How Can Elizabeth Most Responsibly Pay Off Her Bill Sooner

Onlines

Mar 17, 2025 · 5 min read

Table of Contents

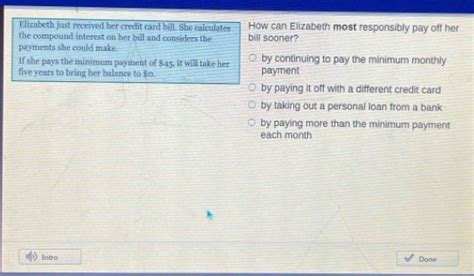

How Can Elizabeth Most Responsibly Pay Off Her Bill Sooner?

Facing a mountain of debt can feel overwhelming, but with a strategic plan and consistent effort, it's entirely possible to conquer it. This comprehensive guide will explore various methods Elizabeth can use to responsibly pay off her bills sooner, focusing on practical strategies, budgeting techniques, and financial discipline. We'll delve into debt reduction strategies, exploring options like the debt snowball and debt avalanche methods, and highlight the importance of building a solid financial foundation.

Understanding Elizabeth's Situation: The First Step to Financial Freedom

Before diving into specific strategies, we need to understand Elizabeth's unique financial landscape. This involves gathering crucial information:

1. Identifying All Debts: A Complete Inventory

Elizabeth needs a comprehensive list of all her debts. This includes:

- Credit card debt: List each card, its balance, interest rate (APR), and minimum payment.

- Loans: This includes student loans, personal loans, auto loans, and any other loans she may have. Note the balance, interest rate, and monthly payment for each.

- Medical bills: Compile a list of all outstanding medical bills, including the amount owed and any payment plans in place.

- Other debts: This category encompasses any other outstanding debts, such as utility bills or store credit accounts.

This detailed inventory is the foundation upon which Elizabeth can build her debt reduction strategy.

2. Calculating Total Debt and Monthly Payments: Facing the Reality

Once Elizabeth has compiled her debt list, she needs to calculate the total amount she owes and her total monthly debt payments. This provides a clear picture of the financial challenge she faces.

3. Assessing Income and Expenses: Budgeting for Success

Creating a realistic budget is paramount. Elizabeth should meticulously track all her income sources (salary, side hustles, investments) and expenses (housing, food, transportation, entertainment). Several budgeting methods can assist:

- 50/30/20 rule: Allocate 50% of her income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-based budgeting: Assign every dollar a purpose, ensuring all income is accounted for.

- Envelope system: Allocate cash to specific categories and only spend from those envelopes.

Accurate budgeting allows Elizabeth to identify areas where she can cut expenses and free up more money for debt repayment.

Debt Reduction Strategies: Choosing the Right Path

With a clear picture of her finances, Elizabeth can choose the most suitable debt reduction strategy:

1. The Debt Snowball Method: Motivational Momentum

This method involves paying off the smallest debt first, regardless of interest rate. The psychological boost of quickly eliminating a debt motivates continued effort. Once the smallest debt is paid, the freed-up funds are added to the next smallest debt's payment, creating a snowball effect.

Advantages: Provides early wins and boosts morale. Disadvantages: May take longer to pay off high-interest debts, leading to higher overall interest paid.

2. The Debt Avalanche Method: Financial Efficiency

This method focuses on paying off the debt with the highest interest rate first. While less motivating initially, it saves money on interest in the long run, leading to faster overall debt elimination.

Advantages: Minimizes total interest paid, leading to faster debt-free status. Disadvantages: Can be less motivating in the early stages, as progress may seem slower.

3. Debt Consolidation: Streamlining Payments

Consolidating debt involves combining multiple debts into a single loan with a potentially lower interest rate. This simplifies payments and can lead to lower monthly payments. However, it's crucial to carefully compare interest rates and fees before consolidating.

Advantages: Simplifies payments, potentially reduces interest rates. Disadvantages: May extend the repayment period, potentially leading to higher overall interest paid if not carefully managed.

4. Balance Transfers: Leveraging Introductory Rates

Transferring balances from high-interest credit cards to cards with 0% introductory APRs can be beneficial. However, it's vital to pay off the balance before the introductory period ends to avoid high interest charges. This requires strong financial discipline.

Advantages: Eliminates interest during the introductory period. Disadvantages: Requires careful planning and discipline to pay off the balance before the introductory period ends. Transfer fees may also apply.

Increasing Income: Expanding Financial Resources

While reducing expenses is crucial, increasing income accelerates debt repayment. Elizabeth can explore:

1. Negotiating a Raise: Maximizing Earning Potential

Elizabeth should research industry standards for her position and present a strong case for a raise to her employer.

2. Side Hustles: Unlocking Extra Income Streams

Numerous side hustles can supplement Elizabeth's income, such as freelance work, gig economy jobs (Uber, DoorDash), online tutoring, or selling crafts or goods online.

3. Selling Unused Assets: Liquidating Resources

Selling unused items, such as electronics, furniture, or clothing, can generate extra cash for debt repayment.

Building a Solid Financial Foundation: Long-Term Sustainability

Beyond debt repayment, Elizabeth needs to build a strong financial foundation for long-term stability:

1. Emergency Fund: Protecting Against Unexpected Expenses

Building an emergency fund (3-6 months of living expenses) protects against unforeseen events and prevents further debt accumulation.

2. Improving Credit Score: Unlocking Future Opportunities

Paying bills on time and reducing debt positively impact her credit score, opening doors to better loan rates and financial opportunities in the future.

3. Financial Literacy: Continuous Learning

Continuously learning about personal finance through books, courses, or financial advisors strengthens her financial knowledge and empowers her to make informed decisions.

Seeking Professional Help: Expert Guidance

If Elizabeth feels overwhelmed, seeking professional help is a wise decision. A financial advisor or credit counselor can provide personalized guidance and support, creating a tailored plan to address her specific financial situation.

Conclusion: A Path to Financial Freedom

Paying off debt requires commitment, discipline, and a strategic approach. By carefully assessing her financial situation, choosing the appropriate debt reduction strategy, increasing her income, and building a solid financial foundation, Elizabeth can successfully navigate her debt and achieve financial freedom. Remember, consistency is key – small, consistent steps lead to significant progress over time. The journey may be challenging, but with determination and the right strategies, Elizabeth can reach her goal of a debt-free future.

Latest Posts

Latest Posts

-

Select The Correct Answer From Each Drop Down Menu

Mar 17, 2025

-

Christian High School Equivalency Exam Answers

Mar 17, 2025

-

Introduction To Health Assessment 3 0 Test

Mar 17, 2025

-

Lord Of The Flies Student Workbook Answers Pdf

Mar 17, 2025

-

In Time Of The Butterflies Quotes

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about How Can Elizabeth Most Responsibly Pay Off Her Bill Sooner . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.