The Demand Curve For Money Shifts To The Right When

Onlines

Mar 20, 2025 · 6 min read

Table of Contents

The Demand Curve for Money Shifts to the Right When: A Comprehensive Guide

The demand curve for money, a fundamental concept in macroeconomics, illustrates the relationship between the interest rate and the quantity of money demanded. It's not a static line; it shifts in response to various economic factors. Understanding why the demand curve shifts to the right is crucial for comprehending monetary policy and economic fluctuations. This comprehensive guide will delve into the intricate details, exploring the key factors that cause a rightward shift and their implications.

Understanding the Money Demand Curve

Before exploring the shifts, let's establish a foundational understanding. The money demand curve depicts the inverse relationship between the interest rate (the opportunity cost of holding money) and the quantity of money demanded. When interest rates are high, individuals and businesses tend to hold less money (because the opportunity cost of holding money – foregoing interest earned in other assets – is higher), opting instead to invest in interest-bearing assets like bonds or savings accounts. Conversely, when interest rates are low, the opportunity cost is lower, leading to a higher demand for money.

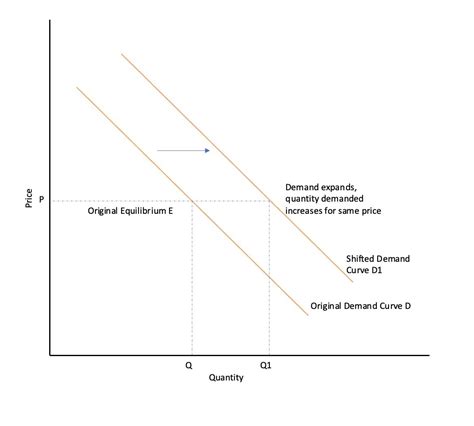

This relationship is typically depicted graphically as a downward-sloping curve. However, it's crucial to remember that this curve represents the quantity of money demanded at a given interest rate, holding other factors constant. When these "other factors" change, the entire curve shifts.

Factors Causing a Rightward Shift in the Money Demand Curve

A rightward shift in the money demand curve signifies that at any given interest rate, the quantity of money demanded is higher than before. This shift is caused by several key economic factors:

1. Increased Real GDP (Economic Growth)

Strong Economic Growth: When the economy expands, real GDP increases. This growth leads to higher levels of transactions, requiring more money for everyday purchases, business investments, and other economic activities. Businesses need more money to finance larger production runs, pay employees, and expand operations. Consumers require more money for increased spending on goods and services. This increased demand for money to facilitate transactions causes a rightward shift in the money demand curve.

Example: A booming technology sector leading to increased investment and consumer spending will translate to a higher demand for money at all interest rate levels.

2. Increased Price Level (Inflation)

Inflationary Pressures: Inflation erodes the purchasing power of money. To maintain their desired level of real balances (the purchasing power of their money), individuals and businesses will demand a larger nominal quantity of money. Essentially, they need more money to buy the same amount of goods and services as prices rise. This increased demand for nominal money balances leads to a rightward shift.

Example: If the inflation rate jumps from 2% to 5%, people will need more money simply to maintain their previous level of purchasing power. This increased need for money to cope with inflation shifts the demand curve to the right.

3. Increased Expectations of Future Inflation

Anticipating Inflation: Even before inflation actually occurs, if individuals and businesses anticipate future inflation, they'll increase their demand for money in the present. This is a preemptive measure to protect themselves from the future erosion of purchasing power. This anticipatory behavior causes a rightward shift, reflecting the forward-looking nature of economic actors.

Example: If the central bank signals a potential increase in the money supply, individuals might anticipate future inflation and increase their money demand immediately.

4. Changes in Payment Technology

Technological Advancements: While it might seem counterintuitive, technological advancements in payment systems can also cause a rightward shift, albeit temporarily. New and more efficient payment systems initially reduce the demand for money held in physical forms. However, the ease of transactions facilitated by these technologies could potentially lead to increased overall economic activity. This increased activity, in turn, could raise the demand for money to conduct more transactions, shifting the curve to the right. The long-term effects on money demand often depend on a variety of other factors.

Example: The adoption of mobile payment apps reduces the need for physical cash but can also lead to increased spending and a higher overall demand for money.

5. Changes in Attitudes and Preferences

Shifting Preferences: Changes in consumer and business attitudes toward holding money can also affect the demand. For instance, a rise in precautionary demand for money (holding money as a buffer against unforeseen circumstances) would shift the curve to the right. Similarly, shifts in institutional preferences or regulations influencing the demand for money can have a significant impact.

Example: Increased uncertainty about the future (economic or political) might lead businesses and individuals to hold onto more cash as a safety net, increasing the demand for money at each interest rate.

6. Changes in Government Regulations

Regulatory Shifts: Government regulations affecting the financial sector can impact money demand. Changes in reserve requirements for banks, for example, can alter the money supply and, indirectly, influence the demand for money. Government policies that promote financial stability can increase public confidence and lower precautionary demand; conversely, policies that create uncertainty might raise precautionary demand.

Example: Increased reserve requirements for banks could theoretically lead to a slight contraction in the money supply, which could, in turn, impact the demand for money although the effects are complex and nuanced.

Implications of a Rightward Shift

A rightward shift in the money demand curve has significant implications for the economy, primarily affecting interest rates and monetary policy:

-

Higher Interest Rates: With a higher demand for money at each interest rate, the equilibrium interest rate will generally rise. This is because the increased demand puts upward pressure on interest rates to clear the market. The central bank may respond to this by increasing the money supply.

-

Monetary Policy Response: Central banks typically respond to rightward shifts in the money demand curve through expansionary monetary policy. This could involve reducing reserve requirements, buying government bonds (open market operations), or lowering the discount rate. The goal is to increase the money supply and keep interest rates from rising too sharply, preventing potential negative impacts on economic growth.

-

Inflationary Pressures: If the rightward shift is primarily driven by inflation or inflationary expectations, then the increase in money demand could further exacerbate inflationary pressures. This is because the increased demand for money may lead to increased spending and further price rises, creating an inflationary spiral.

-

Economic Growth vs. Stability: The central bank faces a difficult trade-off between promoting economic growth and maintaining price stability. A rightward shift driven by robust economic growth may be welcomed, while a shift fueled by inflationary expectations could necessitate more aggressive monetary tightening.

Conclusion

Understanding the factors that cause a rightward shift in the money demand curve is crucial for analyzing macroeconomic trends and evaluating the effectiveness of monetary policy. The interactions between economic growth, inflation, expectations, and technological advancements constantly shape the money demand curve, necessitating a continuous assessment by policymakers and economic analysts. A deep understanding of these dynamics is vital for navigating the complexities of the modern economy and ensuring macroeconomic stability. Failure to accurately assess and respond to these shifts can result in either stifled economic growth or runaway inflation.

Latest Posts

Latest Posts

-

2020 Practice Exam 1 Mcq Apes

Mar 20, 2025

-

Which Of The Following Are Characteristics Of Sequential Order

Mar 20, 2025

-

Exercise 2 16 Preparing An Income Statement Lo C3 P3

Mar 20, 2025

-

Under Dodd 5240 06 Reportable Foreign Intelligence

Mar 20, 2025

-

What Sata Devices Did You Find

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about The Demand Curve For Money Shifts To The Right When . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.