Mini Practice Set 2 Accounting Answers

Onlines

Mar 15, 2025 · 5 min read

Table of Contents

Mini Practice Set 2 Accounting Answers: A Comprehensive Guide

Are you struggling with your accounting mini practice set? This comprehensive guide provides detailed answers and explanations for a typical Mini Practice Set 2, covering common accounting principles and procedures. While specific questions vary between textbooks and instructors, this guide addresses the fundamental concepts found in most sets. Remember to always refer to your specific assignment instructions and textbook for precise requirements.

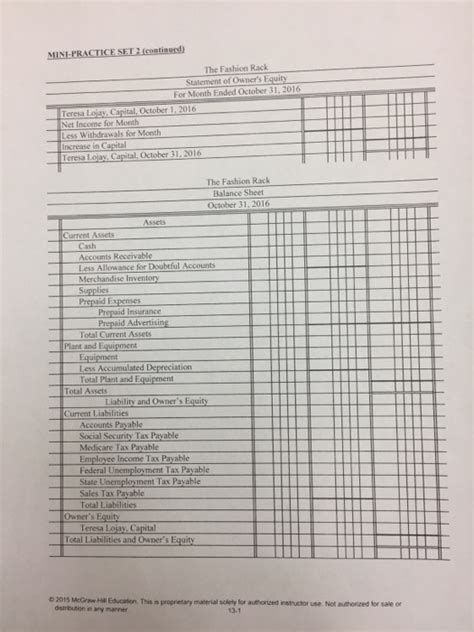

Understanding the Structure of a Mini Practice Set 2

Mini Practice Sets, particularly Set 2, usually build upon the foundational concepts introduced in Set 1. Expect to encounter a broader range of transactions, including more complex adjustments and closing entries. Common elements you'll find include:

- Journal Entries: Recording various transactions, such as purchases, sales, expenses, and payroll.

- Posting to Ledger Accounts: Transferring journal entries to the general ledger to update account balances.

- Trial Balance: Preparing a trial balance to ensure the debits and credits are equal.

- Adjusting Entries: Making necessary adjustments at the end of the period, accounting for accruals, deferrals, and depreciation.

- Adjusted Trial Balance: Preparing a trial balance after incorporating adjusting entries.

- Financial Statements: Preparing the income statement, statement of retained earnings, and balance sheet.

- Closing Entries: Closing temporary accounts (revenues, expenses, and dividends) at the end of the accounting period.

- Post-Closing Trial Balance: Verifying the accuracy of the closing entries.

This guide will walk you through each of these steps, offering explanations and examples to help you understand the process.

Detailed Answers and Explanations

Because specific transactions vary, providing exact numerical answers is impossible without the actual problem set. However, we will illustrate the process with examples, focusing on the underlying accounting principles.

1. Journal Entries

Example Transaction: Purchased office supplies for $100 cash.

- Debit: Office Supplies $100

- Credit: Cash $100

Explanation: The debit increases the office supplies asset account, while the credit decreases the cash asset account.

Example Transaction: Provided services to a client for $500 on account.

- Debit: Accounts Receivable $500

- Credit: Service Revenue $500

Explanation: The debit increases accounts receivable (an asset representing money owed to the business), and the credit increases service revenue (an increase in equity).

Important Considerations:

- Date: Always include the date of each transaction.

- Account Names: Use consistent and accurate account names.

- Debits and Credits: Ensure the debits equal the credits in each journal entry.

- Descriptions: Provide a brief description of each transaction.

2. Posting to Ledger Accounts

After recording journal entries, you'll post the debits and credits to their respective ledger accounts. This involves transferring the information from the journal to individual accounts in the general ledger.

Example: Let's say the "Cash" account had a beginning balance of $1000. After posting the two entries above, the Cash account would show:

- Beginning Balance: $1000

- Credit (Office Supplies): -$100

- Ending Balance: $900

3. Trial Balance

The trial balance is a list of all general ledger accounts and their balances. It's a crucial step to ensure the equality of debits and credits before preparing adjusting entries. If the debits and credits don't match, you'll need to carefully review your journal entries and postings for errors.

4. Adjusting Entries

Adjusting entries are made at the end of the accounting period to ensure that financial statements accurately reflect the business's financial position. Common types of adjusting entries include:

- Accrued Expenses: Expenses incurred but not yet paid (e.g., salaries, interest).

- Accrued Revenues: Revenues earned but not yet received (e.g., interest, rent).

- Prepaid Expenses: Expenses paid in advance (e.g., insurance, rent).

- Unearned Revenues: Revenues received in advance (e.g., subscriptions, deposits).

- Depreciation: Allocation of the cost of an asset over its useful life.

Example: Accrued Salaries

If salaries of $500 were earned by employees but not yet paid at the end of the period:

- Debit: Salaries Expense $500

- Credit: Salaries Payable $500

5. Adjusted Trial Balance

After making all necessary adjusting entries, prepare an adjusted trial balance. This will show the updated account balances after considering the adjustments. This ensures the accuracy of your financial statements.

6. Financial Statements

The adjusted trial balance is the foundation for preparing the financial statements:

- Income Statement: Shows revenues, expenses, and net income (or net loss) for a specific period.

- Statement of Retained Earnings: Shows changes in retained earnings during a period.

- Balance Sheet: Shows assets, liabilities, and equity at a specific point in time.

Remember the basic accounting equation: Assets = Liabilities + Equity

7. Closing Entries

Closing entries transfer the balances of temporary accounts (revenues, expenses, and dividends) to retained earnings at the end of the accounting period. This prepares the accounts for the next accounting period.

Example: If Service Revenue has a balance of $10,000 and Service Expense has a balance of $5,000:

-

Debit: Service Revenue $10,000

-

Credit: Income Summary $10,000 (closing revenue)

-

Debit: Income Summary $5,000

-

Credit: Service Expense $5,000 (closing expense)

-

Debit: Income Summary ($10,000-$5,000) = $5,000

-

Credit: Retained Earnings $5,000 (closing net income)

8. Post-Closing Trial Balance

After making closing entries, prepare a post-closing trial balance. This should only include permanent accounts (assets, liabilities, and equity) with zero balances for temporary accounts. This verifies the accuracy of the closing process.

Common Challenges and Troubleshooting

- Incorrect Journal Entries: Double-check your debits and credits, account names, and descriptions. A single error can affect the entire process.

- Posting Errors: Carefully verify that all journal entries are accurately posted to the correct ledger accounts.

- Trial Balance Imbalance: Thoroughly review your journal entries and postings to find any discrepancies.

- Incorrect Adjusting Entries: Ensure you understand the different types of adjustments and apply them correctly.

- Errors in Financial Statement Preparation: Carefully check your calculations and ensure you are using the correct formulas and accounts.

Tips for Success

- Understand the Concepts: Don't just memorize procedures; understand the underlying accounting principles.

- Practice Regularly: The more you practice, the more comfortable you'll become with the process.

- Use a Spreadsheet: Spreadsheets can help organize your data and make calculations easier.

- Seek Help When Needed: Don't hesitate to ask your instructor or classmates for assistance if you're struggling.

- Review Your Work: Always review your work carefully to identify and correct any errors.

This comprehensive guide provides a framework for tackling your Mini Practice Set 2. While it doesn't offer specific numerical answers due to the variability of practice sets, it thoroughly explains the processes involved. By understanding these concepts and applying them diligently, you'll successfully complete your assignment and strengthen your accounting skills. Remember to consult your textbook and instructor for specific guidance related to your particular practice set. Good luck!

Latest Posts

Latest Posts

-

Summary Of A Feast For Crows

Mar 15, 2025

-

Jaime Decidir Comprar Tableta

Mar 15, 2025

-

You Respond To A Movie Theater For A 70

Mar 15, 2025

-

Po Box 15284 Wilmington De 19850

Mar 15, 2025

-

Manuel Tiene Una Reservacion Para Una Habitacion

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Mini Practice Set 2 Accounting Answers . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.