Payment Arrangements For Settlement Of The Liability Are Made Between

Onlines

Mar 12, 2025 · 6 min read

Table of Contents

Payment Arrangements for Settlement of Liability: A Comprehensive Guide

Reaching a settlement agreement often involves intricate negotiations and careful consideration of various payment arrangements. This comprehensive guide delves into the multifaceted aspects of structuring payments to settle liabilities, covering everything from the initial negotiation phase to the final execution of the agreement. We will explore different payment methods, factors influencing payment structure, legal considerations, and strategies for ensuring a smooth and successful settlement process.

Understanding the Foundation: Negotiating the Settlement

Before diving into payment arrangements, it's crucial to understand the negotiation process. This involves assessing the strength of your case, understanding the opposing party's position, and defining clear objectives. Successful negotiations require skillful communication, compromise, and a willingness to explore various options. Here are key considerations during the negotiation phase:

1. Assessing Your Position:

- Strength of Evidence: A strong case supported by solid evidence significantly improves your negotiating power. This includes contracts, documentation, witness testimonies, and expert opinions.

- Potential Costs: Factor in the potential costs associated with litigation, including legal fees, expert witness fees, and potential damages. Weigh these costs against the potential benefits of settling.

- Risk Assessment: Accurately assess the risks involved in pursuing litigation. Consider the probability of winning, the potential damages you might incur, and the time it might take to resolve the matter.

2. Understanding the Opposing Party's Position:

- Their Motivation: Understanding their motivations for settling will help you craft a more persuasive negotiation strategy. Are they looking for a quick resolution? Are they facing financial constraints?

- Their Resources: Knowing their financial resources can inform your expectations regarding the settlement amount and payment terms.

- Their Legal Counsel: Be aware of the skills and experience of their legal counsel, as this can impact the negotiation process.

3. Defining Clear Objectives:

- Settlement Amount: Establish a realistic target settlement amount, taking into account your assessed position and the opposing party's resources.

- Payment Schedule: Determine a preferred payment schedule that aligns with your financial needs and risk tolerance.

- Confidentiality: Consider the importance of confidentiality and include a confidentiality clause in the settlement agreement.

Exploring Various Payment Arrangements

Once a settlement amount is agreed upon, the next step is determining the payment arrangement. The structure of the payment significantly impacts both parties. Here are common payment options:

1. Lump-Sum Payment:

This is the simplest form of payment, involving a single payment of the entire settlement amount. It provides certainty and finality but may be challenging for either party depending on their financial capacity.

2. Installment Payments:

This involves paying the settlement amount in installments over a predetermined period. This structure can be beneficial when either party faces financial constraints. The agreement should clearly define the payment amount, due dates, and consequences of late payments. Interest may be included to compensate for the delayed payment.

3. Structured Settlements:

Structured settlements are complex agreements that typically involve a combination of lump-sum payments and periodic payments spread over several years. They are often used in cases involving significant injuries or long-term care needs. These settlements frequently utilize annuities to provide a guaranteed stream of income.

4. Payment through Escrow Account:

An escrow account is a neutral third-party account where the funds are held until the terms of the settlement are fulfilled. This method provides security for both parties and ensures that payments are made according to the agreement.

5. Combination of Payment Methods:

In certain situations, a combination of the above methods may be the most suitable option. For example, a partial lump-sum payment upfront followed by installment payments.

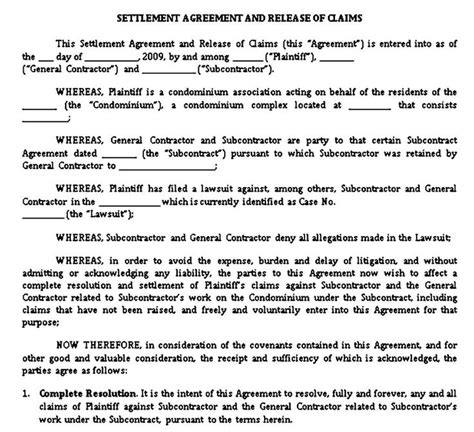

Legal Considerations and Contractual Aspects

Creating a legally sound and enforceable settlement agreement requires careful consideration of several legal aspects:

1. Enforceability:

The agreement must be clear, unambiguous, and meet all legal requirements for a valid contract. Both parties must have the legal capacity to enter into the agreement.

2. Release of Liability:

The agreement should clearly state that the payment constitutes full and final settlement of all claims between the parties. This prevents future disputes or claims arising from the same issue.

3. Confidentiality Clauses:

Confidentiality clauses are often included to protect sensitive information from public disclosure. These clauses should clearly define what information is considered confidential and the consequences of breaching confidentiality.

4. Governing Law:

The agreement should specify which state or jurisdiction's laws govern the agreement. This is crucial for resolving any disputes that may arise.

5. Dispute Resolution:

The agreement should outline a mechanism for resolving disputes that may arise in the future. This might include arbitration or mediation to avoid costly litigation.

Factors Influencing Payment Structure

Several factors influence the choice of payment arrangement. These include:

1. Financial Capacity:

The financial capacity of both parties plays a significant role in determining the feasibility of different payment structures. A party with limited financial resources might require installment payments, while a party with substantial resources might prefer a lump-sum payment.

2. Risk Tolerance:

The level of risk tolerance of both parties influences the payment arrangement. A party with a high risk tolerance might be willing to accept a smaller upfront payment in exchange for potentially larger future payments.

3. Tax Implications:

Tax implications differ significantly depending on the payment structure. Consulting with a tax advisor is crucial to understand the tax implications of various payment arrangements.

4. Future Circumstances:

Future circumstances, such as potential changes in income or expenses, should also be considered. A structured settlement might be more suitable in situations where future income is uncertain.

5. Legal Counsel's Advice:

Seeking advice from legal counsel is paramount to ensure that the chosen payment arrangement is legally sound and protects your interests.

Strategies for a Smooth Settlement Process

Several strategies can contribute to a smooth and efficient settlement process:

1. Clear Communication:

Maintain open and clear communication throughout the process. Address any concerns promptly and honestly.

2. Professionalism:

Maintain a professional demeanor throughout the negotiation and settlement process. Avoid emotional outbursts or personal attacks.

3. Documentation:

Keep meticulous records of all communications, agreements, and payments. This documentation can prove invaluable if disputes arise later.

4. Legal Counsel:

Retain legal counsel to ensure your interests are protected throughout the process. An experienced attorney can guide you through the complex legal aspects of settlement negotiations.

5. Patience:

Reaching a mutually agreeable settlement often takes time and patience. Avoid rushing the process and allow sufficient time for negotiations and documentation.

Conclusion: Navigating the Complexities of Settlement Payments

Successfully navigating the complexities of settlement payments requires a multi-faceted approach. By carefully considering the factors discussed, negotiating effectively, and structuring the payment arrangement appropriately, you can increase your chances of reaching a mutually acceptable and legally sound settlement. Remember that seeking professional advice from legal and financial experts is crucial to ensure a smooth and successful resolution. Understanding the various payment options, legal implications, and strategic considerations will equip you to make informed decisions and protect your interests throughout the settlement process. The ultimate goal is not just a settlement, but a fair and equitable resolution that provides closure for all parties involved.

Latest Posts

Latest Posts

-

Suppose You Are Walking Down A Street

Mar 12, 2025

-

Nr 509 Midterm Exam 72 Questions

Mar 12, 2025

-

Damon Goes To The Hospital Reflection Answers

Mar 12, 2025

-

The Giver Chapter Summaries 1 23 Pdf

Mar 12, 2025

-

A School Counselor Wants To Compare The Effectiveness

Mar 12, 2025

Related Post

Thank you for visiting our website which covers about Payment Arrangements For Settlement Of The Liability Are Made Between . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.