Financial Goal Worksheet Sudent Handout 2b

Onlines

Mar 03, 2025 · 7 min read

Table of Contents

Financial Goal Worksheet: A Student's Guide to Achieving Financial Success (Student Handout 2B)

This comprehensive guide serves as a student handout (2B) designed to help you create a robust and effective financial goal worksheet. We’ll delve into the importance of financial planning, explore different types of financial goals, and provide a step-by-step process to create a personalized worksheet tailored to your specific needs and aspirations. By the end of this guide, you’ll possess the tools and knowledge to confidently navigate your financial future.

Understanding the Importance of Financial Goal Setting

Before we dive into the worksheet itself, let's establish the crucial role financial goal setting plays in your overall success. Many students underestimate the power of proactive financial planning, believing it's something only adults need to worry about. However, establishing sound financial habits early on is key to building a secure and prosperous future.

Why Financial Goal Setting Matters:

- Reduces Financial Stress: Having a clear plan reduces anxiety about money. Knowing where you stand financially and having steps to reach your goals provides a sense of control.

- Improved Financial Decisions: Goals provide a framework for making informed decisions. Instead of impulsive spending, you'll evaluate purchases against your long-term objectives.

- Increased Savings and Investment: Setting concrete financial goals motivates you to save and invest more aggressively, accelerating your progress toward financial independence.

- Enhanced Self-Discipline: Achieving financial goals requires discipline and consistency. The process strengthens your self-discipline, a valuable skill applicable to all areas of life.

- Path to Financial Freedom: By setting and achieving financial goals, you pave the way for financial freedom – the ability to live comfortably without constant financial worries.

Types of Financial Goals: Short-Term, Mid-Term, and Long-Term

Financial goals aren't all created equal. They span different time horizons, reflecting various needs and aspirations. Understanding these distinctions is crucial for effective planning.

1. Short-Term Goals (0-1 year): These are goals you aim to achieve within a year. Examples include:

- Emergency Fund: Building a fund to cover unexpected expenses (e.g., medical bills, car repairs).

- Paying off Small Debts: Eliminating credit card debt or small loans.

- Saving for a Specific Purchase: Accumulating funds for a laptop, textbook, or concert tickets.

- Increasing Monthly Savings: Setting a realistic savings target each month.

2. Mid-Term Goals (1-5 years): These are goals requiring a longer time frame to achieve. Examples include:

- Paying off Student Loans: Developing a repayment plan and strategically reducing your loan balance.

- Saving for a Down Payment: Accumulating funds for a car or a down payment on a house or apartment.

- Investing in Education: Saving for further education, professional development courses, or certifications.

- Building a Larger Emergency Fund: Expanding your emergency fund to cover several months' worth of expenses.

3. Long-Term Goals (5+ years): These goals require significant planning and consistent effort. Examples include:

- Retirement Savings: Starting early and contributing regularly to retirement accounts (e.g., 401(k), IRA).

- Purchasing a Home: Saving for a down payment and planning for all associated costs.

- Starting a Business: Saving for startup costs, developing a business plan, and securing funding.

- Financial Independence: Achieving a level of wealth where passive income covers your expenses.

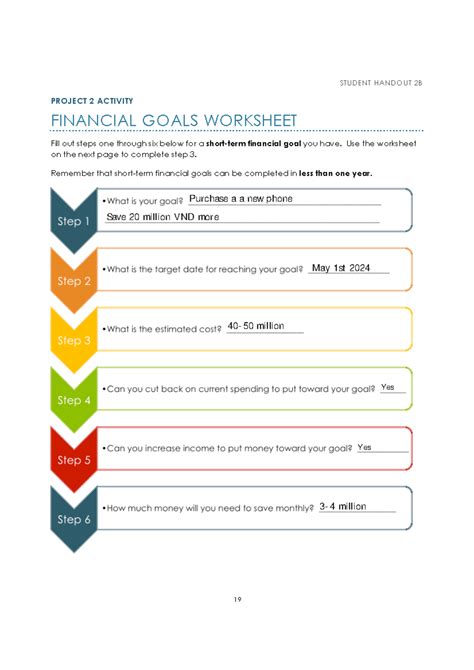

Creating Your Personalized Financial Goal Worksheet (Step-by-Step)

Now, let's construct your personalized financial goal worksheet. This worksheet will serve as your roadmap to achieving your financial aspirations.

Step 1: List Your Goals:

Begin by brainstorming all your financial goals, categorizing them into short-term, mid-term, and long-term objectives. Be as specific as possible. Instead of “save for a car,” write “save $10,000 for a used Honda Civic by December 2024.”

Step 2: Assign a Time Frame:

For each goal, assign a realistic timeframe for completion. Be honest about how long it will take you to achieve each objective, considering your current financial situation and resources.

Step 3: Determine the Required Amount:

Calculate the total amount of money needed for each goal. Research costs, consult price comparison websites, and factor in potential inflation.

Step 4: Establish a Savings/Investment Plan:

Develop a plan for how you will accumulate the funds for each goal. This might involve budgeting, increasing income, making adjustments to your spending habits, or utilizing investment strategies.

Step 5: Identify Potential Roadblocks:

Acknowledge potential challenges or obstacles that might hinder your progress. Consider unexpected expenses, changes in income, or unforeseen circumstances. Develop contingency plans to address these challenges.

Step 6: Track Your Progress Regularly:

Establish a system for monitoring your progress. This could be as simple as reviewing your savings account balance monthly or using budgeting apps to track income and expenses.

Step 7: Review and Adjust Your Plan:

Regularly review your progress and make adjustments as needed. Life circumstances change, and your financial goals should adapt accordingly. Annual reviews are highly recommended.

Sample Financial Goal Worksheet

Below is a sample financial goal worksheet you can adapt and personalize:

| Goal | Goal Type | Timeframe | Target Amount | Savings Plan | Potential Roadblocks | Progress Tracking Method |

|---|---|---|---|---|---|---|

| Emergency Fund ($1000) | Short-Term | 6 months | $1000 | Save $167/month | Unexpected expenses | Monthly balance check |

| New Laptop ($800) | Short-Term | 3 months | $800 | Cut entertainment expenses | Laptop price increase | Weekly savings tracker |

| Pay off Credit Card ($500) | Short-Term | 1 year | $500 | Increased repayment amount | Interest rate changes | Monthly statement review |

| Down Payment Car ($3000) | Mid-Term | 2 years | $3000 | Consistent monthly savings | Unexpected car repairs | Monthly spreadsheet update |

| Student Loan Repayment | Mid-Term | 5 years | $20,000 | Aggressive repayment strategy | Interest rate fluctuations | Quarterly progress review |

| Down Payment House ($20,000) | Long-Term | 10 years | $20,000 | Monthly savings & investments | Job loss, market downturn | Annual financial review |

| Retirement Savings ($100,000) | Long-Term | 30 years | $100,000 | Consistent retirement contributions | Market volatility | Annual portfolio review |

Advanced Financial Goal Setting Techniques

As your understanding of personal finance grows, you can incorporate more advanced techniques into your goal setting process.

- Goal Prioritization: Not all goals are created equal. Prioritize your goals based on importance and urgency. Consider using a prioritization matrix to visually assess your goals.

- SMART Goals: Utilize the SMART goal framework – Specific, Measurable, Achievable, Relevant, and Time-bound. This ensures your goals are clear, attainable, and trackable.

- Budgeting and Expense Tracking: Implement a robust budgeting system to accurately track income and expenses, facilitating informed financial decision-making. Explore various budgeting methods like the 50/30/20 rule or zero-based budgeting.

- Investment Strategies: As your financial resources grow, explore various investment options to enhance your returns. This might involve index funds, mutual funds, bonds, or real estate, each with its own risk profile. However, remember to conduct thorough research or seek professional advice before making investment decisions.

- Contingency Planning: Develop comprehensive contingency plans to handle unexpected events like job loss, medical emergencies, or financial setbacks. This might involve building a robust emergency fund and exploring insurance options.

Conclusion: Embark on Your Financial Journey

Creating a financial goal worksheet is a significant step towards securing your financial future. By setting clear goals, developing a plan, and tracking your progress, you'll build the habits and discipline necessary for long-term financial success. Remember that your financial journey is a marathon, not a sprint. Consistency, patience, and a proactive approach are key to achieving your financial aspirations. This detailed guide and the accompanying worksheet provide the foundational tools. Now it's time to embark on your unique financial journey towards a brighter, more secure future.

Latest Posts

Latest Posts

-

How To Read Literature Like A Professor Notes By Chapter

Mar 04, 2025

-

To Determine The Purpose Of Your Message You First Need

Mar 04, 2025

-

Where Are You Permitted To Use Classified Data

Mar 04, 2025

-

The Following Inforamtion Pertain To Amigo Corp

Mar 04, 2025

-

Steven Roberts Mental Health Counselor Oregon Npi Number

Mar 04, 2025

Related Post

Thank you for visiting our website which covers about Financial Goal Worksheet Sudent Handout 2b . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.