Reinforcement Activity 1 Part A Answer Key Accounting

Onlines

Mar 25, 2025 · 6 min read

Table of Contents

Reinforcement Activity 1 Part A Answer Key: Accounting – A Comprehensive Guide

This comprehensive guide provides detailed answers and explanations for Reinforcement Activity 1, Part A, commonly found in introductory accounting textbooks. We'll cover a range of fundamental accounting concepts, ensuring a thorough understanding of the principles involved. This guide is designed to help students solidify their grasp of these concepts and improve their problem-solving skills in accounting. Remember, understanding the why behind the answer is just as important as getting the correct numerical result.

Section 1: Understanding the Fundamentals of Accounting

Before diving into the specific answers, let's refresh some crucial accounting concepts that are likely tested in Reinforcement Activity 1, Part A. These concepts form the bedrock of accounting and are essential for solving any accounting problem.

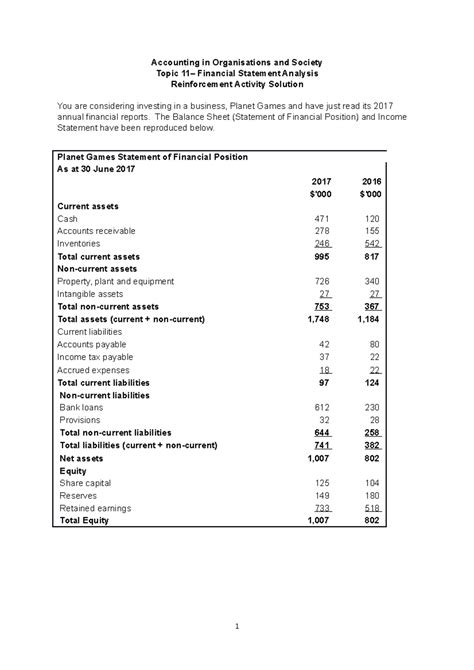

1. The Accounting Equation: The fundamental accounting equation, Assets = Liabilities + Equity, governs all accounting transactions. Understanding this equation is paramount. Assets represent what a company owns (cash, accounts receivable, equipment), liabilities represent what a company owes (accounts payable, loans), and equity represents the owner's stake in the company. Every transaction affects at least two of these accounts, maintaining the equation's balance.

2. Debits and Credits: The double-entry bookkeeping system uses debits and credits to record transactions. Debits increase the balance of asset, expense, and dividend accounts, while credits increase the balance of liability, equity, and revenue accounts. The opposite is true for decreases. Remember the acronym DEAD CLIC (Debits increase Expenses, Assets, and Dividends; Credits increase Liabilities, Income, and Capital).

3. Chart of Accounts: A chart of accounts is a comprehensive list of all accounts used by a business. It's organized systematically, typically by account type (assets, liabilities, equity, revenues, expenses). Understanding the chart of accounts is crucial for proper recording and classification of transactions.

4. Types of Accounts: Familiarize yourself with the different types of accounts, including:

- Assets: Current Assets (cash, accounts receivable, inventory) and Non-Current Assets (property, plant, and equipment, intangible assets).

- Liabilities: Current Liabilities (accounts payable, salaries payable) and Non-Current Liabilities (long-term debt).

- Equity: Owner's capital, retained earnings.

- Revenue: Sales revenue, service revenue.

- Expenses: Cost of goods sold, salaries expense, rent expense.

Section 2: Sample Problems and Detailed Solutions (Reinforcement Activity 1, Part A)

Because we don't have access to the specific questions in your "Reinforcement Activity 1, Part A," we'll create example problems that cover common scenarios encountered in such activities. These examples will demonstrate the application of the accounting principles discussed above.

Example Problem 1: Journal Entries

-

Scenario: On January 10th, Acme Company purchased office supplies for $500 cash. On January 15th, Acme Company provided services to a client for $1,000 on account (meaning the client will pay later).

-

Required: Prepare journal entries for these transactions.

-

Solution:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| Jan 10 | Office Supplies | $500 | |

| Cash | $500 | ||

| To record purchase of supplies | |||

| Jan 15 | Accounts Receivable | $1,000 | |

| Service Revenue | $1,000 | ||

| To record service revenue on account |

Explanation: The January 10th entry shows an increase in the Office Supplies (asset) account and a decrease in the Cash (asset) account. The January 15th entry shows an increase in Accounts Receivable (asset – money owed to the company) and an increase in Service Revenue (revenue account). Both entries follow the rules of debits and credits, and the accounting equation remains balanced.

Example Problem 2: Trial Balance

-

Scenario: After recording several transactions, Acme Company has the following account balances:

- Cash: $2,000

- Accounts Receivable: $1,500

- Office Supplies: $700

- Equipment: $5,000

- Accounts Payable: $800

- Owner's Capital: $6,000

- Service Revenue: $3,000

- Rent Expense: $500

-

Required: Prepare a trial balance.

-

Solution:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $2,000 | |

| Accounts Receivable | $1,500 | |

| Office Supplies | $700 | |

| Equipment | $5,000 | |

| Accounts Payable | $800 | |

| Owner's Capital | $6,000 | |

| Service Revenue | $3,000 | |

| Rent Expense | $500 | |

| Total | $9,700 | $9,800 |

- Explanation: A trial balance lists all accounts with their debit and credit balances. The total debits should always equal the total credits. In this example, there's a slight discrepancy ($100 difference). This indicates an error needs to be identified and corrected in the underlying journal entries. Trial balances are essential for detecting errors before preparing financial statements.

Example Problem 3: Adjusting Entries

-

Scenario: Acme Company prepaid rent for the year on December 31st for $6,000.

-

Required: Prepare the adjusting entry as of December 31st.

-

Solution:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| Dec 31 | Rent Expense | $500 | |

| Prepaid Rent | $500 | ||

| To record rent expense for the month |

- Explanation: This demonstrates an adjusting entry. The initial entry recorded the prepaid rent as an asset. At the end of the accounting period, we need to adjust for the portion of the rent that has been used (expired). Assuming a monthly expense, 1/12th of the prepaid rent ($6000/12 = $500) is expensed. This reduces the prepaid rent (asset) and increases rent expense.

Example Problem 4: Financial Statements

-

Scenario: Using the adjusted balances from the previous examples (correcting the trial balance error), prepare an income statement and a balance sheet.

-

Solution: This requires extensive calculation and preparation; hence, it is omitted from this simplified example. However, the income statement would show revenues less expenses to arrive at net income, while the balance sheet would show assets, liabilities, and equity at a specific point in time.

Remember to always follow the basic accounting principles and the rules of debits and credits when solving problems. If you are uncertain about any of the solutions, refer back to the accounting textbook or consult your instructor for further clarification.

Section 3: Advanced Concepts and Further Practice

Reinforcement activities often build upon earlier concepts. Therefore, understanding these fundamentals is key to tackling more advanced problems. Here are some concepts you might encounter in subsequent activities:

- Depreciation: The systematic allocation of the cost of an asset over its useful life.

- Accrual Accounting: Recognizing revenues when earned and expenses when incurred, regardless of when cash changes hands.

- Cash Accounting: Recognizing revenues and expenses when cash is received or paid.

- Inventory Valuation: Methods for assigning value to inventory (FIFO, LIFO, weighted-average cost).

- Bank Reconciliation: Reconciling the bank statement with the company's cash records.

To further enhance your understanding and prepare for more complex accounting problems, consider practicing additional problems from your textbook, seeking help from your instructor or tutor, or utilizing online accounting resources. Remember, consistent practice and a thorough understanding of the basic principles are crucial for success in accounting. By diligently working through these examples and similar exercises, you will develop a strong foundation in accounting and improve your problem-solving abilities. Don't hesitate to seek further help if needed; mastering accounting is a journey that requires consistent effort and learning.

Latest Posts

Latest Posts

-

The Book Of The Courtier Summary

Mar 26, 2025

-

Amoeba Sisters Video Recap Cell Transport Answer Key

Mar 26, 2025

-

Please Place The Following Societies In Chronological Order

Mar 26, 2025

-

Table 10 2 Model Inventory For Skeletal Muscles

Mar 26, 2025

-

My Year Of Meats Chapter Summary

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Reinforcement Activity 1 Part A Answer Key Accounting . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.