Roadmap To Secured Transactions Bar Exam Essay

Onlines

Mar 04, 2025 · 7 min read

Table of Contents

Roadmap to a Secured Transactions Bar Exam Essay: Mastering the UCC Article 9 Maze

The Secured Transactions portion of the bar exam can feel like navigating a dense forest. Article 9 of the Uniform Commercial Code (UCC) is complex, filled with nuanced rules and exceptions. However, with a structured approach and a deep understanding of key concepts, you can conquer this challenging area and write a high-scoring essay. This roadmap provides a comprehensive guide to mastering secured transactions for your bar exam preparation.

I. Foundational Concepts: Building Your Framework

Before diving into the intricacies of specific scenarios, it's crucial to establish a solid foundation. Understanding these core principles will serve as the bedrock for analyzing any secured transaction problem.

A. The Basics: What is a Secured Transaction?

A secured transaction involves a debtor who owes a creditor money, and the creditor takes collateral as security for the debt. This collateral provides the creditor with recourse should the debtor default. Understanding the relationship between these three parties is paramount.

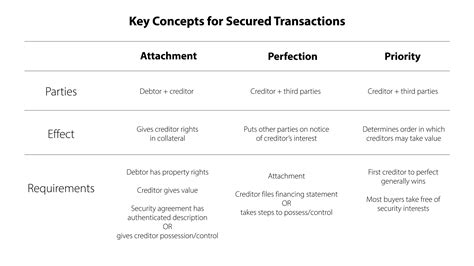

B. Attachment: Creating an Enforceable Security Interest

For a security interest to be enforceable against the debtor, it must attach. Attachment requires three elements:

- Security Agreement: A written agreement (or possession of the collateral) indicating intent to create a security interest. Oral agreements are generally insufficient, unless the collateral is goods in the possession of the secured party. This agreement must reasonably identify the collateral.

- Value: The secured party must give value to the debtor (e.g., loaning money, extending credit).

- Debtor's Rights in the Collateral: The debtor must have rights in the collateral. They can't grant a security interest in something they don't own.

Remember: The failure of any of these three elements prevents attachment, rendering the security interest unenforceable against the debtor.

C. Perfection: Protecting Your Security Interest Against Others

Perfection is the process of giving notice to the world that the secured party has a security interest in the collateral. This protects the secured party's interest against other creditors who might also claim the same collateral. Methods of perfection include:

- Filing a Financing Statement: This is the most common method. The financing statement is filed with the Secretary of State (or a similar office) and generally provides notice to third parties about the security interest. It must contain the names of the debtor and secured party, a description of the collateral, and the authorization of the debtor. Inaccurate filing information could lead to problems. Errors such as incorrect names or addresses can render the filing ineffective.

- Possession of the Collateral: The secured party takes possession of the collateral. This is common with goods like jewelry or vehicles. Possession itself serves as perfection.

- Control: Certain types of collateral, such as investment property, require control by the secured party for perfection.

- Automatic Perfection: In limited circumstances, perfection automatically occurs upon attachment. This is often seen with purchase-money security interests (PMSI) in consumer goods.

D. Priority Disputes: Who Gets Paid First?

When multiple secured parties have claims to the same collateral, priority disputes arise. The rules governing priority are complex and depend on several factors, including:

- Order of Perfection: Generally, the first to perfect has priority.

- Order of Attachment: If perfection doesn't occur, the first to attach has priority.

- Purchase-Money Security Interests (PMSIs): PMSIs generally take priority over other security interests in the same collateral. A PMSI is a security interest that is taken in goods that are purchased with the proceeds of a loan; it is taken in the specific goods to purchase the goods, and it is a specific priority.

- Control: A party who has control generally has priority over a party with a filed financing statement.

II. Types of Collateral: Understanding the Nuances

Article 9 categorizes collateral into different types, each with its own rules regarding perfection and priority. Understanding these categories is critical.

A. Goods: Tangible Personal Property

Goods are broadly categorized into several subtypes:

- Consumer Goods: Used primarily for personal, family, or household purposes.

- Equipment: Used in business.

- Farm Products: Crops, livestock, or supplies used or produced in farming.

- Inventory: Goods held for sale or lease.

The classification of goods significantly impacts perfection and priority rules. For instance, PMSIs in consumer goods automatically perfect upon attachment, whereas equipment usually requires filing.

B. Intangible Collateral: Beyond Tangible Assets

Intangible collateral encompasses a variety of assets, including:

- Accounts: Rights to payment for goods sold or services rendered.

- Chattel Paper: A record representing both a monetary obligation and a security interest in specific goods.

- Instruments: Negotiable instruments like notes and drafts.

- Investment Property: Stocks, bonds, and other securities.

- Deposit Accounts: Bank accounts.

Perfection methods vary greatly depending on the type of intangible collateral. For example, investment property often requires control, whereas accounts may require filing.

C. Proceeds: Tracing the Value

Proceeds are whatever is received upon the sale, exchange, or other disposition of collateral. A security interest in collateral automatically extends to proceeds received from its disposition. However, the secured party must take steps to perfect their interest in the proceeds (unless the perfection in the original collateral automatically extends to the proceeds).

III. Default and Remedies: Enforcing the Security Interest

When the debtor defaults on the loan, the secured party has various remedies available. Understanding these remedies is critical for analyzing secured transaction problems.

A. Repossession: Taking Back the Collateral

The secured party may repossess the collateral. This must be done without breach of the peace. A breach of the peace involves any action that might lead to violence or the threat of violence.

B. Foreclosure: Selling the Collateral

After repossession, the secured party may sell the collateral commercially reasonably. The proceeds from the sale are applied first to the expenses of the sale, then to the debt owed, and any surplus is returned to the debtor. If the sale doesn't cover the debt, the secured party may pursue a deficiency judgment against the debtor for the remaining balance.

C. Strict Foreclosure: Keeping the Collateral

In some cases, the secured party may retain the collateral in satisfaction of the debt. This is allowed only if the debtor consents or if the secured party provides reasonable notification to the debtor.

IV. Analyzing Bar Exam Questions: A Step-by-Step Approach

When faced with a secured transaction essay question on the bar exam, follow a systematic approach:

- Identify the Parties: Determine who the debtor, creditor, and any other potential claimants are.

- Identify the Collateral: Classify the collateral into its appropriate category (goods, intangible, etc.).

- Analyze Attachment: Determine whether the three elements of attachment are present.

- Analyze Perfection: Determine how (if at all) the security interest was perfected, and when.

- Analyze Priority: Determine which secured party (if more than one) has priority in the collateral.

- Analyze Default and Remedies: Determine whether the debtor has defaulted and what remedies are available to the secured party. Analyze whether these remedies were undertaken properly.

V. Practice, Practice, Practice: Mastering the Material

The key to success in secured transactions is practice. Work through numerous hypotheticals and essay questions. Focus on identifying the key issues and applying the relevant rules. Use practice questions provided by bar exam prep companies or law school materials to improve your skills. The more you practice, the more comfortable you will become with the complex rules of Article 9.

VI. Common Pitfalls to Avoid

Several common mistakes can derail your bar exam essay. Be mindful of these:

- Ignoring the facts: Carefully read and analyze the facts of the problem before applying the law. Don't simply recite the rules without applying them to the specific scenario.

- Failing to discuss all relevant issues: Address all the crucial elements, from attachment and perfection to priority and remedies.

- Confusing concepts: Ensure you understand the differences between attachment, perfection, and priority, and their implications.

- Overlooking nuances: The UCC is filled with exceptions and nuances. Be aware of these and apply them appropriately.

- Lack of clarity and organization: Present your analysis in a clear, concise, and well-organized manner. Use headings and subheadings to structure your essay logically. Make sure your conclusion summarizes your findings.

VII. Conclusion: Conquering the Secured Transactions Maze

The secured transactions portion of the bar exam can be daunting, but with a methodical approach, thorough understanding of the fundamental concepts, and consistent practice, you can confidently navigate the complexities of Article 9. By following this roadmap and diligently preparing, you will significantly increase your chances of success on the bar exam. Remember to practice applying these rules in various hypothetical scenarios to strengthen your understanding and refine your essay-writing skills. Good luck!

Latest Posts

Latest Posts

-

How Long Does Coursehero Take To Process

Mar 04, 2025

-

Great Expectations Summary Of Each Chapter

Mar 04, 2025

-

Mastery Worksheet Mat 1033 Test 1 Answers

Mar 04, 2025

-

Two Step Equations Whole Numbers Answer Key

Mar 04, 2025

-

Pols 1101 Albany State University Syllabus

Mar 04, 2025

Related Post

Thank you for visiting our website which covers about Roadmap To Secured Transactions Bar Exam Essay . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.