In Addition To Monetary Information Managerial Accounting Reports Information

Onlines

Mar 23, 2025 · 6 min read

Table of Contents

Beyond the Bottom Line: Managerial Accounting Reports and Non-Monetary Information

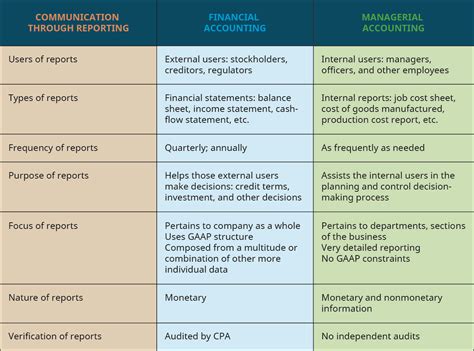

Managerial accounting, unlike financial accounting, isn't solely focused on creating financial statements for external stakeholders. Its primary purpose is to provide information to internal managers for decision-making. While monetary data, like costs, revenues, and profits, forms a crucial part of this information, effective managerial accounting reports go far beyond mere financial figures. This article delves into the vital role of non-monetary information in managerial accounting reports, highlighting its significance in strategic planning, operational efficiency, and overall business success.

The Limitations of Purely Monetary Data

While financial data is undeniably important, relying solely on monetary information paints an incomplete picture of a company's performance and prospects. Consider these limitations:

1. Lack of Context:

Numbers alone lack context. A high profit margin might seem excellent, but without understanding the underlying reasons – increased sales, reduced costs, or a combination – it's impossible to determine its sustainability or replicability. Similarly, a drop in profit might not be due to poor performance but rather external factors like market fluctuations or supply chain disruptions.

2. Overemphasis on Short-Term Gains:

Focusing exclusively on monetary metrics can incentivize short-sighted decisions. Managers might prioritize immediate profits over long-term investments in research and development, employee training, or infrastructure improvements. This short-term focus can hinder long-term growth and sustainability.

3. Ignoring Qualitative Factors:

Monetary data doesn't capture crucial qualitative aspects, such as employee morale, customer satisfaction, brand reputation, and innovation capacity. These factors significantly influence a company's performance and future prospects but are often overlooked when focusing solely on financial figures.

4. Incomplete Performance Measurement:

Financial data provides a narrow view of performance. It might not reflect the efficiency of processes, the effectiveness of marketing campaigns, or the quality of products or services. A company might report high profits but still suffer from inefficiencies and quality issues that could ultimately damage its long-term success.

The Power of Non-Monetary Information in Managerial Accounting

To overcome these limitations, managerial accounting reports must incorporate non-monetary information. This broader perspective allows for a more comprehensive understanding of business operations and informed decision-making. Here are some key areas where non-monetary data enhances managerial accounting:

1. Operational Efficiency:

- Process maps and flowcharts: These visual representations illustrate the steps involved in various processes, revealing bottlenecks, redundancies, and areas for improvement. This information, while non-monetary, directly impacts efficiency and cost reduction.

- Defect rates and quality metrics: Tracking the number of defective products or services provides insights into quality control processes and areas needing attention. This non-financial data is crucial for improving product quality and reducing waste.

- Cycle times and lead times: Measuring the time it takes to complete various processes helps identify inefficiencies and areas for streamlining. Reducing cycle times and lead times directly translates into cost savings and improved customer service.

- Employee productivity metrics: Tracking measures like units produced per hour, tasks completed per day, or customer interactions per hour provide valuable insights into workforce efficiency and potential areas for improvement. This information, while not directly financial, strongly impacts cost and output.

2. Customer Satisfaction and Market Analysis:

- Customer feedback surveys: Gathering customer feedback on product quality, service, and overall experience provides valuable qualitative data that complements financial data on sales and market share. This information is critical for product development, marketing strategies, and improving customer loyalty.

- Market research data: Analyzing market trends, competitor activities, and customer preferences helps managers make informed decisions about product development, pricing, and marketing. While this data may not be directly monetary, it's vital for strategic planning and maximizing market opportunities.

- Customer churn rate: Monitoring the rate at which customers stop using a company's products or services highlights areas for improvement in customer service and product development. While this metric has some financial implications, the underlying causes are often qualitative.

3. Risk Management and Internal Control:

- Safety incident reports: Tracking the number and nature of workplace accidents helps identify safety hazards and implement preventive measures. This non-financial information is vital for maintaining a safe work environment and minimizing potential liabilities.

- Compliance audits: Regular audits of internal controls and compliance with regulations ensure that the company operates ethically and legally. While fines and penalties are financial consequences, the underlying information gathering and assessment are primarily non-monetary.

- Fraud detection mechanisms: Implementing systems to detect and prevent fraud requires assessing risks and vulnerabilities, which are often qualitative in nature. While the financial impact of fraud is substantial, the preventative measures rely on non-monetary risk assessments.

4. Strategic Planning and Innovation:

- Competitive analysis: Analyzing competitors' strengths, weaknesses, and strategies provides insights into market opportunities and competitive threats. This analysis, often qualitative, is vital for developing effective strategic plans.

- Research and development progress reports: Tracking the progress of research and development projects provides crucial non-financial information about innovation pipeline and future product potential.

- Employee skill assessments: Evaluating employee skills and competencies helps identify training needs and resource allocation for future projects. This non-monetary information is crucial for workforce development and long-term strategic goals.

- Intellectual property portfolio: Tracking patents, trademarks, and copyrights provides insights into the company's intellectual property assets, which are vital for long-term competitiveness and value creation. While these have financial implications, their assessment is qualitative.

Integrating Non-Monetary Information into Managerial Accounting Reports

The key to effectively using non-monetary information is its seamless integration into managerial accounting reports. This requires a multi-faceted approach:

- Develop a comprehensive reporting system: The system should capture both financial and non-financial data, using a combination of quantitative and qualitative metrics.

- Use visual aids: Charts, graphs, and dashboards can effectively present non-monetary data, making it easier to understand and interpret.

- Establish clear metrics and targets: Setting clear targets for non-monetary metrics like customer satisfaction, defect rates, or employee turnover helps track progress and identify areas needing improvement.

- Regularly review and update reports: Managerial accounting reports should be dynamic, reflecting changes in the business environment and operational processes.

- Use data visualization tools: Leverage technology and data visualization tools to effectively present both monetary and non-monetary information in a clear and concise manner. This facilitates better understanding and interpretation by managers.

- Foster a data-driven culture: Encourage managers and employees to use data – both financial and non-financial – to make informed decisions and improve operational efficiency.

Conclusion: A Holistic Approach to Managerial Accounting

Managerial accounting reports must go beyond the purely financial to become truly effective decision-making tools. By incorporating a wide range of non-monetary information, businesses can gain a holistic understanding of their operations, identify areas for improvement, and make more informed strategic decisions. This integrated approach ensures that managerial accounting plays a vital role in driving operational excellence, fostering innovation, and ultimately achieving sustainable long-term success. The integration of both monetary and non-monetary data empowers managers to make more well-rounded decisions, balancing short-term gains with long-term sustainability and growth. Ignoring non-monetary data is akin to navigating with only half a map – it's possible, but highly unlikely to lead to the desired destination.

Latest Posts

Latest Posts

-

Chronicle Of A Death Foretold Chapter 1 Summary

Mar 25, 2025

-

Which Of The Following Are Examples Of Peer Review

Mar 25, 2025

-

9 1 Study Guide And Intervention Circles And Circumference

Mar 25, 2025

-

To Kill A Mockingbird Chapter 4 Summary

Mar 25, 2025

-

To Kill A Mockingbird Character Map

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about In Addition To Monetary Information Managerial Accounting Reports Information . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.