General Ledger Questions Contain Multiple Tabs.

Onlines

Mar 13, 2025 · 7 min read

Table of Contents

General Ledger Questions: Mastering the Multi-Tabbed Interface

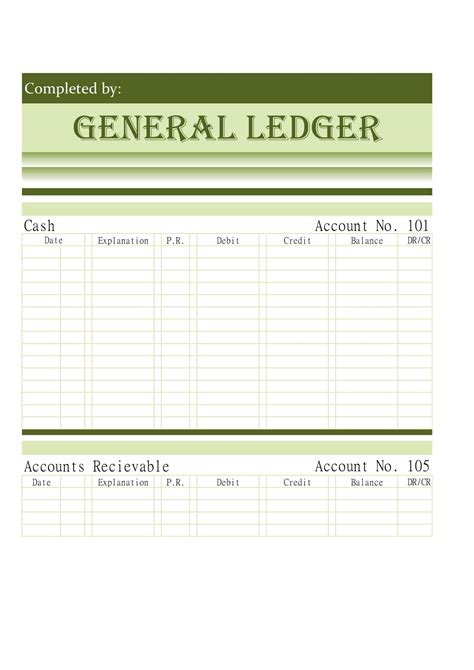

The general ledger, the heart of any accounting system, has evolved significantly. Gone are the days of solely relying on cumbersome physical ledgers. Modern accounting software presents the general ledger as a dynamic, multi-faceted tool, often displayed across multiple tabs. This shift, while offering enhanced functionality and accessibility, can also present challenges for users unfamiliar with navigating this complex interface. This comprehensive guide delves deep into the intricacies of general ledger questions within a multi-tabbed environment, offering practical advice and solutions to common issues.

Understanding the Multi-Tabbed General Ledger Interface

The multi-tabbed interface in modern general ledger software aims to streamline the accounting process. Each tab typically represents a specific aspect or view of the general ledger, allowing for focused analysis and efficient data manipulation. Common tabs include:

1. Chart of Accounts:

This is the foundational tab. It lists all the accounts in your accounting system, organized by type (assets, liabilities, equity, revenue, expenses). This tab is crucial for understanding the structure of your financial records and is often used to add, modify, or delete accounts. Understanding the chart of accounts is the cornerstone of accurate financial reporting.

- Key Considerations: Regularly review and update your chart of accounts to ensure it reflects your business's current structure and activities. Consistent and logical account naming conventions are crucial for simplifying future analysis.

2. Journal Entries:

This tab allows you to record all financial transactions. Each entry requires at least one debit and one credit, ensuring the fundamental accounting equation (Assets = Liabilities + Equity) remains balanced. Modern software often includes features like automated journal entry generation for recurring transactions.

- Key Considerations: Maintaining accurate and timely journal entries is paramount. Regularly reconcile your journal entries with bank statements and other supporting documents to prevent errors and discrepancies. Detailed descriptions for each entry are crucial for audit trails and future analysis.

3. Trial Balance:

The trial balance is a summary of all debit and credit balances from the general ledger. It's a crucial step in the accounting cycle, used to ensure that the debits and credits are equal. A balanced trial balance signifies that the accounting equation is in equilibrium. Discrepancies highlight potential errors in journal entries or the chart of accounts.

- Key Considerations: Generating and reviewing the trial balance regularly is a fundamental aspect of accounting control. Identify and investigate any imbalances immediately. A properly maintained trial balance lays the foundation for accurate financial statement preparation.

4. General Ledger Reports:

This tab provides access to a variety of pre-designed and customizable reports. These reports offer a comprehensive overview of financial activity, ranging from simple account balances to complex analyses of profitability and cash flow.

- Key Considerations: Familiarize yourself with the available reports and their functionality. Customize reports to meet specific analytical needs. Regularly review these reports to gain valuable insights into the financial health of your business.

5. Account Reconciliation:

This tab facilitates the process of comparing your internal accounting records with external statements from banks and other financial institutions. Reconciliation identifies discrepancies, allowing you to rectify errors and ensure the accuracy of your financial data.

- Key Considerations: Regular reconciliation is a critical control procedure. Document all reconciliation steps meticulously for audit purposes. Identify and investigate any discrepancies promptly. The effectiveness of your internal controls is directly related to the diligence of your reconciliation efforts.

Common General Ledger Questions & Solutions using Multiple Tabs

The multi-tabbed interface, while beneficial, can sometimes create confusion. Here are some common questions and solutions:

1. How do I find a specific transaction?

This often involves using the Journal Entries tab in conjunction with search functionality. Most software allows filtering by date, account, description, or other criteria. If you know the specific account involved, you can navigate to the Chart of Accounts tab, locate the account, and then use the system's links to access the relevant transactions.

2. How do I correct a journal entry error?

Usually, you cannot directly delete a journal entry. Instead, you need to create a reversing journal entry. This is done by creating a new entry on the Journal Entries tab, reversing the debits and credits of the original erroneous entry. This ensures the overall ledger remains balanced. Always maintain clear documentation explaining the correction.

3. Why is my trial balance out of balance?

An unbalanced trial balance in the Trial Balance tab indicates a fundamental accounting error. The most frequent causes include:

- Mathematical errors: Double-check all journal entries for accuracy.

- Missing entries: Review if any transactions were omitted.

- Incorrect account assignments: Verify all accounts are correctly coded.

- Data entry errors: Carefully check all data entries for typographical errors.

To fix the imbalance, systematically review each journal entry, focusing on recent transactions first.

4. How do I generate a custom report?

The General Ledger Reports tab usually allows you to create custom reports. Depending on your software, you may be able to select specific accounts, date ranges, and the desired format (e.g., balance sheet, income statement, cash flow statement). Understanding the available fields and filters is key to generating relevant and informative reports.

5. How do I reconcile a bank account?

The Account Reconciliation tab usually guides you through this process. You'll typically import your bank statement data and then compare it to your internal records in the Journal Entries tab. Any differences need investigation and adjustments, potentially involving creating adjusting journal entries.

6. How do I understand the impact of a transaction on the financial statements?

This often requires navigating between multiple tabs. By reviewing the Journal Entries tab for a specific transaction, you can then trace its impact on specific accounts in the Chart of Accounts tab. Finally, the General Ledger Reports tab allows you to see how this impacts the overall balance sheet and income statement. This holistic approach ensures a complete understanding of the transaction's financial implications.

7. How can I improve the efficiency of my general ledger processes?

Efficiency improvements focus on several key areas:

- Automation: Utilize features like automated journal entries for recurring transactions.

- Data validation: Implement robust data entry checks to minimize errors.

- Regular reconciliation: Consistent reconciliation prevents large discrepancies from developing.

- Streamlined workflows: Optimize the process flows to minimize manual steps.

- Training: Ensure adequate training for all users to fully understand the system's functionalities.

8. How do I maintain a clean and organized general ledger?

Maintaining a clean and organized general ledger requires a proactive approach:

- Regular cleanup: Periodically review and correct errors.

- Account naming conventions: Use clear and consistent account names.

- Documentation: Keep detailed records of all transactions and adjustments.

- Regular backups: Regularly back up your data to prevent data loss.

- Software updates: Maintain your accounting software with the latest updates for improved functionality and security.

Advanced General Ledger Concepts and Multi-Tabbed Applications

Beyond the basic functionalities, understanding advanced concepts enhances the effectiveness of using a multi-tabbed general ledger.

1. Intercompany Transactions: When dealing with multiple entities, the general ledger facilitates tracking transactions between them. You will likely use multiple instances of the general ledger, requiring seamless navigation across multiple systems and effective reconciliation processes.

2. Foreign Currency Transactions: For businesses engaging in international trade, the general ledger must handle currency conversions and fluctuations. This involves additional fields and calculations, often facilitated through specialized tabs or modules within the accounting software.

3. Consolidation: In the case of multi-entity organizations, consolidating the financial information from different entities into a single set of financial statements often requires sophisticated features within the general ledger software. These features generally integrate seamlessly with the multi-tabbed interface.

4. Segment Reporting: Segment reporting allows businesses to generate reports for specific divisions, product lines, or geographical regions. This enhances analytical capabilities and provides more granular insights into business performance. The multi-tabbed interface often provides dedicated tabs for setting up and utilizing segment reporting features.

5. Auditing and Compliance: The general ledger plays a critical role in the audit process. The ability to generate detailed reports and audit trails is crucial for compliance with relevant accounting standards and regulations. The detailed records provided by a well-maintained general ledger in a multi-tabbed interface are essential during audits.

Conclusion: Embracing the Power of the Multi-Tabbed General Ledger

The multi-tabbed general ledger interface, while initially seeming complex, ultimately offers significant advantages for efficiency and analytical capability. By mastering the functionality of each tab and understanding how they interrelate, accounting professionals can unlock the true potential of their accounting software. Regular training, diligent data entry, and a proactive approach to maintaining the general ledger will ensure the accuracy and integrity of your financial records, forming the bedrock of informed business decisions. The key to success lies in understanding the interconnectedness of the different tabs and using them strategically to obtain valuable insights into your business's financial health.

Latest Posts

Latest Posts

-

The Opening Sentence Of The Second Paragraph Primarily Serves To

Mar 13, 2025

-

Shadow Health Postpartum Care Gloria Hernandez

Mar 13, 2025

-

Discuss The Importance Of Legislation To Protect Marshes

Mar 13, 2025

-

The Missing Atom In The Luciferin Molecule Is

Mar 13, 2025

-

A Student Is Applying To Two Different Agencies

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about General Ledger Questions Contain Multiple Tabs. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.