Ngpf Activity Bank Types Of Credit Answers

Onlines

Mar 16, 2025 · 7 min read

Table of Contents

NGPF Activity Bank: Types of Credit – A Comprehensive Guide

The Next Gen Personal Finance (NGPF) Activity Bank offers a wealth of resources for learning about personal finance, including a detailed section on different types of credit. Understanding these various types is crucial for making informed financial decisions and building a strong credit history. This comprehensive guide will delve into the answers provided within the NGPF Activity Bank regarding the different types of credit, helping you navigate the complexities of borrowing and credit management.

Understanding Credit: The Foundation

Before exploring the specific types of credit highlighted in the NGPF Activity Bank, let's establish a fundamental understanding of what credit actually is. Credit is essentially borrowing money with the agreement to repay it, usually with interest, over a specific period. Your creditworthiness, or credit score, reflects your history of repaying debts. A strong credit score opens doors to better loan terms, lower interest rates, and a wider range of financial opportunities.

Key Terms:

- Credit Score: A numerical representation of your creditworthiness, typically ranging from 300 to 850. Higher scores indicate lower risk to lenders.

- Interest: The cost of borrowing money. It's expressed as a percentage and is added to the principal amount borrowed.

- Principal: The original amount of money borrowed.

- APR (Annual Percentage Rate): The annual cost of borrowing money, including interest and any fees.

- Credit Report: A detailed record of your borrowing and repayment history. It's compiled by credit bureaus.

Types of Credit Explained: NGPF Activity Bank Insights

The NGPF Activity Bank meticulously categorizes different types of credit, each with its own characteristics, benefits, and drawbacks. Let's examine the key types:

1. Revolving Credit: Flexibility and Ongoing Access

Revolving credit offers a pre-approved credit limit that you can borrow against repeatedly, as long as you stay within the limit. The most common example is a credit card. As you make purchases, you're borrowing against your available credit. You then make payments, reducing your balance and freeing up available credit.

Key Features of Revolving Credit (as highlighted in the NGPF Activity Bank):

- Flexibility: You can borrow and repay multiple times within the credit limit.

- High Interest Rates: Often come with higher interest rates compared to installment loans.

- Potential for Debt Accumulation: Easy access to credit can lead to overspending and debt if not managed carefully.

- Credit Building: Responsible use of revolving credit can significantly boost your credit score.

NGPF Activity Bank Focus: The NGPF resources likely emphasize the importance of paying your credit card balance in full each month to avoid accumulating interest charges. They also likely stress the need for budgeting and responsible spending habits to prevent overextension of credit.

2. Installment Credit: Planned Repayment Schedules

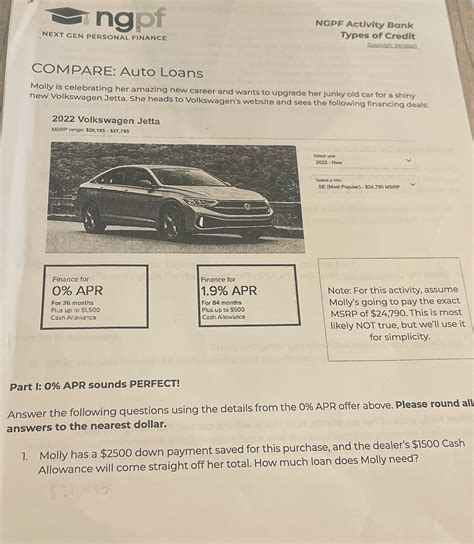

Installment credit involves borrowing a fixed amount of money that you repay in regular installments over a set period. Examples include auto loans, mortgages, and personal loans. Each payment typically includes a portion of the principal and interest.

Key Features of Installment Credit (as explained within the NGPF Activity Bank):

- Fixed Payments: Predictable monthly payments simplify budgeting.

- Lower Interest Rates (often): Often comes with lower interest rates than revolving credit, especially for longer-term loans like mortgages.

- Pre-determined Loan Term: The loan has a specific repayment timeframe.

- Impact on Credit Score: On-time payments significantly improve your credit score. Missed payments can severely damage it.

NGPF Activity Bank Focus: The NGPF materials likely emphasize the importance of understanding the terms of the loan, including the total amount to be repaid (including interest) and the length of the loan. They likely also discuss the impact of different loan terms on the total interest paid.

3. Secured Credit: Collateral as Backup

Secured credit requires collateral—an asset you pledge as security for the loan. If you default on the loan, the lender can seize the collateral. Examples include secured credit cards (requiring a security deposit) and auto loans (where the car serves as collateral).

Key Features of Secured Credit (likely covered in NGPF Activity Bank):

- Lower Risk for Lenders: The presence of collateral reduces the risk for lenders, often leading to more favorable terms for borrowers with limited or damaged credit.

- Easier Approval: Individuals with poor credit history might find it easier to secure a secured loan.

- Collateral Risk: Failure to repay the loan can result in the loss of the collateral.

- Credit Building Potential: Responsible repayment of secured credit can help rebuild creditworthiness.

NGPF Activity Bank Focus: The NGPF materials likely highlight the trade-offs involved in secured credit: the advantage of easier access to credit versus the risk of losing the collateral.

4. Unsecured Credit: No Collateral Required

Unsecured credit doesn't require collateral. It relies solely on the borrower's creditworthiness. Examples include unsecured personal loans and some credit cards. Approval for unsecured credit is generally more difficult to obtain than for secured credit.

Key Features of Unsecured Credit (covered in the NGPF materials):

- No Collateral Risk: You don't risk losing an asset if you default.

- Higher Interest Rates (usually): Lenders compensate for the higher risk by charging higher interest rates.

- Stricter Approval Requirements: Lenders scrutinize borrowers' credit scores and financial stability more carefully.

- Credit Building Opportunity (if managed well): Responsible management of unsecured credit can greatly improve your credit score.

NGPF Activity Bank Focus: The NGPF resources likely contrast unsecured credit with secured credit, emphasizing the higher risk for lenders and, consequently, the higher interest rates for borrowers.

5. Student Loans: Funding Education

Student loans are specifically designed to finance education expenses. They are usually categorized as either federal student loans (backed by the government) or private student loans (from private lenders). Repayment typically begins after graduation or the completion of studies.

Key Features of Student Loans (as likely discussed in NGPF Activity Bank):

- Specific Purpose: Funding educational expenses.

- Government Backing (for federal loans): Federal loans offer benefits like income-driven repayment plans and loan forgiveness programs.

- Interest Rates Vary: Interest rates vary depending on the type of loan, the lender, and the borrower's creditworthiness.

- Long-Term Repayment: Loans often have lengthy repayment periods.

NGPF Activity Bank Focus: The NGPF activities probably stress the importance of understanding the different types of student loans, their repayment terms, and the long-term financial implications of borrowing for education.

6. Payday Loans: Short-Term, High-Cost Borrowing

Payday loans are short-term, high-interest loans designed to be repaid on the borrower's next payday. These loans are often associated with high fees and can trap borrowers in a cycle of debt if not managed with extreme caution.

Key Features of Payday Loans (likely warned against in NGPF Activity Bank):

- Very Short Repayment Period: Typically due on the next payday.

- Extremely High Interest Rates: Much higher than other forms of credit.

- High Fees: Additional charges and fees can significantly increase the overall cost of borrowing.

- Risk of Debt Trap: Difficulty repaying on time can lead to a cycle of debt.

NGPF Activity Bank Focus: The NGPF resources likely strongly discourage the use of payday loans due to their extremely high cost and potential for trapping borrowers in a cycle of debt. They likely present alternative solutions for managing short-term financial emergencies.

Practical Application: Using NGPF Insights to Make Informed Choices

The information presented in the NGPF Activity Bank provides a solid foundation for understanding the diverse landscape of credit products. To leverage this knowledge effectively, consider the following:

- Assess Your Needs: Before applying for any type of credit, clearly define your needs and the amount you need to borrow.

- Compare Options: Shop around for the best rates and terms. Different lenders offer different options.

- Understand the Terms: Meticulously review the loan agreement before signing. Pay close attention to APR, fees, and repayment terms.

- Prioritize Responsible Use: Regardless of the type of credit used, responsible borrowing and timely repayment are crucial for building a strong credit history.

- Budget Wisely: Create a realistic budget to ensure you can comfortably afford your loan payments.

- Seek Help When Needed: If you're struggling with debt, don't hesitate to seek help from credit counselors or financial advisors.

By understanding the nuances of different credit types, as explained in the NGPF Activity Bank and elaborated upon here, you can make well-informed decisions, build a positive credit history, and achieve your financial goals. Remember, responsible credit management is key to long-term financial well-being.

Latest Posts

Latest Posts

-

Count Of Monte Cristo Chapter Summaries

Mar 17, 2025

-

Elige La Palabra Adecuada Para Completar Las Oraciones Comparativas

Mar 17, 2025

-

You Seem Pleased To Have Successfully Whored Yourself Manacled

Mar 17, 2025

-

Muchas Ninas Jovenes Han Estado A Dieta Terrible

Mar 17, 2025

-

Examples Of Public Data Collected By Law From Physicians Include

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Ngpf Activity Bank Types Of Credit Answers . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.