This Graph Could Help An Economist Predict

Onlines

Mar 21, 2025 · 6 min read

Table of Contents

This Graph Could Help an Economist Predict… A Lot

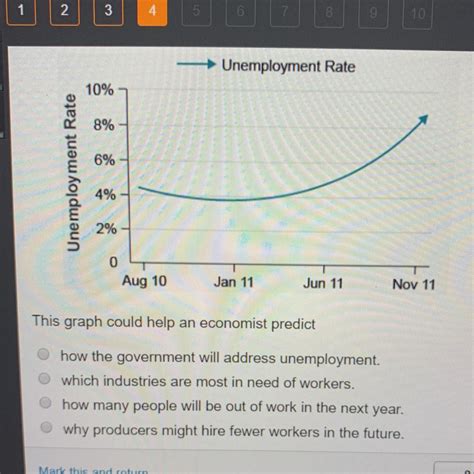

Economists, those masters of predicting the unpredictable, rely on a vast arsenal of tools and models. But at the heart of their forecasts lies the ability to interpret data, to discern patterns where others see chaos. One powerful visual tool that can unlock hidden predictive power is the time series graph. This seemingly simple chart, plotting data points over time, can be a window into future economic trends, revealing valuable insights for economists across various disciplines. This article explores the multifaceted uses of time series graphs in economic prediction, highlighting their strengths, limitations, and the sophisticated techniques used to extract meaningful forecasts.

The Power of Visualization: Unveiling Economic Trends

A time series graph's fundamental strength lies in its ability to visually represent the evolution of an economic variable over time. Whether it's GDP growth, inflation rates, unemployment figures, or stock market indices, plotting these data points against a timeline instantly reveals crucial information:

- Trends: The graph clearly shows whether the variable is generally increasing, decreasing, or stagnating. This long-term trend provides a foundational understanding of the variable's behavior.

- Seasonality: Many economic variables exhibit seasonal fluctuations. For instance, retail sales often peak during the holiday season. A time series graph readily highlights these cyclical patterns.

- Cyclicity: Beyond seasonality, longer-term cyclical patterns can emerge, such as business cycles characterized by periods of expansion and recession. Identifying these cycles is crucial for forecasting future economic activity.

- Anomalies: Unexpected spikes or dips in the data – outliers – become immediately visible on a time series graph, prompting economists to investigate underlying causes and potentially adjust their models.

Example: Imagine a time series graph depicting monthly consumer spending over the past five years. A clear upward trend might indicate robust consumer confidence and a healthy economy. Seasonal peaks around holidays would be evident, while a sudden dip in spending following a major economic event would be readily apparent. This visualization provides a much richer understanding than simply looking at a table of raw data.

Beyond Visual Inspection: Advanced Time Series Analysis

While visual inspection of a time series graph offers valuable insights, true predictive power comes from applying advanced analytical techniques. These techniques aim to model the underlying patterns and extrapolate them into the future:

1. Moving Averages: Smoothing Out the Noise

Moving averages are a simple yet effective technique for smoothing out short-term fluctuations and revealing the underlying trend. A three-month moving average, for example, calculates the average value of the variable over the past three months, providing a smoother representation of the trend. Longer moving averages smooth out more noise but might lag behind recent changes. The choice of the moving average window (the number of periods used to calculate the average) is crucial and depends on the specific data and the desired level of smoothing.

2. Exponential Smoothing: Giving More Weight to Recent Data

Exponential smoothing refines the moving average approach by giving more weight to recent data points. This makes it more responsive to recent changes than simple moving averages. Different variations of exponential smoothing exist, each with its own parameters to fine-tune the weighting scheme. This adaptability makes exponential smoothing a popular choice for forecasting in situations where recent data is considered more relevant.

3. ARIMA Models: Capturing Autocorrelation

Autoregressive Integrated Moving Average (ARIMA) models are powerful statistical tools that explicitly model the autocorrelation within a time series. Autocorrelation refers to the correlation between a data point and its previous values. ARIMA models capture this correlation to make accurate predictions. The order of the ARIMA model (p, d, q) specifies the number of autoregressive (p), integrated (d), and moving average (q) terms needed to adequately represent the data. Selecting the appropriate order requires careful analysis and often involves trial-and-error.

4. Decomposition: Separating Trend, Seasonality, and Randomness

Time series decomposition separates a time series into its constituent components: trend, seasonality, and residuals (random noise). This is particularly useful for data with strong seasonal patterns. By isolating these components, economists can model each separately and then recombine them to generate a more accurate forecast. This method effectively removes the seasonal fluctuations before applying forecasting techniques to the underlying trend.

5. Machine Learning: Harnessing the Power of Algorithms

Recent advances in machine learning have opened new avenues for economic forecasting using time series data. Algorithms like Recurrent Neural Networks (RNNs), particularly Long Short-Term Memory (LSTM) networks, are particularly well-suited for analyzing sequential data like time series. These algorithms can learn complex patterns and relationships within the data that might be missed by traditional statistical methods. However, the complexity of machine learning models necessitates careful data preparation, model validation, and interpretation of results.

Limitations and Considerations

While time series graphs and their associated analytical techniques are invaluable tools, it's crucial to acknowledge their limitations:

- Data quality: The accuracy of any forecast hinges on the quality of the underlying data. Inaccurate, incomplete, or biased data will lead to unreliable predictions.

- Model assumptions: All statistical models make assumptions about the data generating process. If these assumptions are violated, the model's predictions may be inaccurate.

- External shocks: Unexpected events, such as natural disasters, political upheavals, or technological breakthroughs, can significantly impact economic variables and render even the most sophisticated models inaccurate.

- Forecasting horizon: The further into the future the forecast extends, the less accurate it tends to be. Short-term forecasts are generally more reliable than long-term forecasts.

- Overfitting: Complex models, particularly machine learning models, can overfit the data, meaning they perform well on the historical data used for training but poorly on new, unseen data.

Applications Across Economic Disciplines

The utility of time series graphs and analysis extends across various economic fields:

- Macroeconomics: Forecasting GDP growth, inflation, unemployment rates, and other macroeconomic indicators.

- Financial economics: Predicting stock prices, interest rates, exchange rates, and other financial variables.

- Econometrics: Developing and testing econometric models using time series data.

- Labor economics: Analyzing trends in employment, wages, and productivity.

- Environmental economics: Forecasting pollution levels, resource depletion, and climate change impacts.

Conclusion: A Powerful Tool for Economic Insight

Time series graphs are not merely static visualizations; they are dynamic tools capable of unlocking significant predictive power. By combining visual inspection with advanced analytical techniques, economists can gain valuable insights into economic trends, seasonal patterns, and cyclical fluctuations. While limitations exist, the ability to model and forecast economic variables using time series analysis remains crucial for policymakers, businesses, and individuals alike. As data becomes more readily available and analytical techniques become more sophisticated, the role of time series analysis in economic prediction will only continue to grow in importance, offering a clearer lens into the complexities of the economic world. Understanding and mastering these techniques is, therefore, an essential skill for anyone seeking to navigate the ever-evolving landscape of economics.

Latest Posts

Latest Posts

-

You Will Be Holding A Sales Event Soon

Mar 21, 2025

-

Benchmark Career Development Program Proposal Assignment

Mar 21, 2025

-

Joy Luck Club Chapter 1 Summary

Mar 21, 2025

-

Rn Targeted Medical Surgical Respiratory Online Practice 2019

Mar 21, 2025

-

During Her First Day Of Kindergarten Marie

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about This Graph Could Help An Economist Predict . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.