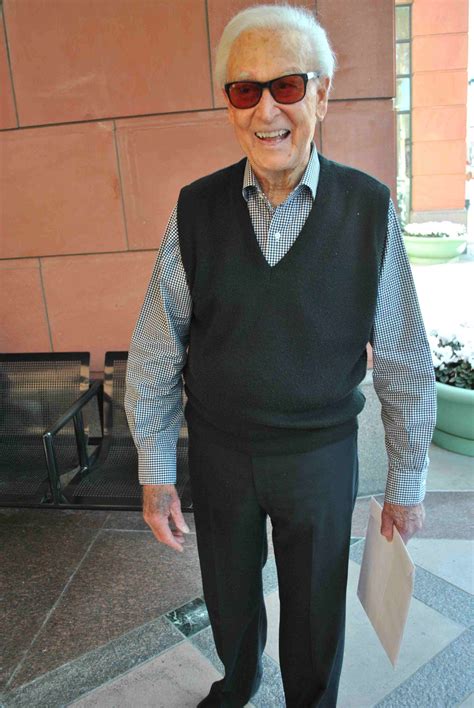

Mr Barker Enjoys A Comfortable Retirement Income

Onlines

Mar 18, 2025 · 6 min read

Table of Contents

Mr. Barker Enjoys a Comfortable Retirement Income: Planning for a Secure and Fulfilling Future

Retirement. The word itself conjures images of relaxation, travel, and pursuing long-held passions. For many, however, the reality of retirement can be far more complex, often intertwined with anxieties about financial security. Mr. Barker, however, is a testament to the power of meticulous planning and a proactive approach to securing a comfortable retirement income. His story serves as a valuable guide for those seeking financial peace of mind in their golden years.

The Pillars of Mr. Barker's Retirement Success

Mr. Barker's comfortable retirement wasn't accidental. It was the result of careful planning and a multifaceted approach to wealth accumulation and preservation. Three key pillars underpinned his success:

1. Early and Consistent Saving: The Power of Compound Interest

One of the most significant factors contributing to Mr. Barker's financial security was his commitment to saving early and consistently throughout his working life. He understood the transformative power of compound interest, the snowball effect where earnings generate further earnings, leading to exponential growth over time. He didn't wait until he was nearing retirement to start saving; instead, he began contributing to retirement accounts early in his career, even when his income was relatively modest. This allowed him to leverage the maximum benefit of compound interest, allowing his savings to grow exponentially over several decades.

Key Takeaway: Starting early is crucial. Even small, consistent contributions early in your career will yield significantly greater returns over time than larger contributions made later in life. Don't underestimate the power of compound interest!

2. Diversification: Spreading the Risk

Mr. Barker didn't put all his eggs in one basket. He diversified his investments across a range of asset classes, including stocks, bonds, and real estate. This strategy mitigated risk. If one investment performed poorly, the others could potentially offset those losses. He understood that market fluctuations are inevitable, but diversification helps cushion the impact.

Key Takeaway: Diversification is key to managing risk in the long term. Don't rely on a single investment strategy; spread your investments across different asset classes to reduce your overall risk exposure. Consult a financial advisor to create a diversified portfolio that aligns with your risk tolerance and retirement goals.

3. Strategic Investment Choices: Maximizing Returns

Mr. Barker wasn't just a passive investor; he actively managed his investments, regularly reviewing his portfolio and adjusting his strategy as needed. He took the time to understand different investment options and chose those that aligned with his risk tolerance and long-term financial goals. This involved staying informed about market trends and economic conditions, seeking professional advice when necessary, and making adjustments to his portfolio based on his evolving circumstances.

Key Takeaway: Passive investing can be beneficial, but active management can lead to potentially greater returns. Educate yourself about different investment options, stay updated on market trends, and consider seeking professional guidance to optimize your investment strategy.

Beyond the Numbers: The Quality of Life in Retirement

Mr. Barker's comfortable retirement income is not just about financial security; it's about the quality of life he enjoys. His retirement is characterized by:

Financial Freedom and Peace of Mind

The absence of financial worries is a significant factor in Mr. Barker's contentment. He has enough income to cover his living expenses comfortably, without needing to worry about unexpected bills or emergencies. This financial freedom allows him to focus on what truly matters: his health, relationships, and personal pursuits.

Key Takeaway: Financial peace of mind is invaluable in retirement. A well-planned retirement strategy minimizes stress and allows you to enjoy your golden years to the fullest.

Pursuing Hobbies and Passions

Mr. Barker is actively engaged in several hobbies he had little time for during his working years. He enjoys gardening, volunteering at the local library, and taking regular trips to visit his grandchildren. These activities enrich his life, providing a sense of purpose and fulfillment.

Key Takeaway: Retirement offers an opportunity to pursue long-held passions and discover new interests. Identify activities that bring you joy and incorporate them into your daily routine to enhance your overall well-being.

Strong Social Connections

Mr. Barker maintains strong social connections with family and friends. He regularly attends social gatherings, participates in community events, and enjoys spending time with loved ones. These connections contribute significantly to his happiness and overall well-being.

Key Takeaway: Social interaction is crucial for emotional and mental health. Maintain and nurture strong social connections in retirement to combat loneliness and enjoy a richer, more fulfilling life.

Maintaining Good Health

Mr. Barker prioritizes his health by eating a balanced diet, exercising regularly, and seeking regular medical checkups. His proactive approach to health maintenance ensures he can enjoy his retirement years to the fullest.

Key Takeaway: Maintaining good health is paramount in retirement. Prioritize healthy lifestyle choices, including regular exercise, a balanced diet, and routine medical checkups, to ensure you can enjoy your retirement years in good health.

Lessons from Mr. Barker: Planning for Your Own Comfortable Retirement

Mr. Barker's story provides valuable lessons for those planning for their own comfortable retirement:

- Start saving early: The earlier you start saving, the more time your money has to grow through compound interest.

- Diversify your investments: Spreading your investments across different asset classes reduces risk.

- Seek professional advice: A financial advisor can help you create a personalized retirement plan that aligns with your goals and risk tolerance.

- Regularly review your plan: Adjust your plan as needed to account for changes in your circumstances or market conditions.

- Consider additional income streams: Explore options such as part-time work, rental income, or investments in dividend-paying stocks to supplement your retirement income.

- Plan for healthcare costs: Healthcare expenses can be substantial in retirement, so factor these costs into your retirement plan.

- Live within your means: Avoid overspending during your working years to ensure you have sufficient funds for retirement.

- Focus on long-term goals: Don't be swayed by short-term market fluctuations. Stay focused on your long-term retirement goals.

Beyond Financial Planning: The Holistic Approach to Retirement

While financial planning is crucial, Mr. Barker's success highlights the importance of a holistic approach to retirement planning. This includes:

- Physical health: Maintain a healthy lifestyle through exercise, a balanced diet, and regular medical checkups.

- Mental health: Engage in activities that stimulate your mind and maintain cognitive function.

- Social connections: Nurture relationships with family and friends, and engage in community activities.

- Purpose and meaning: Find activities that provide a sense of purpose and fulfillment.

By combining meticulous financial planning with a focus on overall well-being, Mr. Barker has created a retirement that is not just financially secure, but also deeply fulfilling and enjoyable. His story serves as an inspiring example for others seeking to achieve a similar level of comfort and contentment in their golden years. Remember, retirement isn't just about the numbers; it's about living a life that is rich, meaningful, and truly enjoyable. Plan wisely, live fully, and embrace the possibilities that await you in retirement.

Latest Posts

Latest Posts

-

Examples Of Questions That Focus On Process Include

Mar 18, 2025

-

Which Statement Is True About First Aid Measures And Hazardous Chemicals

Mar 18, 2025

-

Nurse Toni Is Reviewing The Handout About Iv Pain

Mar 18, 2025

-

Procedure 1 Tracing Blood Flow Patterns

Mar 18, 2025

-

E 5 Analyze Rhetorical Strategies In Historical Texts Set 1

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Mr Barker Enjoys A Comfortable Retirement Income . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.