Financial Decisions And Opportunity Cost Answer Key

Onlines

Mar 30, 2025 · 7 min read

Table of Contents

Financial Decisions and Opportunity Cost: The Complete Answer Key

Making sound financial decisions is crucial for achieving personal and financial goals. However, navigating the complex world of finance often involves understanding and accounting for opportunity cost, a concept that significantly impacts the effectiveness of every financial choice. This comprehensive guide will delve into the intricacies of financial decisions, exploring various aspects and providing a detailed answer key to help you master this critical element of financial literacy.

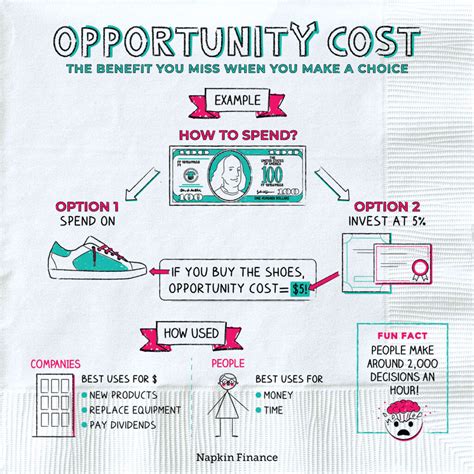

What is Opportunity Cost?

Opportunity cost represents the potential benefits an individual, investor, or business misses out on when choosing one alternative over another. It's not just about the monetary value; it encompasses all the potential gains that could have been realized from the forgone option. Essentially, it's the cost of what you give up to get something else.

Example: Imagine you have $10,000 to invest. You can either invest it in a high-yield savings account earning 5% annual interest or invest in a startup company with a potentially higher, but also riskier, return. If you choose the savings account, the opportunity cost is the potential higher return (and possibly higher risk) you could have gained from investing in the startup. Conversely, if you invest in the startup, the opportunity cost is the guaranteed 5% return from the savings account.

Key takeaway: Understanding opportunity cost helps make informed decisions by explicitly considering the trade-offs involved.

Types of Financial Decisions and Their Opportunity Costs

Numerous financial decisions involve opportunity cost considerations. Here are some key areas:

1. Investing: Stocks vs. Bonds vs. Real Estate

- Stocks: Offer high potential returns but carry higher risk. The opportunity cost of investing in stocks might be the lower but safer returns from bonds or real estate.

- Bonds: Generally considered lower-risk investments offering moderate returns. The opportunity cost includes potentially higher returns from stocks, but also increased risk.

- Real Estate: Can provide both income (rent) and appreciation, but requires significant capital and carries various associated costs (maintenance, property taxes). The opportunity cost might be the higher liquidity and potentially higher returns offered by stocks or bonds.

Answer Key: The best investment depends on your risk tolerance, time horizon, and financial goals. There's no single "right" answer; the optimal choice minimizes your opportunity cost given your individual circumstances.

2. Saving vs. Spending

- Saving: Prioritizing saving reduces immediate gratification but builds wealth over time. The opportunity cost is the immediate enjoyment or purchase you forgo.

- Spending: Provides instant gratification but may hinder long-term financial goals. The opportunity cost is the potential future value of the saved money, such as compounded interest, investment growth, or reduced debt.

Answer Key: The ideal balance between saving and spending is personal and depends on your financial situation, goals, and risk tolerance. A well-defined budget helps minimize the negative opportunity cost of either extreme.

3. Debt Management: Paying Down Debt vs. Investing

- Paying Down Debt: Reducing debt decreases interest payments and improves your credit score. The opportunity cost is the potential returns you could have earned by investing the money used to pay down debt.

- Investing: Investing allows your money to grow, potentially exceeding inflation. The opportunity cost is the faster debt reduction and potential reduction in financial stress that comes from prioritizing debt repayment.

Answer Key: High-interest debt often demands priority repayment to minimize interest charges and avoid escalating debt. However, once high-interest debt is under control, investing a portion of your income can provide long-term financial benefits. The optimal balance depends on interest rates, investment potential, and your overall financial situation.

4. Career Choices: Salary vs. Job Satisfaction

- High-Salary Job: Offers greater financial security but might involve less job satisfaction or work-life balance. The opportunity cost is the potential fulfillment and personal well-being derived from a more fulfilling, lower-paying job.

- Fulfilling Job: Might offer greater job satisfaction but potentially lower income. The opportunity cost is the potential for higher earnings and faster wealth accumulation associated with a higher-paying job.

Answer Key: Career choices often involve complex trade-offs between income and personal fulfillment. Understanding your priorities and aligning your choices with your values will help minimize the opportunity cost. Consider the long-term implications of each choice, including potential for career advancement and earning potential.

5. Education and Training: Cost vs. Future Earnings

- Further Education: Increases skills and knowledge, potentially leading to higher future earnings. The opportunity cost is the time and money spent on education, which could have been used for immediate income generation or other investments.

- Immediate Employment: Provides immediate income but might limit long-term earning potential. The opportunity cost is the potential for higher future earnings and career advancement that further education could have offered.

Answer Key: The value of education is often reflected in higher future earning potential. However, it’s crucial to assess the potential return on investment (ROI) of education, considering tuition fees, living expenses, and potential increase in earning capacity.

Calculating Opportunity Cost

While not always easily quantifiable, opportunity cost can be estimated. The process often involves:

- Identifying Alternatives: Clearly define the different options available.

- Assessing Potential Benefits: Estimate the potential gains associated with each alternative. This may involve researching market rates, potential investment returns, or projected salary increases.

- Choosing the Best Alternative: Select the option that aligns best with your goals and risk tolerance.

- Calculating the Difference: The opportunity cost is the difference between the benefits of the chosen alternative and the benefits of the next-best alternative.

Example: Let's say you have $5,000 to invest.

- Option A: Invest in a bond yielding 3% annually. Potential return after one year: $150.

- Option B: Invest in a stock with a projected return of 8% annually. Potential return after one year: $400.

If you choose Option A (the bond), the opportunity cost is $250 ($400 - $150), representing the potential return forgone by not choosing Option B.

Note: This is a simplified calculation. Real-world calculations often involve more complex factors such as risk, inflation, and taxes.

Minimizing Opportunity Cost

Several strategies can help minimize the negative impact of opportunity cost:

- Conduct Thorough Research: Gather information to understand the potential benefits and drawbacks of each option.

- Set Clear Financial Goals: Defining your goals provides a framework for evaluating alternatives and choosing options that align with your objectives.

- Develop a Budget: A well-structured budget helps manage resources effectively and allocate funds strategically towards achieving your goals.

- Diversify Investments: Spreading investments across different asset classes can mitigate risk and potentially increase overall returns.

- Seek Professional Advice: Consulting with a financial advisor can provide expert guidance and help navigate complex financial decisions.

- Regularly Review and Adjust: Financial circumstances and goals evolve over time. Regularly review your financial decisions and make adjustments as needed.

Opportunity Cost and Long-Term Financial Planning

Opportunity cost is not just a short-term consideration; it's a crucial factor in long-term financial planning. Failing to account for opportunity cost can significantly impact the achievement of long-term financial goals such as retirement planning, homeownership, or starting a business.

For example, delaying saving and investing during your earning years incurs a significant opportunity cost due to the lost potential for compound interest growth. Similarly, making poor investment choices can lead to substantial losses and missed opportunities for wealth accumulation.

Conclusion: Mastering Opportunity Cost for Financial Success

Understanding and effectively managing opportunity cost is paramount to making informed financial decisions. It's about recognizing the trade-offs involved in every choice and striving to maximize the benefits while minimizing potential losses. By diligently following the principles outlined in this guide, you'll equip yourself with the knowledge and tools to navigate financial choices effectively and achieve your long-term financial goals. Remember that the key is not to eliminate opportunity cost, which is impossible, but to consciously minimize its negative impact and maximize the positive aspects of your chosen path. Consistent learning, thoughtful planning, and a proactive approach to financial management will empower you to make sound decisions and build a secure financial future.

Latest Posts

Latest Posts

-

Gramatica C Subject Pronouns And Ser Answer Key

Apr 01, 2025

-

I Look Into My Glass Reveals Elements Of Romanticism Through

Apr 01, 2025

-

Discrete Mathematics With Applications 5th Edition Solutions Pdf

Apr 01, 2025

-

Physioex 9 0 Exercise 9 Activity 5

Apr 01, 2025

-

You Should Not Attempt To Lift A Patient

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Financial Decisions And Opportunity Cost Answer Key . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.