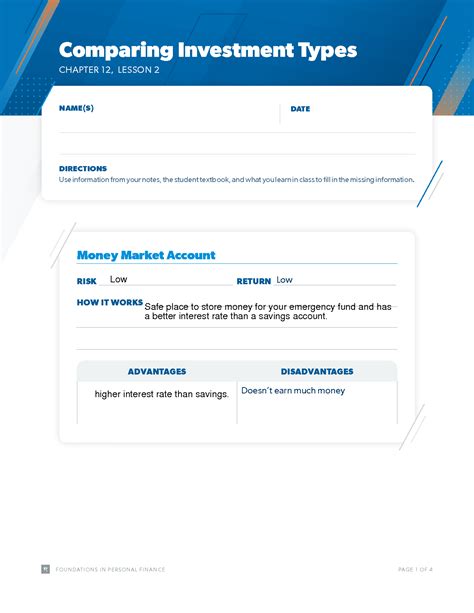

Comparing Investment Types Chapter 12 Lesson 2

Onlines

Mar 11, 2025 · 7 min read

Table of Contents

Comparing Investment Types: Chapter 12, Lesson 2 - A Deep Dive

This comprehensive guide delves into the diverse world of investment types, providing a detailed comparison to help you make informed financial decisions. We'll dissect various investment options, examining their risk profiles, potential returns, and suitability for different investor profiles. This in-depth analysis extends beyond a simple overview, aiming to equip you with the knowledge needed to navigate the complexities of the investment landscape.

Understanding Investment Fundamentals

Before diving into specific investment types, it's crucial to grasp fundamental concepts. Investment, at its core, is the commitment of capital with the expectation of generating future income or appreciation. This future gain can take various forms, including:

- Capital Appreciation: An increase in the value of an asset over time. For example, if you buy a stock for $100 and it rises to $150, you've experienced a $50 capital appreciation.

- Income Generation: Receiving regular payments from your investment, such as dividends from stocks or interest from bonds.

- Both Capital Appreciation and Income Generation: Some investments, like real estate, offer both potential for capital appreciation (property value increase) and income generation (rental income).

Understanding your investment goals – whether it's long-term wealth building, retirement planning, or short-term gains – is paramount in selecting appropriate investments. Your risk tolerance, the length of time you can commit your money, and your overall financial situation all influence your investment choices.

Major Investment Types: A Comparative Analysis

The investment world offers a vast array of choices. We'll focus on some of the most prevalent types, comparing their characteristics to provide clarity:

1. Stocks (Equities)

Stocks represent ownership in a company. When you buy stock, you become a shareholder, entitled to a portion of the company's profits (dividends) and voting rights (depending on the class of shares).

Advantages:

- High Growth Potential: Stocks historically offer the highest potential for long-term growth, outpacing other asset classes over the long run.

- Dividends: Many companies pay dividends, providing a stream of income.

- Liquidity: Stocks are relatively easy to buy and sell.

Disadvantages:

- High Risk: Stock prices can fluctuate significantly, leading to potential losses.

- Volatility: The stock market is inherently volatile, influenced by economic conditions, company performance, and investor sentiment.

- No Guaranteed Returns: There's no guarantee of profit when investing in stocks.

2. Bonds (Fixed Income)

Bonds are essentially loans you make to a government or corporation. In return, they promise to repay the principal (the amount you lent) plus interest over a specified period.

Advantages:

- Lower Risk than Stocks: Bonds are generally considered less risky than stocks, offering more stability.

- Regular Income: Bonds provide a steady stream of income through interest payments.

- Diversification: Bonds can help diversify your portfolio, reducing overall risk.

Disadvantages:

- Lower Returns than Stocks: Bond returns are typically lower than stock returns.

- Interest Rate Risk: Bond prices can fall if interest rates rise.

- Inflation Risk: Inflation can erode the real return on bonds.

3. Real Estate

Real estate involves investing in properties, whether residential, commercial, or industrial. Returns can come from rental income, capital appreciation, or both.

Advantages:

- Tangible Asset: Real estate is a tangible asset, offering a sense of security.

- Potential for High Returns: Real estate can appreciate significantly over time, generating substantial profits.

- Tax Advantages: Various tax benefits are often associated with real estate investment.

Disadvantages:

- Illiquidity: Real estate is generally less liquid than stocks or bonds. Selling a property can take time.

- High Initial Investment: Real estate often requires a significant upfront investment.

- Maintenance Costs: Property ownership involves ongoing maintenance and repair expenses.

4. Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

Advantages:

- Diversification: Mutual funds provide instant diversification, spreading risk across multiple investments.

- Professional Management: Funds are managed by professional investment managers.

- Accessibility: Mutual funds are relatively easy to buy and sell.

Disadvantages:

- Fees: Mutual funds charge fees, which can eat into returns.

- Performance Variability: Mutual fund performance can vary widely depending on the fund's investment strategy and market conditions.

- Lack of Control: You have limited control over the specific investments within a mutual fund.

5. Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds, but they trade on stock exchanges like individual stocks.

Advantages:

- Diversification: ETFs offer diversification across various asset classes.

- Low Costs: ETFs generally have lower expense ratios than mutual funds.

- Liquidity: ETFs are easily bought and sold throughout the trading day.

Disadvantages:

- Market Volatility: ETF prices can fluctuate with market conditions.

- Expense Ratios: Though generally lower than mutual funds, ETFs still have expense ratios.

- Limited Control: You have less control over the underlying assets within an ETF.

6. Commodities

Commodities are raw materials or primary agricultural products that can be bought and sold, such as gold, oil, or wheat.

Advantages:

- Inflation Hedge: Commodities can act as a hedge against inflation.

- Diversification: Commodities can diversify a portfolio, reducing overall risk.

- Potential for High Returns: Commodity prices can fluctuate significantly, offering potential for substantial gains.

Disadvantages:

- High Volatility: Commodity prices are notoriously volatile.

- Difficult to Store: Physical commodities require storage facilities.

- Market Speculation: Commodity markets are susceptible to speculation, influencing price movements.

Comparing Risk and Return

A fundamental principle of investing is the relationship between risk and return: higher potential returns generally come with higher risk. The following table summarizes the risk and return profiles of the investment types discussed:

| Investment Type | Risk Level | Return Potential |

|---|---|---|

| Stocks | High | High |

| Bonds | Moderate | Moderate |

| Real Estate | Moderate to High | Moderate to High |

| Mutual Funds | Moderate | Moderate |

| ETFs | Moderate | Moderate |

| Commodities | High | High |

This is a generalization, and the actual risk and return of any specific investment will depend on various factors.

Diversification: A Crucial Strategy

Diversification is a key element of successful investing. It involves spreading your investments across different asset classes to reduce risk. By diversifying, you're less vulnerable to significant losses if one particular investment performs poorly. A well-diversified portfolio might include a mix of stocks, bonds, real estate, and other asset classes, tailored to your individual risk tolerance and financial goals.

Choosing the Right Investment Strategy

The best investment strategy depends entirely on your individual circumstances, goals, and risk tolerance. Factors to consider include:

- Time Horizon: How long do you plan to invest your money? Longer time horizons generally allow for greater risk-taking.

- Risk Tolerance: How much risk are you comfortable taking? Your risk tolerance should influence your asset allocation.

- Financial Goals: What are you hoping to achieve with your investments? Retirement planning, buying a home, or funding your children's education all require different investment strategies.

Seeking Professional Advice

While this guide provides a valuable overview, it's crucial to remember that investing involves complexities. Consider consulting with a qualified financial advisor who can help you create a personalized investment plan aligned with your specific needs and goals. They can provide guidance on asset allocation, risk management, and tax implications, ensuring you make informed decisions that support your long-term financial well-being.

Conclusion: Navigating the Investment Landscape

The world of investing is multifaceted and dynamic. Understanding the various investment types, their risk profiles, and the importance of diversification is essential for building a successful investment portfolio. This detailed comparison provides a foundation for making well-informed decisions. Remember to conduct thorough research, consider your personal circumstances, and seek professional advice when necessary. Investing wisely is a journey that requires continuous learning and adaptation, but with careful planning and execution, you can work towards achieving your financial goals. Always remember that past performance is not indicative of future results, and all investments carry a degree of risk. This information is for educational purposes only and is not financial advice.

Latest Posts

Latest Posts

-

Brave New World Chapter 4 Summary

Mar 11, 2025

-

Game Of Thrones Book Story Summary

Mar 11, 2025

-

A Partition Between A Users Computer

Mar 11, 2025

-

What Theme Is Best Revealed By This Conflict

Mar 11, 2025

-

A Restraint Order Must Contain Which Of The Following

Mar 11, 2025

Related Post

Thank you for visiting our website which covers about Comparing Investment Types Chapter 12 Lesson 2 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.