Fin 320 Final Project Financial Analysis Report

Onlines

Apr 07, 2025 · 6 min read

Table of Contents

FIN 320 Final Project: A Comprehensive Guide to Financial Analysis Reporting

This guide provides a comprehensive framework for tackling your FIN 320 final project, focusing specifically on crafting a compelling and insightful financial analysis report. We will cover essential aspects, from choosing the right company and data gathering to performing insightful analyses and presenting your findings effectively. Remember to always consult your course syllabus and professor's instructions for specific requirements.

I. Choosing Your Target Company

The selection of your target company is crucial. The company should offer sufficient publicly available financial data to conduct a thorough analysis. Consider factors like:

- Industry: Select a company from an industry you find interesting and understand reasonably well. This will make the analysis process more engaging.

- Data Availability: Ensure the company's financial statements (income statement, balance sheet, cash flow statement) are readily accessible through reliable sources like SEC filings (for US-listed companies) or the company's investor relations website.

- Company Size and Complexity: Start with a company of manageable size and complexity. Avoid extremely large multinational corporations initially, as their financial statements can be overwhelming for a beginner.

- Financial Health: While you will analyze the company's financial health regardless, choosing a company with reasonably strong historical performance can make the analysis easier and allow for more predictive modeling.

II. Gathering and Preparing Financial Data

Once you've chosen your company, you need to meticulously gather the necessary financial data. This typically involves:

- Income Statement (Profit & Loss Statement): This statement shows the company's revenues, expenses, and profits over a specific period. You'll need data for at least three years, preferably five, to establish trends.

- Balance Sheet: This statement provides a snapshot of the company's assets, liabilities, and equity at a specific point in time. You will need the balance sheet for the same periods as the income statement.

- Statement of Cash Flows: This statement tracks the movement of cash into and out of the company. It's crucial for understanding liquidity and solvency. Again, multiple years of data are needed.

- Industry Benchmarks: Gather data on comparable companies within the same industry. This will allow you to compare your chosen company's performance against its peers. Resources like Yahoo Finance, Google Finance, and industry-specific databases can be helpful.

Data Preparation: Before beginning your analysis, ensure your data is consistent and reliable. This includes:

- Currency Conversion: If analyzing international companies, convert all financial data into a single currency.

- Adjustments: Make any necessary adjustments for accounting changes or unusual events.

- Data Cleaning: Check for inconsistencies or errors in the data. Spreadsheet software like Excel or Google Sheets can help in organizing and cleaning your data.

III. Performing the Financial Analysis

This is the core of your project. Your analysis should be comprehensive and insightful, drawing meaningful conclusions from the data. Consider the following key areas:

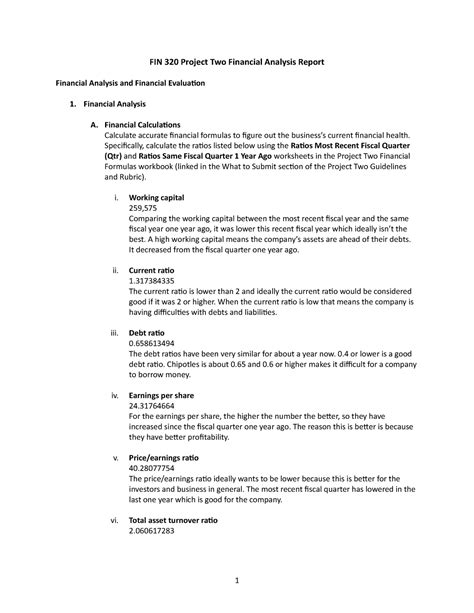

A. Ratio Analysis

Ratio analysis involves calculating various financial ratios to assess different aspects of the company's performance. Some essential ratios include:

- Liquidity Ratios: (Current Ratio, Quick Ratio) These measure the company's ability to meet its short-term obligations.

- Solvency Ratios: (Debt-to-Equity Ratio, Times Interest Earned) These measure the company's ability to meet its long-term obligations.

- Profitability Ratios: (Gross Profit Margin, Net Profit Margin, Return on Assets (ROA), Return on Equity (ROE)) These measure the company's ability to generate profits.

- Activity Ratios: (Inventory Turnover, Days Sales Outstanding) These measure the efficiency of the company's operations.

Interpreting Ratios: Don't just calculate the ratios; interpret their meaning in the context of the company's industry and historical performance. Compare your calculated ratios to industry averages and the company's past performance to identify strengths and weaknesses. Trends over time are as important as the single year's ratios.

B. Trend Analysis

Trend analysis involves examining the changes in key financial metrics over time. This helps identify patterns and predict future performance. Use charts and graphs to visually represent trends in revenues, expenses, profits, and other key indicators.

C. Common-Size Financial Statements

Common-size financial statements express each line item as a percentage of a base figure (e.g., total assets for the balance sheet, total revenue for the income statement). This facilitates comparisons across time periods and with competitors, highlighting changes in the relative importance of different financial items.

D. Cash Flow Analysis

Analyze the statement of cash flows to understand the company's cash inflows and outflows from operating, investing, and financing activities. Identify key sources of cash and areas where cash is being used. This analysis is particularly important for assessing the company's liquidity and sustainability.

E. Forecasting and Valuation (Optional, but highly recommended)

For a more advanced analysis, consider forecasting future financial performance using techniques like regression analysis or time series modeling. You can then use these forecasts to estimate the company's intrinsic value using valuation models like discounted cash flow (DCF) analysis. This adds a significant level of sophistication to your project. Note that forecasting is inherently uncertain, so clearly articulate your assumptions and limitations.

IV. Presenting Your Findings

The final report should be well-structured, clear, concise, and visually appealing. Consider the following:

- Executive Summary: Briefly summarize your key findings and conclusions. This section should be engaging and highlight the most important insights.

- Company Overview: Provide background information on the company, its industry, and its business model.

- Methodology: Describe your data sources and analytical techniques. This demonstrates the rigor of your analysis.

- Financial Analysis: Present your ratio analysis, trend analysis, common-size statements, and cash flow analysis in a logical order. Use tables and charts to present data effectively.

- Discussion and Interpretation: Discuss your findings, explaining their implications for the company's financial health and future prospects. Relate your findings to industry benchmarks and the company's strategic goals.

- Limitations: Acknowledge any limitations of your analysis, such as data availability or assumptions made in your forecasts.

- Conclusion: Summarize your key conclusions and provide recommendations for the company's future actions.

- Appendices (if necessary): Include supporting documents, such as detailed calculations and raw data.

Visual Aids: Use charts, graphs, and tables to present your data effectively. Visual aids make your report more engaging and easier to understand. Avoid overwhelming the reader with excessive data; focus on presenting the most relevant information clearly.

V. Ensuring Quality and Accuracy

- Accuracy: Double-check your calculations and ensure the accuracy of your data. Errors can significantly impact your conclusions.

- Clarity and Conciseness: Write in clear and concise language, avoiding jargon and technical terms that your audience may not understand.

- Professionalism: Maintain a professional tone throughout your report. Proofread carefully to eliminate grammatical errors and typos.

- Formatting: Use a consistent formatting style throughout your report. This enhances readability and professionalism.

VI. Beyond the Numbers: Adding Depth and Insight

While accurate calculations are paramount, merely presenting numbers isn't enough for a high-scoring FIN 320 project. Elevate your analysis by:

- Connecting Financial Data to Strategic Initiatives: Analyze how the company's financial performance reflects its strategic decisions and objectives.

- Industry Contextualization: Compare your analysis to industry trends and competitor performance. This provides crucial perspective on the company's position within its market.

- Qualitative Considerations: Don't ignore qualitative factors such as management quality, competitive landscape, and technological disruptions that can impact the company's financial performance.

- Critical Thinking: Go beyond simply reporting the data; critically analyze the findings, identifying potential risks and opportunities. Formulate well-supported opinions based on evidence.

By following this comprehensive guide, you'll be well-equipped to produce a high-quality financial analysis report for your FIN 320 final project. Remember that thoroughness, accuracy, and insightful interpretation are key to achieving a strong grade. Good luck!

Latest Posts

Latest Posts

-

The Knowledge Of Print Conventions Does Not Include

Apr 09, 2025

-

Chronicle Of A Death Foretold Symbolism

Apr 09, 2025

-

Macroeconomic Topics Do Not Usually Include

Apr 09, 2025

-

The Accompanying Graph Represents Haydens Fro Yo

Apr 09, 2025

-

With A Few Exceptions When Is Lockout Tagout Required

Apr 09, 2025

Related Post

Thank you for visiting our website which covers about Fin 320 Final Project Financial Analysis Report . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.