Sprint Purch Agency Nextel Sys Corp

Onlines

Mar 04, 2025 · 6 min read

Table of Contents

Sprint, Nextel, and the Rise and Fall of a Wireless Giant: A Deep Dive into the Merger and its Aftermath

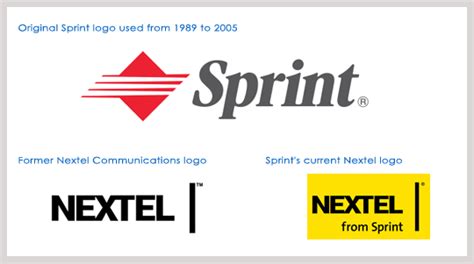

The telecommunications landscape is a dynamic and ever-changing environment. Mergers and acquisitions are a common occurrence, often shaping the industry's trajectory. One such pivotal event was the 2005 merger of Sprint Nextel Corporation, a combination of two major players, Sprint and Nextel. This article delves into the history of Sprint and Nextel, the intricacies of their merger, the subsequent challenges faced by the newly formed entity, and the long-term impact on the competitive wireless market. We'll analyze the strategic decisions, operational hurdles, and ultimately, the reasons behind the eventual dismantling of the Sprint Nextel behemoth.

The Genesis of Sprint and Nextel: Two Separate Paths Converging

Before their union, Sprint and Nextel were distinct entities with unique strengths and weaknesses. Understanding their individual histories is crucial to analyzing the success (or lack thereof) of their merger.

Sprint: A Pioneer in Wireless Innovation

Sprint, initially known as Southern Pacific Communications Company, carved a name for itself as a technological innovator in the long-distance market. It later ventured into wireless communications, establishing itself as a significant player through strategic acquisitions and investments in cutting-edge technologies. Sprint’s network infrastructure, known for its wide coverage and robust capabilities, formed the backbone of its competitive advantage. Their focus on technology and network infrastructure was a key differentiator. They consistently invested in CDMA technology, setting the stage for a potential powerful merger, or at least a strong partnership.

Nextel: The Walkie-Talkie Revolution

Nextel, on the other hand, gained prominence with its innovative push-to-talk (PTT) technology, providing a unique service that resonated strongly with businesses and professional users. Their iDEN network, while technologically different from Sprint's CDMA network, offered a distinct value proposition focused on instant communication. This made Nextel a significant player in a niche market, although it potentially lacked the long-term scalability of Sprint's technology. Their strength lay in their unique service offering and a loyal customer base who valued the immediacy of their PTT capabilities.

The Sprint Nextel Merger: A Bet on Synergy and Domination

The 2005 merger between Sprint and Nextel was a monumental event, creating the third-largest wireless carrier in the United States. The rationale behind this ambitious endeavor was predicated on several key factors:

-

Synergies: The expectation was that combining Sprint's vast network infrastructure and Nextel's unique PTT service would create powerful synergies, leading to increased market share and improved profitability. This included leveraging existing infrastructure to reduce operational costs and expand market reach.

-

Market Consolidation: The telecommunications industry was undergoing a period of consolidation, with larger players aiming to gain a competitive edge through scale and scope. The merger was seen as a necessary step to compete with industry giants like Verizon and AT&T.

-

Diversification: The merger aimed to diversify the combined entity's customer base, reducing reliance on a single customer segment. Sprint’s consumer focus was complemented by Nextel's business-oriented clientele.

-

Technological Innovation: Combining the two networks and technologies potentially held the promise of technological advancements. It created a scenario for integrating innovation from both networks and technologies.

The Post-Merger Reality: Challenges and Shortcomings

Despite the initial optimistic forecasts, the Sprint Nextel merger faced significant challenges. The anticipated synergies failed to materialize to the extent initially projected, resulting in a series of setbacks:

-

Network Integration Difficulties: Integrating two vastly different network technologies (CDMA and iDEN) proved far more complex and costly than anticipated. The resulting network performance suffered, impacting customer satisfaction and network reliability. This failure to seamlessly integrate network technologies is a classic pitfall of large-scale mergers. Underestimating the complexity of combining disparate systems is a frequent issue.

-

Cultural Clash: The merger brought together two distinctly different corporate cultures. This cultural clash led to internal conflicts, decreased efficiency, and higher attrition rates among employees. This is a common problem with mergers and often overlooks the human element.

-

Loss of Key Personnel: During the merger integration process, several key personnel from both Sprint and Nextel left the company, creating knowledge gaps and exacerbating managerial challenges. The loss of institutional memory and expertise hampered the company's ability to navigate challenges effectively.

-

Financial Strain: The high cost of integration, coupled with declining network performance and customer churn, put a significant strain on the company's finances. This impacted the ability to invest in upgrades and improvements, leading to a vicious cycle of decline.

-

Competition: The failure to effectively integrate the networks and the subsequent loss of customers left Sprint Nextel vulnerable to competition from more established and robust networks. This intensified the competitive pressure and compounded their problems.

The Aftermath: Restructuring, Sale, and Legacy

In the years following the merger, Sprint Nextel underwent several restructuring attempts, including cost-cutting measures and efforts to improve network performance. However, these initiatives proved insufficient to reverse the negative trajectory. Ultimately, the company was forced to explore strategic alternatives, including a potential sale or merger. In the end, they did not manage to succeed in restoring their position as a major telecom player in the United States.

The failure of the Sprint Nextel merger serves as a cautionary tale highlighting the complexities and potential pitfalls of large-scale mergers and acquisitions in the telecommunications industry. It underscores the importance of:

-

Thorough Due Diligence: A comprehensive assessment of all aspects of the target company, including network infrastructure, technology, culture, and financial stability.

-

Realistic Integration Plans: Developing a detailed and realistic plan for integrating disparate systems, technologies, and cultures. This requires significant planning and the allocation of sufficient resources.

-

Effective Change Management: Implementing robust change management strategies to minimize disruption and ensure smooth transitions for employees and customers. This involves clearly communicating the reasons behind the changes and actively involving employees in the process.

The legacy of Sprint Nextel remains a complex one. While the merger ultimately failed to deliver on its ambitious goals, it highlighted some valuable lessons regarding the challenges and opportunities in the telecommunications industry. The merger provided valuable insights into the need for thorough due diligence, effective integration planning, and skillful management of change.

Conclusion: Lessons Learned and Future Implications

The Sprint Nextel merger stands as a potent case study for strategic management in the competitive telecommunications industry. The failure to successfully integrate two distinct network technologies, coupled with significant cultural clashes and operational inefficiencies, ultimately resulted in a diminished market position and financial instability. The experience highlights the critical need for extensive due diligence, meticulously crafted integration plans, and effective change management strategies when undertaking such significant mergers.

The story of Sprint and Nextel serves as a reminder that size alone does not guarantee success. Synergy is not automatic; it requires careful planning and execution. This case continues to be analyzed in business schools and strategic management discussions, illustrating the challenges inherent in large-scale mergers, and the critical need to address both technological and cultural aspects of integration. The aftermath of this merger continues to shape the current landscape of the telecommunications industry, emphasizing the importance of prudent strategic decision-making and rigorous execution in the face of market dynamism. The legacy of Sprint Nextel underscores the vital lessons for companies considering similar ambitious mergers.

Latest Posts

Latest Posts

-

Ramones Drones Inc Makes Local Delivers Using Small Drones

Mar 05, 2025

-

Which Statement Is Not True About Receipts

Mar 05, 2025

-

Exercise 33 Review And Practice Sheet Endocrine System

Mar 05, 2025

-

Which Of The Following Statements Is Accurate About Airborne Transmission

Mar 05, 2025

-

The Great Gatsby Summary Of Each Chapter

Mar 05, 2025

Related Post

Thank you for visiting our website which covers about Sprint Purch Agency Nextel Sys Corp . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.