Primary Claims Submission Includes A Patient Who Has Coverage By

Onlines

Mar 10, 2025 · 5 min read

Table of Contents

Primary Claims Submission: Understanding Patient Coverage and the Claims Process

Submitting primary claims accurately and efficiently is crucial for healthcare providers. This process involves understanding the patient's insurance coverage and navigating the complexities of various payer requirements. This comprehensive guide will delve into the intricacies of primary claims submission, focusing on patients with multiple insurance coverages. We'll explore the nuances of determining primary and secondary insurers, handling coordination of benefits (COB), and ensuring smooth claim processing to avoid delays and denials.

Understanding Primary and Secondary Insurance

When a patient has more than one insurance policy, determining the primary and secondary insurer is the first critical step in the claims submission process. This is often governed by the "birthday rule" or other contractual agreements between the insurers.

The Birthday Rule

The birthday rule is a common method used to determine primary insurance coverage. It dictates that the policyholder whose birthday falls earlier in the year is considered the primary insurer. This rule applies to both parents' insurance policies covering a child. However, it’s crucial to remember this is a general guideline.

Exceptions to the Birthday Rule

The birthday rule isn't universally applicable. Many exceptions exist, including:

- Court Orders: Legal agreements, such as divorce decrees, often specify which parent holds primary insurance responsibility.

- Insurance Company Specific Rules: Specific insurance policies might have their own internal rules overriding the birthday rule. Always refer to the individual policy documents.

- Dependent Children: Even with the birthday rule, the order of coverage can depend on whether the child is considered a dependent on both parents' plans. Policy details will dictate this.

Determining Primary Coverage: A Step-by-Step Guide

- Collect Patient Insurance Information: Obtain complete details of all insurance policies held by the patient, including policy numbers, group numbers, and employer information.

- Identify the Policyholders: Determine who the policyholder is for each policy.

- Apply the Birthday Rule (or other applicable rules): Use the birthday rule as a starting point, but always check for exceptions.

- Review Policy Documents: If there's ambiguity, refer to the specific policy language of each insurer.

- Contact the Insurers if Necessary: If you are still unsure, contact the insurance carriers directly to clarify coverage.

Coordination of Benefits (COB)

Coordination of Benefits (COB) is the process of managing claims when a patient has multiple insurance plans. The goal is to ensure that the patient doesn't receive more than 100% reimbursement for their medical expenses. The primary insurer typically pays its portion of the claim first, leaving the secondary insurer responsible for the remaining balance (after applying their own coverage percentages and deductibles).

Understanding COB Clauses

Each insurance policy includes a COB clause, outlining its procedures for handling multiple coverage situations. These clauses often specify:

- Order of Payment: Defines which insurer is primary and secondary.

- Payment Limitations: Sets limits on the total amount reimbursed across all plans.

- Coordination Procedures: Details the process for submitting claims to both insurers.

Failure to adhere to the COB procedures can lead to claim denials and payment delays.

The Primary Claims Submission Process

Submitting a primary claim involves several critical steps:

1. Accurate Patient Information:

- Full Legal Name: Verify the spelling matches the insurance card.

- Date of Birth: Ensure accuracy to prevent denials.

- Policy Number and Group Number: These identifiers are crucial for proper routing.

- Address and Contact Information: Current and accurate contact information is essential for communication.

2. Detailed Medical Information:

- Diagnosis Codes (ICD codes): Use the most accurate and up-to-date codes.

- Procedure Codes (CPT or HCPCS codes): Precise and relevant codes are critical for reimbursement.

- Dates of Service: Accurate dates are essential for processing.

- Place of Service: Specify the location where services were rendered.

3. Proper Claim Form Completion:

- Electronic Claims Submission (EDI): EDI is the preferred method by most payers, offering speed and accuracy.

- Paper Claims: While less efficient, paper claims remain an option for some payers. Ensure accurate and legible completion.

4. Supporting Documentation:

- Medical Records: Provide detailed medical records supporting the diagnosis and procedures.

- Pre-authorization: Include any necessary pre-authorization forms or approvals.

5. Following Up on Claims:

- Monitoring Claim Status: Regularly check the status of submitted claims.

- Addressing Denials: Promptly address any claim denials by reviewing the reason for denial and providing any missing information.

- Appealing Denied Claims: If a denial is deemed inaccurate, follow the payer's appeal process.

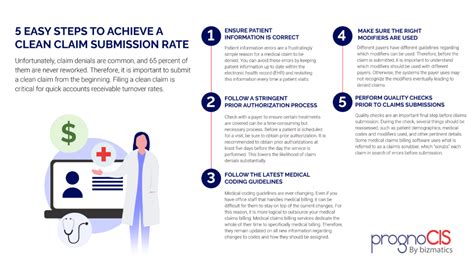

Common Reasons for Primary Claim Denials

Understanding common causes of claim denials can significantly improve the success rate of your primary claim submissions. Some frequent issues include:

- Incorrect or Missing Information: Incomplete or inaccurate patient data, diagnosis codes, or procedure codes.

- Lack of Pre-authorization: Failure to obtain necessary pre-authorization for certain procedures.

- Non-covered Services: The insurance policy doesn't cover the specific services rendered.

- Billing Errors: Incorrect billing practices or coding errors.

- Timely Filing Limits: Claims submitted beyond the payer's specified timeframe.

- Duplicate Claims: Submitting the same claim multiple times.

Best Practices for Efficient Primary Claims Submission

- Implement a Robust Claims Management System: Use software designed to manage claims efficiently and minimize errors.

- Establish Clear Internal Processes: Develop standardized procedures for collecting patient information, completing claims forms, and tracking claim status.

- Train Staff Thoroughly: Ensure your billing staff is adequately trained in medical coding, billing regulations, and insurance payer requirements.

- Maintain Accurate Patient Records: Keep meticulous records to facilitate accurate and timely claims submission.

- Regularly Review Payer Guidelines: Stay informed about changes in payer guidelines and regulations.

- Utilize Electronic Data Interchange (EDI): Take advantage of EDI to streamline the claims submission process.

The Role of Technology in Primary Claims Submission

Technology plays a vital role in modern claims processing. Claim management software automates many tasks, reducing manual effort and the risk of errors. EDI significantly speeds up the submission process and improves accuracy. Automated clearinghouses facilitate seamless communication with payers.

Conclusion

Effective primary claims submission is critical for healthcare providers. Understanding patient coverage, applying the birthday rule and other relevant guidelines, and meticulously completing claims forms significantly improves the chance of timely and accurate payments. By following the best practices outlined in this guide, healthcare providers can streamline their claims process, minimize denials, and ensure efficient revenue cycle management. Remember, proactive monitoring, thorough training, and the use of technology are essential components of a successful primary claims submission strategy. Continuously staying abreast of industry updates and payer-specific rules is crucial for long-term success in navigating the complexities of medical billing.

Latest Posts

Latest Posts

-

Apush Unit 3 Progress Check Mcq

Mar 10, 2025

-

What Is Brand Association Select All That Apply

Mar 10, 2025

-

Basic Communication Crossword Notes Puzzle Answers

Mar 10, 2025

-

How Do You Individualize A Patients Care Plan In Epic

Mar 10, 2025

-

Rising Action Examples In Helen Keller

Mar 10, 2025

Related Post

Thank you for visiting our website which covers about Primary Claims Submission Includes A Patient Who Has Coverage By . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.