigating consumer complaints related to variable life insurance policies and taking appropriate action to resolve disputes.

The specific regulations vary from state to state, but the overarching goal is to protect consumers from unfair or deceptive practices and ensure the financial stability of insurance companies.

2. The Securities and Exchange Commission (SEC): Overseeing the Investment Aspect

Given the investment component of variable life insurance policies, the SEC plays a vital role in regulating these products. Variable life insurance policies invest premiums in separate accounts, usually containing mutual funds or other securities. The SEC’s regulatory oversight focuses on:

- Prospectus Disclosure: Ensuring that the prospectuses accurately disclose the investment risks and potential returns associated with the separate accounts. The prospectus is a key document that consumers use to understand the policy's features and investment options.

- Registration of Securities: Requiring the registration of the securities offered within the separate accounts. This ensures that the securities are properly disclosed and meet the SEC's disclosure requirements.

- Anti-fraud Provisions: Enforcing anti-fraud provisions to prevent fraudulent or manipulative activities in the sale and management of variable life insurance policies. This protection extends to both the insurer and the investor.

- Investment Advisor Oversight: Indirectly overseeing investment advisors who manage the separate accounts. While not directly regulating the advisors themselves (that falls under other regulatory bodies), the SEC ensures that the investment strategies align with the prospectus and are appropriately disclosed.

3. The Financial Industry Regulatory Authority (FINRA): Regulating Broker-Dealers

FINRA, a self-regulatory organization for brokerage firms and exchange markets, plays a crucial role in overseeing the distribution of variable life insurance policies. They regulate the activities of broker-dealers who sell these products, focusing on:

- Sales Practices: Monitoring the sales practices of broker-dealers to ensure compliance with fair dealing standards and prevent fraudulent or manipulative sales practices.

- Suitability: Ensuring that broker-dealers recommend variable life insurance policies that are suitable for their clients' investment objectives, financial situations, and risk tolerance. This involves a thorough understanding of the client's needs and investment goals.

- Disclosure Requirements: Enforcing disclosure requirements to ensure that broker-dealers provide clients with complete and accurate information about the policy's features, risks, and costs. This helps clients make informed decisions.

- Training and Licensing: Setting training and licensing requirements for brokers selling variable life insurance products. This guarantees a minimum level of competence among those offering such complex financial products.

The Entity That Doesn't Directly Regulate Variable Life Policies: [The Answer]

While several entities are involved, the Federal Reserve (also known as the Fed) does not directly regulate variable life insurance policies. The Federal Reserve's primary responsibilities focus on monetary policy, banking supervision, and maintaining the stability of the U.S. financial system. While indirectly impacting the broader economic environment that influences insurance companies, the Fed does not have the direct regulatory authority over variable life policies that rests with state insurance departments, the SEC, and FINRA.

Understanding the Interplay of Regulatory Entities

It's crucial to understand that these regulatory bodies don't operate in isolation. Their responsibilities often overlap, creating a comprehensive framework for overseeing variable life insurance. For instance, a state insurance department might work with the SEC if an investigation reveals potential securities fraud. Similarly, FINRA might coordinate with state regulators to address sales practice violations. This collaborative approach ensures robust oversight and protection for consumers.

The Importance of Consumer Awareness

Consumers need to be aware of the regulatory framework governing variable life insurance. Before purchasing a policy, it's vital to:

- Read the Prospectus Carefully: Understand the investment options, risks, and fees associated with the policy.

- Ask Questions: Don't hesitate to ask your insurance agent or broker any questions you may have about the policy.

- Check the Insurer's Financial Strength: Assess the financial strength of the insurance company issuing the policy. Ratings from independent rating agencies can provide valuable insights.

- File Complaints: If you believe you have been subjected to unfair or deceptive sales practices, file a complaint with the appropriate regulatory authority.

By understanding the regulatory landscape and exercising due diligence, consumers can make informed decisions and protect themselves from potential risks associated with variable life insurance policies.

Conclusion: A Multi-Layered Regulatory System for Complex Products

Variable life insurance policies are intricate financial instruments demanding comprehensive regulation. The regulatory system described above, comprising state insurance departments, the SEC, and FINRA, provides a robust framework for consumer protection and market stability. While the Federal Reserve plays a significant role in the overall financial health of the country, its direct influence on variable life insurance is minimal. Consumers should always remember to be informed and actively participate in their financial decision-making, utilizing the available regulatory resources for guidance and protection. The shared responsibility between these agencies, and the consumer's due diligence, ensures a more stable and trustworthy market for variable life insurance.

Latest Posts

Latest Posts

-

Counselor Competency Can Be Assured If

Mar 29, 2025

-

Anatomy And Physiology Coloring Workbook Answer Key

Mar 29, 2025

-

Chapter 1 Summary Things Fall Apart

Mar 29, 2025

-

Assignment 2 1 Interpret Insurance Card Information

Mar 29, 2025

-

Miguel Y Rosa Estan Muy Cansados

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about All Of The Following Entities Regulate Variable Life Policies Except . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.