Funding 401ks And Roth Iras Worksheet

Onlines

Mar 14, 2025 · 5 min read

Table of Contents

Funding 401(k)s and Roth IRAs: A Comprehensive Worksheet and Guide

Saving for retirement can feel daunting, but understanding the options available – particularly 401(k)s and Roth IRAs – empowers you to make informed decisions. This comprehensive guide provides a detailed worksheet to help you plan your contributions and a thorough explanation of both accounts, guiding you towards a secure financial future.

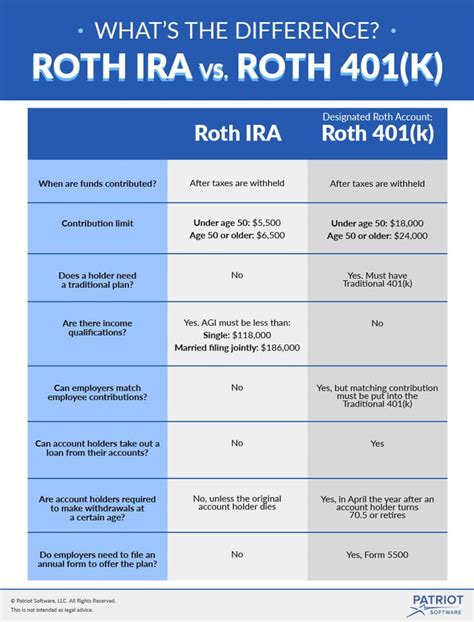

Understanding 401(k)s and Roth IRAs: Key Differences

Before diving into the worksheet, let's clarify the core differences between 401(k)s and Roth IRAs. Both are powerful retirement savings vehicles, but they differ significantly in how and when you pay taxes.

401(k)s: Pre-tax Contributions

- Tax Advantages: Contributions are made pre-tax, meaning you reduce your taxable income in the present. This lowers your current tax liability. You'll pay income taxes upon withdrawal in retirement.

- Employer Matching: Many employers offer matching contributions, essentially free money for your retirement savings. This is a significant benefit not offered with Roth IRAs.

- Contribution Limits: Annual contribution limits are set by the IRS and adjust annually. You can contribute a percentage of your salary, up to a maximum dollar amount.

- Investment Options: 401(k)s typically offer a range of investment options, such as mutual funds, index funds, and sometimes company stock. The available options depend on your employer's plan.

- Withdrawal Rules: Early withdrawals generally incur penalties unless you meet specific exceptions (e.g., hardship withdrawals).

Roth IRAs: After-tax Contributions

- Tax Advantages: Contributions are made after-tax, meaning you don't receive an immediate tax deduction. However, withdrawals in retirement are tax-free.

- Income Limits: There are income limits for contributing to a Roth IRA. If your income exceeds a certain threshold, you may not be able to contribute or may face contribution limitations.

- Contribution Limits: Similar to 401(k)s, annual contribution limits are set by the IRS and updated annually.

- Investment Options: You have a wide range of investment options available, including stocks, bonds, ETFs, and mutual funds. This flexibility allows for greater diversification.

- Withdrawal Rules: Early withdrawals of contributions are generally penalty-free, though you may still owe taxes on earnings.

The Funding 401(k)s and Roth IRAs Worksheet

This worksheet will help you determine your optimal contribution strategy, considering your income, expenses, and retirement goals.

Part 1: Assessing Your Current Financial Situation

| Item | Amount |

|---|---|

| Gross Annual Income: | $___________________________________ |

| Federal Income Tax Rate: | ________% |

| State Income Tax Rate (if applicable): | ________% |

| Monthly Expenses: | $___________________________________ |

| Monthly Savings (excluding retirement): | $___________________________________ |

| Existing Retirement Savings: | $___________________________________ |

| Current 401(k) Contribution (if applicable): | $___________________________________ |

| Current Roth IRA Contribution (if applicable): | $___________________________________ |

Part 2: Determining Your Retirement Goals

| Item | Details |

|---|---|

| Desired Retirement Age: | _____________ |

| Estimated Retirement Income Needs (Annual): | $___________________________________ |

| Retirement Savings Goal (at retirement age): | $___________________________________ |

Part 3: Calculating Maximum Contributions

(Consult the IRS website for the most up-to-date contribution limits)

| Account Type | Contribution Limit (2024) | Your Planned Contribution (Annual) |

|---|---|---|

| 401(k) | $_________ | $_________ |

| Roth IRA | $_________ | $_________ |

Part 4: Employer Matching (401(k) Only)

- Does your employer offer matching contributions? ☐ Yes ☐ No

- If yes, what is the matching percentage? _________%

- Maximum employer matching contribution (annual): $_________

Part 5: Tax Implications

- Tax savings from 401(k) contributions (annual): $_________ (Calculate based on your tax rate and 401(k) contributions).

- Tax Implications on Roth IRA withdrawals in retirement: Tax-free.

Part 6: Action Plan

| Action | Timeline | Notes |

|---|---|---|

| Increase 401(k) contributions | ||

| Start contributing to a Roth IRA | ||

| Review investment options in 401(k)/Roth IRA | ||

| Reassess your financial situation annually | Annually |

Maximizing Your Retirement Savings: Strategic Considerations

Beyond filling out the worksheet, several strategies can maximize your retirement savings.

1. Maximize Employer Matching: Free Money!

If your employer offers a 401(k) match, contribute at least enough to receive the full match. This is essentially free money, significantly boosting your retirement savings.

2. Consider a Roth IRA Ladder

A Roth IRA ladder is a strategy to systematically withdraw from your Roth IRA during retirement, ensuring tax-free income. This approach requires careful planning and understanding of withdrawal rules.

3. Diversify Your Investments

Don't put all your eggs in one basket. Diversify your investments across different asset classes (stocks, bonds, real estate, etc.) to mitigate risk. A well-diversified portfolio can help weather market fluctuations.

4. Regularly Review and Adjust

Your financial situation changes over time. Regularly review your contribution amounts and investment strategy to ensure they align with your evolving goals and risk tolerance. Annual reviews are recommended.

5. Seek Professional Advice

Consider consulting a financial advisor to personalize your retirement savings strategy. They can provide tailored advice based on your specific circumstances and risk profile.

6. Understand Fees

Be mindful of fees associated with 401(k)s and Roth IRAs. High fees can significantly erode your returns over time. Choose low-cost investment options whenever possible.

7. Automatic Contributions

Set up automatic contributions to your 401(k) and Roth IRA. This ensures consistent contributions without requiring manual effort, promoting consistent savings habits.

8. Increase Contributions Over Time

As your income grows, gradually increase your contributions to your retirement accounts. This "pay-rise" approach builds a larger nest egg over time.

The Power of Compounding: Long-Term Growth

The magic of retirement savings lies in the power of compounding. The longer your money is invested, the more it grows due to both the initial investment and the accumulation of earnings on those earnings. This compounding effect is crucial for building a substantial retirement nest egg.

Conclusion: Plan Early, Plan Wisely

Funding your 401(k) and Roth IRA is a crucial step toward securing a comfortable retirement. By understanding the differences between these accounts, utilizing the worksheet provided, and implementing the strategic considerations discussed, you can build a strong foundation for your financial future. Remember, consistent contributions, smart investment choices, and long-term planning are key to achieving your retirement goals. Don't delay; start planning today.

Latest Posts

Latest Posts

-

Po Box 115009 Carrollton Tx 75011

Mar 14, 2025

-

Topic 1 Performance Assessment Form A Answers

Mar 14, 2025

-

Characters From Count Of Monte Cristo

Mar 14, 2025

-

Amus 100 Introduction To Music

Mar 14, 2025

-

Pediatric Advanced Life Support Exam A Answers

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Funding 401ks And Roth Iras Worksheet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.