The Debt Snowball Chapter 4 Lesson 6

Onlines

Mar 19, 2025 · 7 min read

Table of Contents

The Debt Snowball: Chapter 4, Lesson 6 - Mastering Momentum and Maintaining Motivation

Dave Ramsey's The Total Money Makeover introduces the debt snowball method in Chapter 4, Lesson 6. This isn't just about paying off debt; it's about building momentum, mastering your mindset, and fostering a powerful financial future. This lesson emphasizes the psychological and motivational aspects crucial for success, often overlooked in purely mathematical debt-reduction strategies. Let's delve into the core principles and explore how you can apply them to your own financial journey.

Understanding the Power of the Debt Snowball

The debt snowball method differs significantly from the debt avalanche method. The avalanche prioritizes paying off debts with the highest interest rates first, a mathematically optimal approach. The snowball, conversely, focuses on paying off the smallest debts first, regardless of interest rates. This seemingly counterintuitive approach leverages the power of psychological momentum.

The Psychological Advantage: Small Wins Fuel Big Changes

Chapter 4, Lesson 6 highlights the importance of early victories. Paying off that small credit card debt, even if it has a lower interest rate than a larger loan, provides a tangible sense of accomplishment. This early success fuels motivation and reinforces positive financial habits. This initial win becomes the foundation for tackling larger debts with renewed confidence and determination.

Imagine trying to climb a massive mountain. The avalanche method is like meticulously planning your route, calculating the most efficient path to the summit. It's logical, but it can feel daunting. The snowball method, however, is like starting with a smaller, nearby hill. Conquering that hill builds confidence and momentum, making the larger mountain seem less intimidating.

The snowball effect: Accelerating Your Progress

As you pay off smaller debts, you free up more money to aggressively attack the next largest debt. This snowball effect rapidly accelerates your progress. The psychological boost from each victory fuels the process, creating a virtuous cycle of achievement and motivation. This is where the true power of the debt snowball lies: not just in the mathematical efficiency, but in the unwavering psychological strength it cultivates.

Maintaining Motivation: Overcoming Obstacles and Staying on Track

The journey to financial freedom is rarely smooth. Obstacles will arise. Chapter 4, Lesson 6 addresses these challenges, offering strategies to maintain motivation when faced with setbacks.

Dealing with Setbacks and Unexpected Expenses

Life throws curveballs. Unexpected car repairs, medical emergencies, or job loss can derail even the most meticulously planned budget. The key here is to adapt, not abandon. Instead of panicking and giving up, adjust your snowball plan. Perhaps you need to temporarily consolidate payments or slow down the payment process on larger debts. The important thing is to keep moving forward, even if at a slightly slower pace. Don't let temporary setbacks become permanent defeats.

The Importance of a Support System

Surrounding yourself with a supportive network is crucial. Share your financial goals with friends, family, or a financial mentor. Having people who understand your struggles and celebrate your successes can provide invaluable encouragement and accountability. Consider joining a financial support group, where you can share experiences and learn from others. This collective support can significantly impact your perseverance.

Celebrating Milestones and Rewarding Yourself

Don't underestimate the power of celebration. Acknowledge and celebrate each debt paid off. This doesn't mean extravagant spending; it's about recognizing your achievements and rewarding yourself in small, meaningful ways. A small dinner out, a movie night, or a new book can serve as powerful reminders of your progress and motivate you to continue. These small rewards reinforce positive behaviour and prevent burnout.

Beyond the Snowball: Building a Strong Financial Foundation

The debt snowball method is more than just a debt-reduction strategy; it's a gateway to building a solid financial foundation. Once you've conquered your debts, the momentum you've built can propel you towards even greater financial success.

Saving and Investing: The Next Phase of Financial Freedom

After becoming debt-free, the freed-up cash flow should be redirected towards savings and investing. Chapter 4, Lesson 6 implicitly emphasizes this transition. Building an emergency fund becomes the next priority, providing a safety net against future unexpected expenses. Once the emergency fund is established, investing for the future—retirement, education, or other long-term goals—becomes a critical next step.

Maintaining Financial Discipline: The Long-Term Perspective

Financial freedom is not a destination; it’s a journey. Maintaining financial discipline after paying off debt is crucial to prevent falling back into debt. Continue budgeting, tracking expenses, and making conscious financial decisions. This ongoing commitment is vital to securing your financial future and ensuring the long-term benefits of your hard work.

Addressing Common Concerns and Misconceptions

Several common concerns and misconceptions surround the debt snowball method. Let's address some of them:

Is the Debt Snowball Always the Best Method?

While the debt snowball method offers significant psychological advantages, it may not always be the most mathematically efficient. The debt avalanche method, which prioritizes high-interest debts, often leads to lower overall interest payments. The choice between the two methods depends on individual circumstances and priorities. For those who struggle with motivation, the psychological boost of the snowball method can outweigh the slightly higher interest costs.

What if I Have Multiple High-Interest Debts?

The snowball method can still work effectively even with multiple high-interest debts. Focus on the smallest debt first to generate initial momentum. As you pay off smaller debts, you'll have more available funds to allocate to those with higher interest rates. The key is to remain consistent and focused on making progress.

Can I Modify the Snowball Method?

Yes, you can modify the snowball method to fit your individual circumstances. You might choose to combine aspects of the snowball and avalanche methods, prioritizing small debts while still acknowledging high-interest rates. Flexibility is key; the most important thing is to find a method that works for you and keeps you motivated.

Practical Application and Steps to Success

Let's outline the practical steps involved in implementing the debt snowball method:

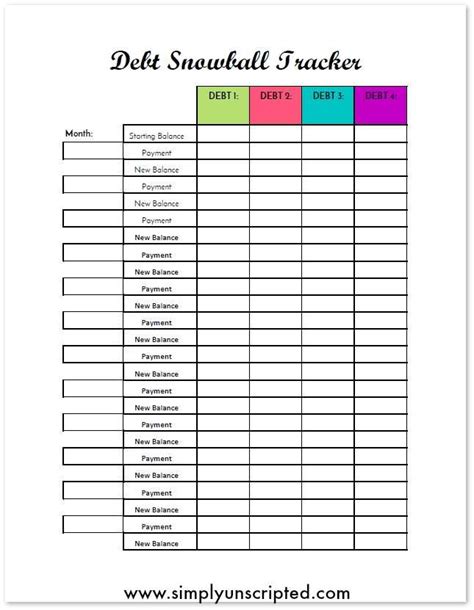

- List Your Debts: Create a comprehensive list of all your debts, including the balance, interest rate, and minimum payment.

- Prioritize Your Debts: Arrange your debts in ascending order based on balance, starting with the smallest.

- Create a Budget: Develop a detailed budget that tracks your income and expenses. Identify areas where you can cut expenses to allocate more funds towards debt repayment.

- Make Minimum Payments: Make minimum payments on all debts except the smallest.

- Attack the Smallest Debt: Allocate all extra funds towards the smallest debt until it's paid off.

- Snowball the Payments: Once the smallest debt is paid off, roll those payments into the next smallest debt, significantly increasing the repayment amount.

- Repeat the Process: Continue this process, snowballing payments until all debts are eliminated.

- Celebrate Milestones: Acknowledge and celebrate each debt paid off to maintain motivation.

- Build an Emergency Fund: After becoming debt-free, focus on building a substantial emergency fund.

- Invest for the Future: Once the emergency fund is established, start investing for long-term financial goals.

Conclusion: Embracing the Journey to Financial Freedom

Chapter 4, Lesson 6 of The Total Money Makeover isn't simply about a debt repayment strategy; it's a lesson in building resilience, cultivating motivation, and fostering a long-term commitment to financial well-being. The debt snowball method, with its emphasis on psychological momentum, provides a powerful tool for overcoming debt and achieving financial freedom. By understanding its principles, embracing its challenges, and adapting it to your individual circumstances, you can embark on a journey towards a brighter, more secure financial future. Remember, the journey is as important as the destination; the lessons learned along the way will serve you long after your last debt is paid. Stay committed, stay focused, and celebrate your successes. Your financial freedom awaits.

Latest Posts

Latest Posts

-

Symbols In Their Eyes Were Watching God

Mar 19, 2025

-

Analyzing History Causes Of Ww1 Worksheet Answers

Mar 19, 2025

-

En El Mar Cuando Fui De Vacaciones

Mar 19, 2025

-

Unit 6 Progress Check Mcq Apush

Mar 19, 2025

-

Assignment 5 1 Medical Terms And Word Building

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Debt Snowball Chapter 4 Lesson 6 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.