Online And Mobile Banking Student Activity Packet Unit: Banking

Onlines

Mar 03, 2025 · 6 min read

Table of Contents

Online and Mobile Banking: A Student Activity Packet - Unit: Banking

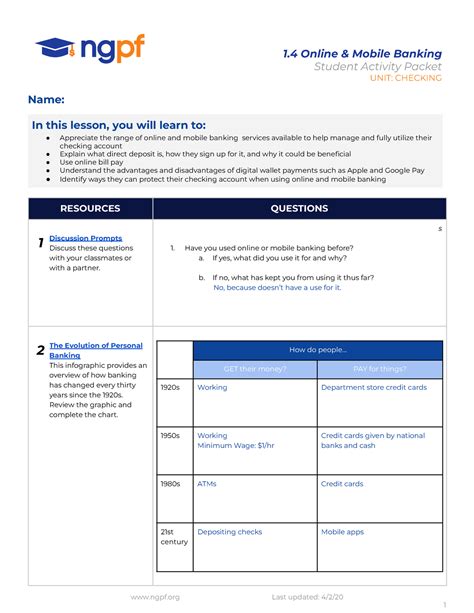

This comprehensive activity packet delves into the world of online and mobile banking, providing students with a practical understanding of its functionalities, security measures, and overall impact on personal finance. Through a series of engaging activities, discussions, and research tasks, students will develop crucial financial literacy skills relevant to their current and future lives.

Unit Objectives:

Upon completion of this unit, students will be able to:

- Define online and mobile banking and differentiate between the two.

- Identify the advantages and disadvantages of using online and mobile banking services.

- Describe the security features implemented by banks to protect user accounts.

- Explain how to safely and effectively use online and mobile banking platforms.

- Evaluate different banking apps and online platforms based on their features and security protocols.

- Demonstrate the ability to perform basic banking transactions online and via mobile app (simulated).

- Analyze the impact of online and mobile banking on personal finance management.

- Discuss the ethical considerations surrounding online and mobile banking.

Activity 1: What is Online and Mobile Banking?

Discussion: Begin with a class discussion exploring students' pre-existing knowledge of online and mobile banking. Ask open-ended questions such as:

- What are your experiences with online banking?

- Have you used a mobile banking app? If so, which one?

- What do you think are the benefits and drawbacks of online/mobile banking?

Activity: Students will create a Venn diagram comparing and contrasting online banking and mobile banking. They should highlight key differences, focusing on accessibility, features, and security aspects. Consider prompting them with these specific features:

- Account access and balance checking

- Bill pay capabilities

- Funds transfer options

- Mobile check deposit

- Customer support access

- Security features (two-factor authentication, biometrics)

Activity 2: Advantages and Disadvantages of Online and Mobile Banking

Research & Presentation: Divide students into groups, assigning each group either the advantages or disadvantages of online and mobile banking. They will research and compile a list of at least five points for their assigned category. Each group will present their findings to the class, fostering a robust discussion on the overall pros and cons.

Example Advantages:

- Convenience: Access accounts 24/7, from anywhere with an internet connection.

- Cost Savings: Often eliminates fees associated with physical branch visits.

- Time Savings: Faster and more efficient than traditional banking methods.

- Increased Security: Robust security measures to protect against fraud.

- Accessibility: Particularly beneficial for individuals with disabilities or those in remote areas.

Example Disadvantages:

- Security Risks: Susceptibility to hacking, phishing scams, and malware.

- Technical Issues: Reliance on technology and internet connectivity.

- Lack of Personal Interaction: Limited face-to-face interaction with bank representatives.

- Learning Curve: Requires technological literacy and familiarity with online platforms.

- Potential for Errors: Mistakes in online transactions can be difficult to rectify.

Activity 3: Security in Online and Mobile Banking

Interactive Lesson & Quiz: This section focuses on the importance of online banking security. The instructor can lead a discussion on common security threats (phishing, malware, scams), and preventive measures (strong passwords, two-factor authentication, software updates). A short quiz can assess students' understanding of security best practices.

Key Security Concepts to Cover:

- Phishing: Explain how phishing scams work and how to identify them. Show examples of phishing emails and websites.

- Malware: Discuss different types of malware and their potential impact on banking security. Emphasize the importance of antivirus software and regular updates.

- Strong Passwords: Teach students how to create strong, unique passwords that are difficult to crack. Discuss password managers as a tool for secure password storage.

- Two-Factor Authentication (2FA): Explain how 2FA works and its importance in enhancing account security. Provide examples of different 2FA methods (SMS codes, authenticator apps).

- Biometric Authentication: Discuss the use of biometric authentication methods like fingerprint or facial recognition for enhanced security.

- Secure Websites: Teach students how to identify secure websites (look for "https" and a padlock icon in the browser address bar).

Activity 4: Simulating Online Banking Transactions

Role-Playing & Case Studies: Using a simulated online banking platform (a mock-up or a free educational resource), students will practice performing basic banking transactions. This can be done individually or in small groups. Scenario-based case studies can add an element of realism. For example:

- Transferring funds between accounts.

- Paying bills online.

- Depositing a check (simulated).

- Checking account balance and transaction history.

- Contacting customer support (simulated chat or email).

Important Note: Ensure the simulated environment is safe and does not involve real financial transactions.

Activity 5: App Evaluation and Comparison

Comparative Analysis: Students will research and compare different mobile banking apps (e.g., Chase, Wells Fargo, Bank of America, etc.). They should evaluate the apps based on several criteria:

- Ease of use and navigation.

- Features and functionalities.

- Security features (2FA, biometrics, fraud alerts).

- Customer reviews and ratings.

- Overall user experience.

Students can present their findings in a comparative table or short report, justifying their evaluations. Encourage critical thinking about the trade-offs between different features and security levels.

Activity 6: Impact of Online and Mobile Banking on Personal Finance

Debate & Discussion: This section explores the broader impact of online and mobile banking on personal finance management. Students can participate in a debate focusing on whether online and mobile banking has had a positive or negative impact on individual financial well-being. Consider these discussion points:

- Improved budgeting and tracking capabilities.

- Increased accessibility to financial services.

- Potential for overspending and impulse purchases.

- Risk of financial fraud and identity theft.

- Changes in the banking industry and customer service.

Activity 7: Ethical Considerations in Online and Mobile Banking

Ethical Dilemma Scenarios: Present students with several ethical dilemma scenarios related to online and mobile banking. This encourages critical thinking about responsible online behavior and ethical decision-making. Examples:

- A friend shares their online banking password with you. What do you do?

- You receive a suspicious email appearing to be from your bank. How do you respond?

- You discover a security flaw in a banking app. What steps should you take?

Students will discuss and analyze each scenario, considering the ethical implications and appropriate actions to take.

Activity 8: Creating a Personal Online Banking Security Plan

Individual Project: Students will create a personal online banking security plan, outlining specific steps they will take to protect their online accounts. This plan should include:

- Strong password creation and management strategies.

- Methods for identifying and avoiding phishing scams.

- Procedures for reporting suspicious activity.

- Regular software updates and security checks.

- Use of multi-factor authentication.

Assessment:

Assessment can be based on a combination of:

- Participation in class discussions.

- Completion of activities and assignments.

- Presentation of research findings.

- Performance on quizzes and tests.

- Submission of the individual security plan.

This comprehensive activity packet provides a robust framework for teaching students about online and mobile banking. By combining interactive activities, research tasks, and real-world scenarios, students will develop a thorough understanding of this increasingly important aspect of personal finance. Remember to adapt and modify these activities to suit the specific needs and learning styles of your students.

Latest Posts

Latest Posts

-

The Fda Regulations Governing Disclosure Of Individual Cois Require

Mar 03, 2025

-

In This Problem A B C And D

Mar 03, 2025

-

Kimberly Pace Death Investigation Yoknapatawpha County Sheriffs Department

Mar 03, 2025

-

Jane Ai Clinical Judgement Assessments Gray

Mar 03, 2025

-

To Kill A Mockingbird Chapter Summaries

Mar 03, 2025

Related Post

Thank you for visiting our website which covers about Online And Mobile Banking Student Activity Packet Unit: Banking . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.