Statement Of Cash Flows For Snowdrop A Limited Company

Onlines

Mar 31, 2025 · 6 min read

Table of Contents

Statement of Cash Flows for Snowdrop A Limited Company: A Comprehensive Guide

Understanding a company's financial health goes beyond just looking at its profits. A crucial element of financial analysis is the Statement of Cash Flows, which provides a detailed picture of how a company generates and uses cash during a specific period. This article will delve deep into the Statement of Cash Flows for a hypothetical limited company, Snowdrop A Limited, illustrating its components and significance. We'll explore different scenarios and highlight the critical information this statement reveals to investors, creditors, and management.

What is a Statement of Cash Flows?

The Statement of Cash Flows, also known as the Cash Flow Statement, tracks the movement of cash both into and out of a company. Unlike the income statement, which uses accrual accounting (recognizing revenue when earned and expenses when incurred), the cash flow statement focuses solely on actual cash transactions. This provides a clearer picture of a company's liquidity – its ability to meet its short-term obligations. It's a vital tool for assessing a company's financial stability and future prospects. For Snowdrop A Limited, understanding its cash flow statement is crucial for informed decision-making.

The Three Main Sections of the Statement of Cash Flows

The statement is typically divided into three main sections:

1. Operating Activities: The Core Business

This section reflects cash flows generated from the company's core business operations. For Snowdrop A Limited, this might include:

-

Cash received from customers: Money earned from sales of goods or services. This is a key indicator of the company's sales performance and customer payment behavior. Delays in payments can significantly impact cash flow.

-

Cash paid to suppliers: Payments made for raw materials, inventory, and other supplies. Efficient inventory management and strong supplier relationships can positively influence this component.

-

Cash paid to employees: Salaries, wages, and other employee-related expenses. This is a significant and relatively predictable cash outflow.

-

Cash paid for operating expenses: Rent, utilities, insurance, and other operational costs. Careful budgeting and cost control are essential here.

-

Interest received and paid: Cash flows related to interest income and interest expense on loans.

-

Taxes paid: Corporate income taxes paid during the period.

Analyzing Snowdrop A Limited's Operating Cash Flow: A strong positive operating cash flow suggests Snowdrop A Limited's core business is generating sufficient cash to cover its day-to-day expenses. A negative operating cash flow, however, may indicate underlying problems with sales, cost control, or credit management.

2. Investing Activities: Long-Term Assets

This section details cash flows related to the acquisition and disposal of long-term assets. For Snowdrop A Limited, this could involve:

-

Purchase of property, plant, and equipment (PP&E): Capital expenditures on new equipment, buildings, or land. This represents investments in the company's future growth and capacity.

-

Sale of PP&E: Cash inflows from selling existing assets. This might happen due to obsolescence, upgrades, or strategic realignment.

-

Investments in other companies: Acquisitions of stakes in other businesses.

-

Proceeds from the sale of investments: Cash generated from divesting from other companies.

Analyzing Snowdrop A Limited's Investing Cash Flow: High capital expenditures usually suggest significant investment in future growth. However, excessive spending without corresponding revenue growth might raise concerns about financial sustainability. Analyzing the nature of investments and disposals provides insights into Snowdrop A Limited's strategic direction.

3. Financing Activities: How the Company is Funded

This section focuses on how Snowdrop A Limited finances its operations, including:

-

Proceeds from issuing debt: Cash raised through loans or bonds. This indicates the company's reliance on external financing.

-

Repayment of debt: Cash outflows used to repay loans or bonds.

-

Proceeds from issuing equity: Cash raised by selling shares. This dilutes ownership but can provide substantial capital.

-

Repurchasing of shares: Cash spent buying back company stock. This reduces the number of outstanding shares, potentially increasing earnings per share.

-

Payment of dividends: Cash distributed to shareholders as a return on their investment.

Analyzing Snowdrop A Limited's Financing Cash Flow: This section reveals Snowdrop A Limited's capital structure and its reliance on debt or equity financing. A consistent reliance on debt might indicate higher financial risk, while a balanced approach may reflect stronger financial stability. The dividend policy provides insights into the company's commitment to shareholder returns.

Indirect vs. Direct Method for Operating Activities

There are two primary methods for presenting the operating activities section:

-

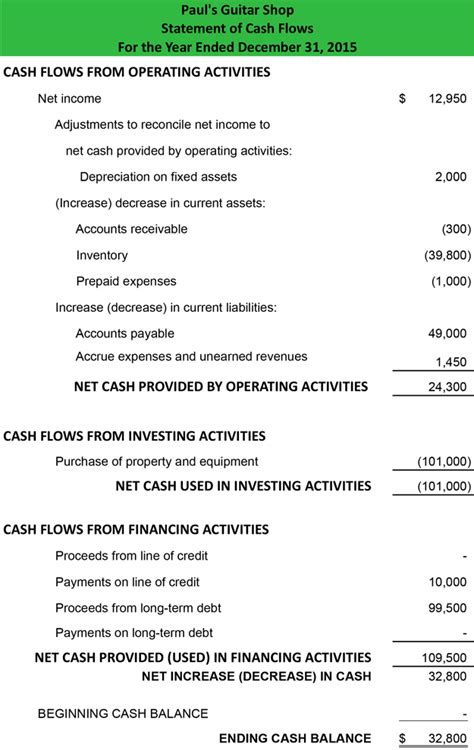

Indirect Method: Starts with net income and adjusts it for non-cash items (like depreciation) and changes in working capital (accounts receivable, inventory, accounts payable). This is the most common method.

-

Direct Method: Directly shows cash inflows and outflows from operating activities. While more transparent, it's less commonly used due to its complexity.

Snowdrop A Limited's statement might use either method, but the indirect method is more probable due to its widespread adoption. Regardless of the method, the underlying information remains the same.

Analyzing the Statement of Cash Flows for Snowdrop A Limited

Analyzing Snowdrop A Limited's statement requires a multi-faceted approach:

-

Trend Analysis: Comparing cash flows over multiple periods (e.g., year-over-year) reveals patterns and potential issues. Is operating cash flow growing consistently? Are capital expenditures increasing disproportionately? These questions offer valuable insights.

-

Ratio Analysis: Several ratios can be derived from the statement, including the cash flow from operations to current liabilities ratio, which assesses the company's ability to meet short-term debt obligations.

-

Free Cash Flow: This is a crucial metric calculated by subtracting capital expenditures from cash flow from operations. It represents the cash available to the company after covering its operating and capital needs. A high free cash flow indicates greater financial flexibility.

-

Comparing to Industry Benchmarks: Comparing Snowdrop A Limited's cash flows to industry averages helps assess its relative performance and identify areas for improvement.

Interpreting Key Indicators

Several key indicators from Snowdrop A Limited's statement are crucial for interpretation:

-

Positive vs. Negative Cash Flow: A consistent positive cash flow across all sections is ideal. However, negative cash flow in one section doesn't necessarily signal disaster; it needs to be considered in context with the overall picture.

-

Changes in Working Capital: Significant increases or decreases in accounts receivable, inventory, or accounts payable can impact cash flow and require further investigation.

-

Relationship Between Net Income and Cash Flow: Discrepancies between net income and cash flow from operations indicate the impact of non-cash items. Understanding these discrepancies is crucial.

-

Debt Levels: High levels of debt can limit financial flexibility and increase financial risk.

The Significance of the Statement of Cash Flows

The Statement of Cash Flows for Snowdrop A Limited (and any company) provides valuable information for various stakeholders:

-

Investors: Helps assess the company's ability to generate returns, pay dividends, and repay debt.

-

Creditors: Provides insights into the company's ability to meet its debt obligations.

-

Management: Facilitates better financial planning, budgeting, and resource allocation.

-

Potential Acquisition Targets: Used by potential acquirers to gauge the target company's financial strength.

Conclusion: A Holistic View of Snowdrop A Limited's Finances

The Statement of Cash Flows offers a crucial perspective on Snowdrop A Limited's financial health that complements information from the balance sheet and income statement. By thoroughly analyzing its operating, investing, and financing activities, investors, creditors, and management can gain a comprehensive understanding of the company's cash generation capabilities, its strategic direction, and its overall financial sustainability. Regular monitoring and analysis of this critical financial statement are paramount for informed decision-making and long-term success. Remember that this analysis is only a starting point. Further investigation, considering industry context and macroeconomic factors, is essential for a comprehensive understanding of Snowdrop A Limited’s financial health.

Latest Posts

Latest Posts

-

The Man Who Built America Worksheet Answers

Apr 01, 2025

-

As You Can See Uh I Ve Gained Some Weight

Apr 01, 2025

-

Characters Of The Perks Of Being A Wallflower

Apr 01, 2025

-

Exploring Photosynthesis And Plant Pigments Lab

Apr 01, 2025

-

What Happens In Chapter 12 Of To Kill A Mockingbird

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Statement Of Cash Flows For Snowdrop A Limited Company . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.