List The Six Principles Associated With Bond-pricing Relationships.

Onlines

Mar 06, 2025 · 5 min read

Table of Contents

Six Principles Governing Bond Pricing Relationships: A Deep Dive

Bond pricing, seemingly a complex interplay of factors, actually adheres to a set of fundamental principles. Understanding these principles is crucial for investors, traders, and anyone navigating the fixed-income market. This article delves into the six key principles governing bond pricing relationships, explaining them in detail and illustrating their practical applications.

1. The Inverse Relationship Between Bond Prices and Yields

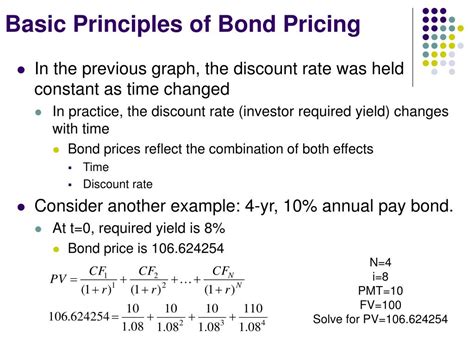

This is arguably the most fundamental principle of bond pricing. It states that bond prices and yields move in opposite directions. When interest rates rise (and hence yields), the present value of the bond's future cash flows (coupon payments and principal repayment) decreases, leading to a lower price. Conversely, when interest rates fall, the present value of future cash flows increases, resulting in a higher bond price.

Understanding the Mechanism

This inverse relationship stems from the very nature of bond valuation. Bonds are essentially discounted cash flow instruments. Their price is calculated by discounting the expected future cash flows by the appropriate discount rate (yield to maturity). A higher discount rate results in a lower present value (price), and vice versa.

Practical Implications

This principle is crucial for investment strategies. For instance, if an investor anticipates rising interest rates, they might consider selling bonds to avoid price declines. Conversely, if interest rates are expected to fall, buying bonds could be a profitable strategy.

2. The Impact of Time to Maturity on Bond Prices

The time remaining until a bond's maturity significantly impacts its price sensitivity to interest rate changes. Longer-maturity bonds are generally more sensitive to interest rate changes than shorter-maturity bonds. This is because the present value of distant cash flows is more significantly affected by changes in the discount rate.

Duration and Interest Rate Risk

The concept of duration quantifies this interest rate sensitivity. Duration measures the weighted average time until a bond's cash flows are received. Higher duration implies greater interest rate risk. Longer-maturity bonds typically have higher durations and thus higher price volatility.

Strategic Implications

Investors with a longer investment horizon might tolerate higher duration bonds, accepting higher risk for potentially greater returns. Conversely, investors with shorter horizons might prefer shorter-maturity bonds with lower duration and less price volatility.

3. The Influence of Coupon Rate on Bond Prices

The coupon rate, the annual interest payment relative to the bond's face value, also influences price sensitivity. Bonds with lower coupon rates are generally more sensitive to interest rate changes than bonds with higher coupon rates. This is because a lower coupon payment contributes a smaller proportion of the total return, making the bond's price more reliant on the discount rate.

Understanding the Mechanics

A bond with a low coupon rate receives most of its return from the repayment of the principal at maturity. The present value of this principal payment is highly sensitive to interest rate changes. Conversely, bonds with high coupon rates receive a larger portion of their return from periodic interest payments, making them less sensitive to interest rate fluctuations.

Investment Strategy Considerations

Investors seeking higher returns might consider lower coupon bonds, but should be aware of the increased price volatility. Higher coupon bonds offer more stability but might offer lower overall returns in a low-interest-rate environment.

4. The Relationship Between Bond Ratings and Prices

Credit rating agencies assess the creditworthiness of bond issuers. Higher-rated bonds (e.g., AAA) generally command higher prices and lower yields than lower-rated bonds (e.g., BB or below). This reflects the lower perceived risk of default for higher-rated bonds.

Default Risk Premium

The difference in yield between a higher-rated bond and a lower-rated bond of similar maturity is known as the default risk premium. This premium compensates investors for the increased risk of default associated with lower-rated bonds.

Investment Implications

Investors with a lower risk tolerance might focus on higher-rated bonds, accepting lower returns for greater security. Higher-risk-tolerant investors might consider lower-rated bonds, seeking potentially higher returns but accepting the greater risk of default.

5. The Impact of Call Provisions on Bond Prices

Some bonds include call provisions, which allow the issuer to redeem the bond before its maturity date. Callable bonds generally trade at lower prices than non-callable bonds with similar characteristics. This is because the call provision introduces uncertainty for the investor, as the bond could be redeemed at an unfavorable time.

Call Risk and Yield

The lower price reflects the call risk, the risk that the bond will be called before maturity, potentially limiting the investor's potential returns. To compensate for this risk, callable bonds typically offer higher yields than comparable non-callable bonds.

6. The Influence of Inflation on Bond Prices

Inflation significantly affects bond prices. Inflation erodes the purchasing power of future cash flows, impacting the present value of the bond. Higher inflation generally leads to higher interest rates, which in turn negatively impacts bond prices.

Real vs. Nominal Yields

Investors should consider both nominal yields (stated yields) and real yields (nominal yields adjusted for inflation). Real yields represent the true return after accounting for inflation.

Inflation Expectations and Bond Prices

Market expectations of future inflation are incorporated into bond yields. Higher inflation expectations lead to higher yields and lower bond prices. Conversely, lower inflation expectations lead to lower yields and higher bond prices.

Conclusion: Navigating the Complexities of Bond Pricing

Understanding these six principles provides a strong foundation for navigating the intricacies of bond pricing. These principles are interconnected and their relative importance varies depending on specific market conditions and investor preferences. Investors should carefully consider these factors when making investment decisions, ensuring their strategies align with their risk tolerance and investment goals. By applying this knowledge, investors can make informed choices and successfully navigate the dynamic world of fixed-income investments. Remember, diligent research and a well-defined investment strategy are essential for success in the bond market.

Latest Posts

Latest Posts

-

Aromas Se Quemen De Placido Olor Lyrics

Mar 06, 2025

-

Ana Y Enrique Piden Unos Refrescos Frios

Mar 06, 2025

-

Exercise Methodology Includes Which Of The Following Exercise Cycle Components

Mar 06, 2025

-

How Did You Get To The Top Of Sao Carlos

Mar 06, 2025

-

Find The Trigonometric Ratio Maze Answer Key

Mar 06, 2025

Related Post

Thank you for visiting our website which covers about List The Six Principles Associated With Bond-pricing Relationships. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.