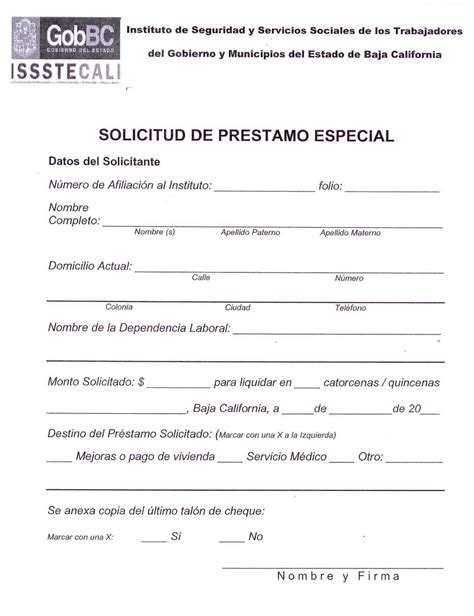

Debemos Llenar Este Formulario Cuando Solicitemos El Préstamo.

Onlines

Mar 25, 2025 · 6 min read

Table of Contents

Completing Loan Applications: A Comprehensive Guide to Filling Out Loan Forms Successfully

Applying for a loan can feel overwhelming, especially when faced with lengthy and complex forms. Understanding what information is required and why is crucial for a smooth and successful application process. This comprehensive guide will walk you through the process of filling out loan applications, ensuring you provide accurate and complete information to maximize your chances of approval.

Understanding the Importance of Accurate Information

Before diving into the specifics of filling out the forms, it's essential to understand why accuracy is paramount. Lenders use the information you provide to assess your creditworthiness and determine your eligibility for the loan. Inaccurate or incomplete information can lead to:

- Application Rejection: Incomplete or incorrect details can immediately disqualify your application. Lenders need a complete picture of your financial situation to make an informed decision.

- Delayed Processing: Missing information will cause delays as the lender attempts to contact you for clarification. This can significantly prolong the loan approval process.

- Loan Denial: Even if your application isn't rejected outright, inaccuracies can negatively impact your credit score and reduce your chances of securing a loan at a favorable interest rate.

- Legal Issues: In some cases, providing false information can have serious legal consequences.

Therefore, it's vital to treat the loan application process with utmost care and attention to detail.

Common Sections of a Loan Application Form

Loan application forms vary depending on the lender and the type of loan. However, most forms include the following key sections:

1. Personal Information:

This section typically requires basic identifying information, including:

- Full Legal Name: Use your legal name as it appears on your government-issued identification documents.

- Date of Birth: Provide your accurate date of birth.

- Social Security Number (SSN) or Tax Identification Number (TIN): This is crucial for verifying your identity and credit history.

- Address: Provide your current and complete mailing address.

- Phone Number and Email Address: Ensure these contact details are accurate and readily accessible.

Accuracy is key here. Any discrepancies between the information provided and official records can lead to delays or rejection.

2. Employment Information:

This section focuses on your employment history and income stability:

- Current Employer: Include your employer's name, address, and phone number.

- Job Title and Length of Employment: Be precise about your job title and the duration of your employment.

- Gross Monthly Income: Provide your gross monthly income (before taxes and deductions). This is a crucial factor in determining your repayment capacity.

- Previous Employers (if applicable): If you've changed jobs recently, provide details about your previous employers.

Providing a consistent employment history demonstrates financial stability and increases your chances of approval.

3. Financial Information:

This section delves into your financial standing:

- Bank Account Information: You'll need to provide your bank account details for direct deposit of loan proceeds and loan payments.

- Credit History: Lenders will typically perform a credit check to assess your creditworthiness. Be prepared for this process.

- Assets and Liabilities: You may be asked to list your assets (e.g., savings, investments, property) and liabilities (e.g., outstanding loans, credit card debts). Accuracy is paramount in this section.

- Monthly Expenses: Lenders will want to understand your monthly budget to determine your ability to repay the loan. Include housing, transportation, food, and other essential expenses.

Providing a clear and accurate picture of your financial situation allows lenders to assess your risk profile accurately.

4. Loan Details:

This section specifies the loan you are applying for:

- Loan Amount: Specify the amount you are seeking to borrow.

- Loan Purpose: Explain the intended use of the loan funds. Be clear and concise.

- Loan Term: Indicate the desired repayment period.

- Collateral (if applicable): If applying for a secured loan, detail the collateral being offered.

Clearly defining the loan details prevents misunderstandings and ensures you receive the loan amount and terms you need.

5. Authorization and Signatures:

This section typically includes:

- Authorization for Credit Check: You'll need to authorize the lender to perform a credit check.

- Signature: Sign and date the application to confirm the accuracy of the information provided.

This section formally authorizes the lender to process your application and confirms your understanding of the terms and conditions.

Tips for Successfully Completing Loan Applications

- Read the Instructions Carefully: Before starting, thoroughly read all instructions and guidelines provided by the lender.

- Gather Necessary Documents: Collect all necessary documents beforehand, such as proof of income, bank statements, and identification documents.

- Be Accurate and Complete: Double-check every piece of information for accuracy. Missing information will only delay the process.

- Use a Pen with Black or Blue Ink: This ensures legibility and avoids any issues with processing the application.

- Maintain Cleanliness: Avoid smudges or alterations that could cause confusion.

- Ask for Clarification: If you are unsure about anything, contact the lender directly for clarification before submitting the form.

- Proofread Thoroughly: Before submitting, review the entire application for any errors or omissions.

- Keep Copies: Always keep a copy of your completed application for your records.

Dealing with Loan Application Rejection

Even with careful preparation, your loan application might be rejected. If this happens, understand the reasons for rejection and address them before applying again. Common reasons for rejection include:

- Poor Credit Score: A low credit score indicates higher risk for lenders. Work on improving your credit score by paying bills on time and reducing debt.

- Insufficient Income: Insufficient income demonstrates an inability to repay the loan. Explore ways to increase your income or apply for a smaller loan amount.

- High Debt-to-Income Ratio: A high debt-to-income ratio suggests you already have a heavy debt burden, making it difficult to manage additional debt. Prioritize reducing existing debt before applying again.

- Incomplete Application: Ensure you thoroughly complete all sections of the application.

- Inaccurate Information: Provide only truthful and accurate information.

Types of Loans and Their Application Processes

Different loan types have varying application processes and requirements. Some common types include:

- Personal Loans: These are unsecured loans for personal use. Applications typically require details about your income, expenses, and credit history.

- Mortgage Loans: These are secured loans used to purchase a property. Applications are more extensive, requiring details about your income, credit score, employment history, and the property itself.

- Auto Loans: These loans finance the purchase of a vehicle. Applications will require information about your income, credit history, and the vehicle being purchased.

- Student Loans: These loans are used to finance education. Applications typically involve details about your enrollment status, academic progress, and financial need.

- Business Loans: These loans provide funding for businesses. Applications are often more extensive and require detailed financial statements, business plans, and projections.

Each loan type necessitates a tailored approach to the application process. Thoroughly research the specific requirements and guidelines for the type of loan you are seeking.

Conclusion:

Completing loan applications successfully requires accuracy, attention to detail, and a thorough understanding of your own financial situation. By following the guidelines outlined in this guide, you can significantly improve your chances of securing the loan you need. Remember, honesty and transparency are crucial throughout the application process. If you encounter any difficulties, don't hesitate to contact the lender for assistance. Taking the time to meticulously complete your loan application demonstrates responsibility and increases your chances of approval, paving the way for financial success.

Latest Posts

Latest Posts

-

When Resolving A Customers Issue You Should Sound Conclusive

Mar 26, 2025

-

Cassidy Is A Medical Assistant In A Hospital

Mar 26, 2025

-

What Percentage Of Errors Does Your Bodys Auto Correct System Detect

Mar 26, 2025

-

Ways That Organizations Can Create Structural Empowerment Include

Mar 26, 2025

-

Ap Physics 1 Unit 7 Progress Check Mcq Part A

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Debemos Llenar Este Formulario Cuando Solicitemos El Préstamo. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.