Application Problem 1 3 Accounting Answers

Onlines

Mar 28, 2025 · 6 min read

Table of Contents

Application Problem 1-3 Accounting Answers: A Comprehensive Guide

Many accounting students struggle with application problems, especially those involving complex scenarios and multiple steps. This comprehensive guide delves into a common application problem, typically found in introductory accounting textbooks, focusing on providing a detailed solution and explaining the underlying accounting principles. While I cannot provide answers directly tied to a specific textbook’s problem number (due to copyright restrictions and variations between editions), I will present a generalized problem and its solution, covering fundamental concepts that address the challenges found in Application Problem 1-3 type questions. This generalized approach ensures the explanation is applicable to a wide range of similar problems.

Understanding the Typical Structure of Application Problem 1-3

Application problems in introductory accounting, often numbered around 1-3, typically introduce a business scenario and require students to apply basic accounting principles to analyze and record transactions. These problems usually test understanding of:

- Debits and Credits: The fundamental double-entry bookkeeping system where debits increase asset, expense, and dividend accounts while decreasing liability, owner's equity, and revenue accounts. Credits work in the opposite manner.

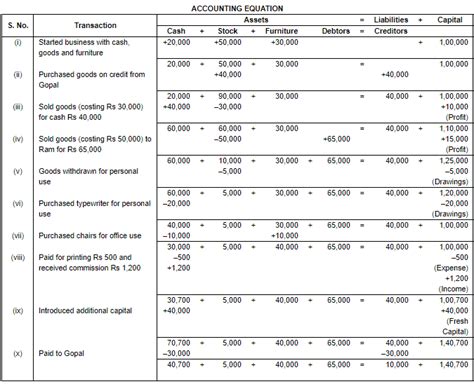

- Accounting Equation: The core equation of accounting: Assets = Liabilities + Owner's Equity. Every transaction must maintain this balance.

- Journal Entries: Recording transactions in a journal using debits and credits.

- T-Accounts: Visual representation of individual accounts showing debits and credits.

- Trial Balance: A summary of all general ledger accounts at a specific point in time, ensuring debits equal credits.

A Generalized Application Problem and Its Solution

Let's consider a generalized business scenario often reflected in Application Problem 1-3 type questions:

Scenario: "ABC Company, a newly established business, had the following transactions during its first month of operations:"

- Owner invested $50,000 cash in the business.

- Purchased equipment for $10,000 cash.

- Purchased supplies for $2,000 on account.

- Provided services to customers for $8,000 cash.

- Provided services to customers for $5,000 on account.

- Paid rent expense of $1,500 cash.

- Paid salaries expense of $3,000 cash.

- Received $4,000 cash from customers on account.

- Paid $1,000 on account for supplies purchased earlier.

Required: Prepare journal entries for each transaction, post them to T-accounts, prepare a trial balance, and analyze the financial impact of the transactions.

Detailed Solution:

Step 1: Journal Entries

Each transaction will be recorded as a journal entry with a debit and a credit, maintaining the accounting equation's balance.

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| Oct 1 | Cash | $50,000 | |

| Owner's Capital | $50,000 | ||

| Owner invested cash in the business. | |||

| Oct 5 | Equipment | $10,000 | |

| Cash | $10,000 | ||

| Purchased equipment for cash. | |||

| Oct 10 | Supplies | $2,000 | |

| Accounts Payable | $2,000 | ||

| Purchased supplies on account. | |||

| Oct 15 | Cash | $8,000 | |

| Service Revenue | $8,000 | ||

| Provided services for cash. | |||

| Oct 20 | Accounts Receivable | $5,000 | |

| Service Revenue | $5,000 | ||

| Provided services on account. | |||

| Oct 25 | Rent Expense | $1,500 | |

| Cash | $1,500 | ||

| Paid rent expense. | |||

| Oct 28 | Salaries Expense | $3,000 | |

| Cash | $3,000 | ||

| Paid salaries expense. | |||

| Oct 30 | Cash | $4,000 | |

| Accounts Receivable | $4,000 | ||

| Received cash from customers on account. | |||

| Oct 31 | Accounts Payable | $1,000 | |

| Cash | $1,000 | ||

| Paid on account for supplies. |

Step 2: T-Accounts

T-accounts visually represent the debits and credits for each account. Here are examples for a few key accounts:

Cash:

Cash

------------------------

Debit | Credit

---------|---------

$50,000 | $10,000

| $1,500

$8,000 | $3,000

$4,000 | $1,000

---------|---------

Balance: $40,500

Accounts Receivable:

Accounts Receivable

------------------------

Debit | Credit

---------|---------

$5,000 | $4,000

---------|---------

Balance: $1,000

Service Revenue:

Service Revenue

------------------------

Debit | Credit

---------|---------

| $8,000

| $5,000

---------|---------

Balance: $13,000

Step 3: Trial Balance

The trial balance summarizes all accounts to ensure the debits and credits are equal.

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $40,500 | |

| Accounts Receivable | $1,000 | |

| Supplies | $2,000 | |

| Equipment | $10,000 | |

| Accounts Payable | $1,000 | |

| Owner's Capital | $50,000 | |

| Service Revenue | $13,000 | |

| Rent Expense | $1,500 | |

| Salaries Expense | $3,000 | |

| Total | $58,000 | $58,000 |

Step 4: Financial Statement Analysis

The trial balance helps create financial statements. From the trial balance, we can see the company's assets ($53,500), liabilities ($1,000), and owner's equity ($52,500). This analysis allows for assessments of profitability (through Service Revenue and Expenses) and the overall financial health of ABC Company.

Advanced Concepts and Variations

Application problems may introduce more complex scenarios that build upon the fundamental concepts discussed above. These might include:

- Adjusting Entries: Accruals (revenue earned but not yet received, or expenses incurred but not yet paid) and deferrals (prepaid expenses or unearned revenue). These entries are made at the end of an accounting period to ensure revenue and expense recognition align with the accrual accounting principle.

- Depreciation: Allocating the cost of long-term assets (like equipment) over their useful lives.

- Inventory: Accounting for the purchase, sale, and valuation of inventory using methods like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out).

- Multiple Owners: Incorporating the contributions and withdrawals of multiple business owners.

Addressing these advanced concepts requires a thorough understanding of the foundational elements covered above. The core principles of debits, credits, the accounting equation, and proper transaction recording remain vital, regardless of the problem's complexity.

Mastering Application Problems: Tips and Strategies

Here are some strategies for tackling Application Problems in accounting:

- Read Carefully: Understand the scenario thoroughly before attempting any calculations. Identify the key transactions and their implications.

- Analyze Each Transaction: Break down each transaction into its debit and credit components, ensuring the accounting equation remains balanced.

- Use T-Accounts: Visualizing the accounts with debits and credits makes tracking easier and helps prevent errors.

- Prepare a Trial Balance: Regularly checking the trial balance ensures that debits equal credits, identifying potential errors early.

- Practice Regularly: Solving numerous problems is key to mastering accounting principles. Work through different scenarios to strengthen your understanding.

- Seek Help When Needed: Don't hesitate to ask your professor, TA, or classmates for assistance if you're struggling. Explaining your problem to someone else often helps you identify where you're making mistakes.

- Utilize Online Resources: While direct answers to specific problem sets should be avoided for academic integrity reasons, numerous online resources offer explanations of accounting principles and examples of similar problems. Focus on the principles and apply them to your unique problem set.

By consistently applying these strategies and focusing on understanding the underlying accounting principles, you can significantly improve your ability to solve application problems effectively and confidently. Remember, practice is key to mastering accounting. The more problems you work through, the more comfortable you'll become with the concepts and the better you'll be at identifying and solving accounting issues.

Latest Posts

Latest Posts

-

What Is A Decent Bowling Score

Mar 31, 2025

-

Cellular Respiration Graphic Organizer Answer Key

Mar 31, 2025

-

What Would Occur If An Unfocused Slide Image Was Downloaded

Mar 31, 2025

-

The Thematic Focus Of Nehemiah Is Rebuilding The Temple

Mar 31, 2025

-

Everything I Never Told You Characters

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Application Problem 1 3 Accounting Answers . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.