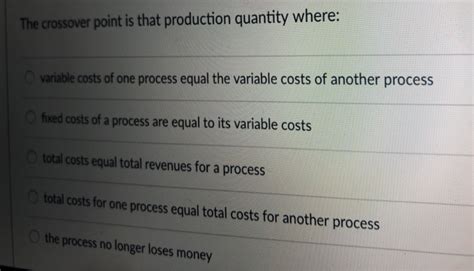

The Crossover Point Is That Production Quantity Where __________.

Onlines

Mar 21, 2025 · 5 min read

Table of Contents

The Crossover Point: Where Production Quantity Makes or Breaks Your Business

The crossover point, also known as the break-even point, is that crucial production quantity where total revenue equals total costs. It's the point where a business is neither making a profit nor incurring a loss. Understanding and calculating this point is fundamental to successful business planning and management, influencing decisions on pricing, production levels, and overall business strategy. This in-depth article will explore the crossover point, its calculation, its significance, and factors affecting it.

Understanding the Components of the Crossover Point

Before diving into the calculation, let's define the key components:

-

Fixed Costs: These are costs that remain constant regardless of production volume. Examples include rent, salaries, insurance, and loan repayments. These costs are incurred even if no units are produced.

-

Variable Costs: These costs directly relate to the production volume. They increase as production increases and decrease as production decreases. Examples include raw materials, direct labor, and packaging.

-

Total Costs: This is the sum of fixed costs and variable costs. It represents the total expenditure incurred in producing a specific quantity of goods.

-

Revenue: This is the income generated from selling the produced goods or services. It's calculated by multiplying the selling price per unit by the number of units sold.

The crossover point is achieved when: Total Revenue = Total Costs

Calculating the Crossover Point: A Step-by-Step Guide

There are several methods for calculating the crossover point, but the most common involves using the following formula:

Crossover Point (in units) = Fixed Costs / (Selling Price per Unit - Variable Cost per Unit)

Let's illustrate this with an example:

Imagine a small bakery producing artisan bread. Their fixed costs (rent, utilities, salaries) are $5,000 per month. The variable cost per loaf of bread (flour, yeast, labor) is $2. They sell each loaf for $5.

Using the formula:

Crossover Point = $5,000 / ($5 - $2) = 1667 loaves

This means the bakery needs to sell 1667 loaves of bread each month to cover all its costs and reach the crossover point. Anything above 1667 loaves represents profit, and anything below represents a loss.

Beyond the Basic Calculation: Incorporating More Nuances

While the basic formula provides a good starting point, a more comprehensive analysis should consider several factors:

-

Multiple Products: If a business produces multiple products, calculating the crossover point becomes more complex. It requires a more sophisticated approach, potentially involving linear programming or simulation techniques to consider the interplay between different products and their respective costs and selling prices.

-

Sales Mix: The proportion of different products sold significantly impacts overall profitability. A business needs to analyze its sales mix to accurately project total revenue and accurately determine the crossover point.

-

Seasonality and Demand Fluctuations: If demand for products varies throughout the year, the crossover point calculation needs to be adjusted for each period. This requires analyzing historical sales data and projecting future demand to determine realistic crossover points for different periods.

-

Pricing Strategies: Pricing decisions significantly impact the crossover point. Lower prices reduce the profit margin per unit, increasing the required sales volume to reach the crossover point. Conversely, higher prices increase the profit margin, reducing the required sales volume. Careful pricing strategies are crucial for optimization.

-

Economies of Scale: As production volume increases, a business may benefit from economies of scale, reducing its average cost per unit. This can shift the crossover point to a lower production level. This effect needs to be factored in for a more accurate calculation.

-

Inflation and External Factors: Inflation and external economic factors can influence costs and prices, impacting the crossover point. Regular monitoring and adjustments to the calculation are needed to account for these changes.

The Significance of the Crossover Point in Business Decision-Making

Understanding the crossover point is crucial for various business decisions:

-

Pricing Strategies: The crossover point helps determine the minimum price needed to cover costs and ensure profitability. It aids in making informed pricing decisions that balance profitability and competitiveness.

-

Production Planning: It informs production planning by establishing the minimum production volume required to break even. This allows for optimized resource allocation and prevents unnecessary production costs.

-

Investment Decisions: The crossover point helps assess the viability of investments and expansion plans. It indicates whether the projected sales volume will be enough to cover the increased costs.

-

Financial Forecasting: It plays a vital role in financial forecasting and budgeting. It allows businesses to predict their financial performance and make informed decisions about resource allocation.

-

Risk Management: Analyzing the crossover point helps identify the risks associated with different production levels. It allows businesses to implement mitigation strategies to minimize potential losses.

Beyond the Numbers: The Importance of Qualitative Factors

While quantitative analysis is essential, the crossover point calculation should not be viewed in isolation. Qualitative factors also play a vital role in decision-making:

-

Market Demand: Even if a business reaches its crossover point, sustained profitability depends on sufficient market demand. A careful market analysis is crucial to assess the potential for long-term sales.

-

Competitive Landscape: The competitive landscape influences pricing strategies and market share. A business needs to analyze competitors' pricing and offerings to determine its competitive position.

-

Product Differentiation: Product differentiation can allow businesses to command higher prices and achieve profitability at lower production volumes. Unique selling propositions are crucial for differentiation.

-

Operational Efficiency: Operational efficiency can significantly reduce costs and improve profitability. Improving processes and optimizing resources can positively impact the crossover point.

Conclusion: A Dynamic Tool for Business Success

The crossover point is more than just a numerical calculation; it's a dynamic tool for strategic business planning and decision-making. While the basic formula provides a fundamental understanding, a thorough analysis encompassing multiple products, sales mix, seasonality, pricing strategies, economies of scale, and external factors is crucial for achieving accuracy. Furthermore, integrating qualitative factors like market demand, competition, and operational efficiency ensures a holistic approach to business management, leveraging the crossover point as a cornerstone for sustainable growth and profitability. By incorporating these aspects, businesses can utilize the crossover point to make informed choices, optimize their operations, and navigate the complexities of the market effectively. Regular monitoring and adjustment of the crossover point analysis, accounting for evolving market conditions and internal changes, remain critical for ongoing business success.

Latest Posts

Latest Posts

-

Biology The Core 3rd Edition Pdf

Mar 23, 2025

-

Treatment And Transport Priorities At The Scene

Mar 23, 2025

-

Summary Of Chapter 2 Of The Giver

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about The Crossover Point Is That Production Quantity Where __________. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.