Tessa Is Processing Payroll Data That Includes Employees Names

Onlines

Mar 23, 2025 · 6 min read

Table of Contents

Tessa Processes Payroll: A Deep Dive into Data Security and Efficiency

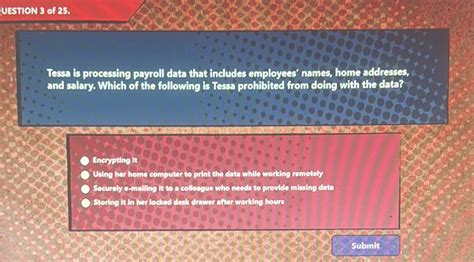

Tessa's workday often revolves around payroll data. This seemingly mundane task is actually a critical function demanding accuracy, efficiency, and, most importantly, robust security. Processing payroll data, which includes employees' names, addresses, social security numbers (SSNs), salaries, and tax information, necessitates a meticulous approach. This article explores the multifaceted nature of Tessa's job, delving into the processes, challenges, and best practices involved in handling sensitive employee data.

Understanding the Payroll Process: More Than Just Numbers

Payroll processing isn't simply inputting numbers into a software program. It's a multi-stage process that requires precision and attention to detail. Let's break down the key steps involved, highlighting where employee names play a crucial role:

1. Data Collection and Verification: The Foundation of Accuracy

This initial stage involves gathering all necessary employee information. This includes:

- Employee Names: Accurate spelling and consistent formatting of names are essential to prevent errors in payments and reporting. Any discrepancy in names can lead to delays and potential legal issues.

- Addresses: Correct addresses ensure timely delivery of paychecks or direct deposit information.

- SSNs/Tax IDs: These are critical for tax calculations and reporting compliance. Any error here can lead to significant penalties.

- Hours Worked: For hourly employees, accurate tracking of hours is paramount for calculating gross pay.

- Salary/Wage Information: This forms the basis of calculating net pay after deductions.

- Deductions: This includes information about taxes (federal, state, local), health insurance premiums, retirement plan contributions, and other deductions as per employee requests.

Verification is key: Tessa must diligently verify the accuracy of all collected data. This might involve comparing information across multiple sources or reconciling discrepancies with employees directly. This step is crucial in minimizing errors and ensuring legal compliance.

2. Payroll Calculation: The Core of the Process

Once data is collected and verified, Tessa proceeds to the core calculation process. This involves:

- Gross Pay Calculation: This is calculated based on hours worked (for hourly employees) or salary (for salaried employees).

- Tax Calculation: Federal, state, and local taxes are calculated based on employee's earnings and tax filing status. This often requires using tax tables or specialized payroll software.

- Deduction Calculation: All deductions (insurance, retirement, etc.) are subtracted from gross pay.

- Net Pay Calculation: This is the final amount paid to the employee after all deductions.

Employee names are crucial here too, ensuring that the calculated pay is associated with the correct individual. Any error in the name field can result in payment to the wrong employee, causing serious financial and legal repercussions.

3. Payment Processing: Getting the Money to Employees

The next phase involves distributing the calculated payments:

- Direct Deposit: This is the most common method, requiring accurate banking information. Employee names are linked to their bank accounts to ensure correct deposits.

- Check Distribution: Though less common, checks still require accurate addressing and employee name verification on the check itself.

- Payroll Card: Similar to direct deposit, this requires verification of employee name and associated card information.

Accurate employee names are essential to prevent payment errors and ensure that employees receive their rightful earnings.

4. Reporting and Record Keeping: Compliance and Auditing

Finally, Tessa must generate various reports and maintain accurate records:

- Payroll Register: A comprehensive record of all employee payments.

- Tax Reports: Various tax forms (W-2, 1099, etc.) need to be filed accurately with relevant tax authorities.

- Auditing Trails: Maintaining a complete audit trail ensures transparency and facilitates easy tracking of any discrepancies.

Employee names are integral to all these reports, ensuring clear identification of each employee's payment and tax information. Accurate reporting is crucial for legal compliance and minimizes potential penalties.

Challenges in Payroll Data Processing: Navigating the Complexities

Tessa faces several challenges while processing payroll:

- Data Accuracy: Maintaining accuracy across various data points is a constant challenge. Human error, data entry mistakes, and inconsistencies in information can all lead to inaccuracies.

- Data Security: Payroll data is highly sensitive. Protecting it from unauthorized access and breaches is a top priority. Strict security measures, including password protection, encryption, and access controls, are vital.

- Compliance: Navigating constantly evolving tax laws and regulations is demanding. Staying up-to-date with changes and ensuring compliance with all relevant laws is crucial.

- Time Constraints: Payroll processing often operates under tight deadlines. Efficiency and automation are essential to meet these deadlines effectively.

- Software and Technology: Utilizing appropriate payroll software and technology can streamline the process but requires ongoing training and updates.

Best Practices for Efficient and Secure Payroll Processing

Implementing best practices is vital for Tessa to efficiently and securely process payroll:

- Data Validation: Implementing data validation rules to catch errors early in the process.

- Regular Data Backups: Protecting data from loss through regular backups and disaster recovery plans.

- Access Control: Limiting access to payroll data to authorized personnel only.

- Employee Self-Service: Empowering employees to access and update their own payroll information, reducing the burden on Tessa and improving accuracy.

- Automation: Utilizing automation tools to streamline repetitive tasks, saving time and reducing errors.

- Regular Audits: Conducting regular audits to ensure accuracy and compliance.

- Employee Training: Training employees on the importance of data accuracy and security.

- Software Updates: Keeping payroll software updated with the latest security patches and features.

- Data Encryption: Encrypting sensitive data both at rest and in transit.

- Multi-Factor Authentication: Implementing multi-factor authentication to enhance security.

The Future of Payroll Processing: Embracing Technology

The future of payroll processing is increasingly reliant on technology. Emerging trends include:

- Cloud-Based Payroll Solutions: Cloud-based solutions offer scalability, accessibility, and enhanced security.

- AI and Machine Learning: AI and machine learning can automate various tasks, improve accuracy, and detect anomalies.

- Blockchain Technology: Blockchain technology could enhance data security and transparency in payroll processing.

- Biometric Authentication: Biometric authentication methods can further strengthen security.

Tessa’s role in processing payroll data, including employee names, is evolving rapidly. By embracing these technological advancements, she can enhance efficiency, security, and accuracy while ensuring legal compliance. The focus will shift towards leveraging technology to minimize human error, strengthen security, and improve the overall experience for both employees and the payroll administrator.

Conclusion: The Importance of Accuracy, Security, and Efficiency

Tessa's job highlights the crucial role of accurate and secure payroll processing. Employee names are just one component of a larger process that demands meticulous attention to detail, robust security measures, and compliance with evolving regulations. By employing best practices and embracing emerging technologies, organizations can ensure that payroll processing is efficient, reliable, and protects sensitive employee information. The focus must always be on minimizing errors, maximizing security, and maintaining compliance—all essential aspects of responsible payroll management. Tessa’s work exemplifies the importance of this multifaceted function in maintaining a healthy and productive workplace.

Latest Posts

Latest Posts

-

Which Of The Following Is Not A Function Of Wetlands

Mar 25, 2025

-

War Of The Worlds Book Characters

Mar 25, 2025

-

Agent J Takes An Application And Initial Premium

Mar 25, 2025

-

Chapter 12 Summary Things Fall Apart

Mar 25, 2025

-

Which Of The Following Statements About Personal Selling Is Correct

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about Tessa Is Processing Payroll Data That Includes Employees Names . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.