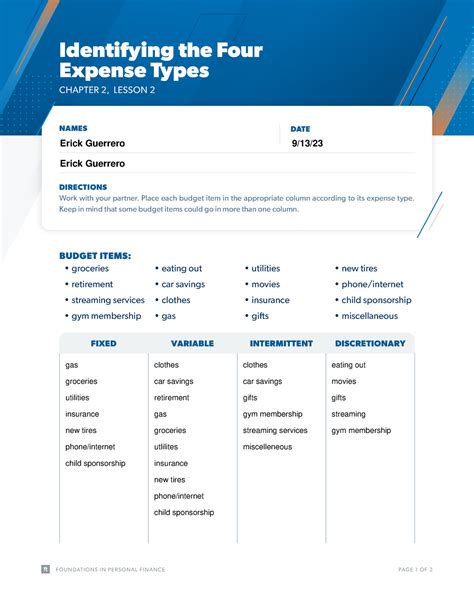

Identifying The Four Expense Types Chapter 2 Lesson 2

Onlines

Mar 13, 2025 · 7 min read

Table of Contents

Identifying the Four Expense Types: A Deep Dive into Chapter 2, Lesson 2

Understanding expenses is crucial for individuals and businesses alike. Whether you're managing a personal budget or overseeing a multi-million dollar corporation, accurately identifying and categorizing expenses is the cornerstone of effective financial management. This comprehensive guide delves into the four primary expense types – cost of goods sold (COGS), operating expenses, interest expenses, and taxes – providing a detailed breakdown of each, along with practical examples and strategies for effective management.

The Four Pillars of Expenses: A Detailed Overview

Chapter 2, Lesson 2 of any comprehensive finance course typically introduces the four fundamental types of expenses. Mastering these categories is essential for creating accurate financial statements, making informed business decisions, and achieving your financial goals.

1. Cost of Goods Sold (COGS): The Direct Cost of Production

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods or services sold by a business. This includes the raw materials, direct labor, and manufacturing overhead directly attributable to the creation of the products or services. It's a crucial component of the income statement, directly impacting profitability.

Key Components of COGS:

- Direct Materials: These are the raw materials that are directly used in the production process. For example, for a bakery, this would include flour, sugar, eggs, and butter. For a clothing manufacturer, it would be the fabric, buttons, and zippers.

- Direct Labor: This encompasses the wages and benefits paid to employees directly involved in the production process. In the bakery example, this would be the bakers and pastry chefs. For the clothing manufacturer, it would be the seamstresses and tailors.

- Manufacturing Overhead: This includes indirect costs associated with production, such as factory rent, utilities, and depreciation of manufacturing equipment. These costs are not directly traceable to a specific product but are necessary for production to occur.

Example: A furniture manufacturer sells 100 chairs. The cost of wood per chair is $20, the direct labor cost per chair is $15, and the manufacturing overhead allocated per chair is $5. The total COGS for the 100 chairs is (20 + 15 + 5) * 100 = $4000.

Calculating COGS: The calculation of COGS is crucial for determining gross profit (Revenue - COGS). Accurate COGS tracking is essential for tax purposes and for making informed decisions about pricing and production efficiency. Businesses often use inventory management systems to track COGS accurately.

2. Operating Expenses: The Costs of Running Your Business

Operating Expenses are the costs incurred in the day-to-day operations of a business, excluding COGS. These expenses are essential for the business to function but are not directly tied to the production of goods or services. They are often categorized into various sub-groups for better analysis and management.

Common Categories of Operating Expenses:

- Selling Expenses: These costs are related to marketing and selling products or services. Examples include advertising, sales commissions, and marketing materials.

- General and Administrative Expenses: These encompass costs associated with running the general business operations, such as rent, utilities, salaries of administrative staff, insurance, and office supplies.

- Research and Development Expenses: Costs incurred in developing new products or improving existing ones. This includes salaries of R&D personnel, laboratory costs, and patent fees.

Example: A retail store has rent of $2000 per month, salaries of $5000 per month, utilities of $500 per month, and advertising expenses of $1000 per month. The total operating expenses for the month are $8500.

Managing Operating Expenses: Businesses constantly strive to optimize operating expenses to improve profitability. This involves analyzing each expense category, identifying areas for cost reduction, and negotiating better terms with suppliers.

3. Interest Expenses: The Cost of Borrowing Money

Interest Expenses represent the cost of borrowing money. This expense is incurred when a business or individual takes out a loan, issues bonds, or utilizes other forms of debt financing. The amount of interest expense depends on the principal amount borrowed, the interest rate, and the loan term.

Types of Interest Expenses:

- Interest on Bank Loans: This is the most common type of interest expense, incurred when borrowing money from a bank or other financial institution.

- Interest on Bonds: Businesses often issue bonds to raise capital. The interest paid on these bonds is considered an interest expense.

- Interest on Credit Card Debt: High interest rates on credit cards can significantly impact personal and business finances.

Example: A business borrows $100,000 at an annual interest rate of 5%. The annual interest expense is $5000 ($100,000 * 0.05).

Minimizing Interest Expenses: Businesses aim to minimize interest expenses by securing loans with favorable interest rates, maintaining a strong credit rating, and managing cash flow effectively to reduce reliance on debt financing.

4. Taxes: The Obligation to the Government

Taxes represent the payments made to government agencies at various levels – federal, state, and local. These taxes can include income tax, sales tax, property tax, and various other levies depending on the jurisdiction and the type of business.

Types of Taxes:

- Income Tax: Tax on profits earned by businesses or individuals.

- Sales Tax: Tax on the sale of goods and services.

- Property Tax: Tax on the ownership of real estate.

- Payroll Tax: Taxes withheld from employee wages and paid by employers.

Example: A business with a net income of $100,000 might pay a 25% corporate income tax, resulting in a tax expense of $25,000.

Tax Planning and Compliance: Effective tax planning is essential for minimizing tax liabilities while remaining compliant with all applicable regulations. This often involves consulting with tax professionals to understand the complexities of tax laws and to optimize tax strategies.

Analyzing and Managing Expense Types: Practical Strategies

Understanding the four expense types is only the first step. Effectively managing these expenses is crucial for financial health. Here are some key strategies:

1. Accurate Record Keeping: Maintain detailed and organized records of all expenses. Use accounting software or spreadsheets to track expenses by category. This allows for accurate financial reporting and informed decision-making.

2. Budgeting and Forecasting: Develop a budget that allocates funds to each expense category. Regularly review and adjust the budget based on actual expenses and changes in business conditions. Forecasting future expenses helps in proactive financial planning.

3. Cost Control and Reduction: Regularly analyze expenses to identify areas for potential cost savings. Negotiate with suppliers, explore alternative vendors, and implement cost-saving measures where appropriate.

4. Expense Reporting and Analysis: Generate regular expense reports to monitor spending patterns and identify trends. Analyze these reports to understand which expense categories are contributing to profitability or impacting it negatively.

5. Technology and Automation: Leverage technology such as accounting software and expense management tools to automate expense tracking, processing, and reporting. This enhances efficiency and reduces the risk of errors.

6. Professional Guidance: Consult with financial professionals, such as accountants and financial advisors, for assistance in managing expenses, developing effective tax strategies, and making informed financial decisions.

The Interplay Between Expense Types and Financial Statements

The four expense types are integral components of several key financial statements:

-

Income Statement: COGS, operating expenses, interest expenses, and taxes are all reported on the income statement, which shows a company's profitability over a period of time. Understanding how each expense category impacts the bottom line is crucial for effective financial analysis.

-

Cash Flow Statement: The cash flow statement tracks the movement of cash into and out of a business. Expenses are reflected in the cash outflow section of the statement, providing insights into how cash is being used to fund operations.

-

Balance Sheet: While not directly reported on the balance sheet, the impact of expenses is reflected in the balance sheet through changes in assets and liabilities. For example, the payment of operating expenses reduces cash, and the accrual of taxes creates a liability.

Conclusion: Mastering Expense Management for Success

Identifying and understanding the four expense types – COGS, operating expenses, interest expenses, and taxes – is fundamental to effective financial management for both individuals and businesses. By implementing robust expense tracking systems, employing cost-control strategies, and leveraging available technology, you can gain valuable insights into your financial performance, make data-driven decisions, and ultimately achieve your financial goals. Remember, proactive expense management isn't just about cutting costs; it's about optimizing resource allocation to maximize profitability and long-term sustainability. Continuous monitoring, analysis, and adaptation are crucial for navigating the ever-changing financial landscape.

Latest Posts

Latest Posts

-

What Is Included In All Vascular Injection Procedures

Mar 14, 2025

-

How Many Chapters Are In The Book The Giver

Mar 14, 2025

-

How Did The Beetle Uncover The Ants Secret Plan

Mar 14, 2025

-

When I Was Puerto Rican Summary

Mar 14, 2025

-

Buying New Furniture For Your Home Would Increase

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Identifying The Four Expense Types Chapter 2 Lesson 2 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.