Wall Street Prep Excel Crash Course Exam Answers

Onlines

Mar 23, 2025 · 5 min read

Table of Contents

Wall Street Prep Excel Crash Course Exam Answers: A Comprehensive Guide

Landing a coveted role in finance often hinges on demonstrating proficiency in Microsoft Excel. The Wall Street Prep Excel Crash Course is a popular resource for aspiring finance professionals aiming to hone their Excel skills. This guide provides comprehensive insights into the course material, offering strategic approaches to tackling the exam and mastering the core concepts. We won't provide direct answers to the exam questions (that would defeat the purpose of learning!), but we will equip you with the knowledge and techniques to confidently ace the test. This is not about shortcuts, but about truly understanding and mastering Excel for a successful finance career.

Understanding the Wall Street Prep Excel Crash Course

The Wall Street Prep Excel Crash Course is designed to build a solid foundation in Excel, covering essential functions and techniques used daily in finance. It goes beyond basic spreadsheet operations, focusing on advanced functionalities crucial for financial modeling, data analysis, and presentation. The course typically covers areas like:

- Data Manipulation: This includes sorting, filtering, cleaning, and transforming data. Understanding how to efficiently handle large datasets is paramount.

- Formulas and Functions: Mastery of key formulas, including

SUM,AVERAGE,IF,VLOOKUP,HLOOKUP,INDEX,MATCH,COUNTIF,SUMIF, and many others, is essential. Understanding the logic behind these functions is more important than simply memorizing their syntax. - Data Analysis: The course will cover techniques for analyzing data, identifying trends, and drawing conclusions. This may involve creating pivot tables, charts, and graphs.

- Financial Modeling: This is a core component, covering concepts like building financial models, incorporating assumptions, sensitivity analysis, and scenario planning.

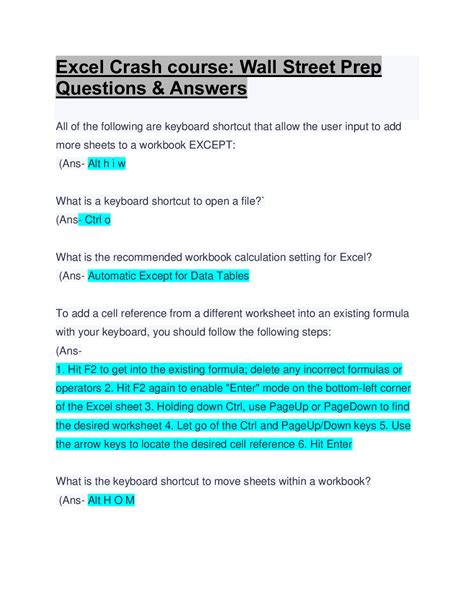

- Keyboard Shortcuts: Learning and mastering keyboard shortcuts significantly accelerates your workflow.

- Data Validation: Ensuring data accuracy and consistency through data validation techniques is a key skill.

Key Concepts to Master for the Exam

To succeed in the Wall Street Prep Excel Crash Course exam, you need to go beyond surface-level understanding. Focus on these crucial areas:

1. VLOOKUP and INDEX/MATCH: These functions are the workhorses of financial modeling. Understand the differences between them, when to use each, and how to handle errors effectively. Practice building complex nested formulas using these functions. Remember to understand the importance of FALSE vs. TRUE in VLOOKUP and the different match types in INDEX/MATCH.

2. Data Validation: Master the various data validation tools, including drop-down lists, data ranges, and custom formulas. This ensures data accuracy and consistency within your models. Understand how to create effective error messages.

3. Pivot Tables and Charts: Practice creating and manipulating pivot tables to summarize and analyze large datasets. Learn how to filter, sort, and group data within pivot tables. Master creating various chart types, choosing the most appropriate chart for different types of data.

4. Advanced Formulas and Functions: Don’t just memorize formulas; understand their underlying logic. This will allow you to adapt them to various scenarios. Practice using SUMPRODUCT, COUNTIFS, SUMIFS, OFFSET, and other advanced functions.

5. Keyboard Shortcuts: Efficiently navigating Excel requires mastering keyboard shortcuts. Practice using shortcuts for navigation, formula entry, formatting, and data manipulation. This will significantly improve your speed and accuracy.

6. Financial Modeling Techniques: Understand the principles of building a financial model, including the structure, assumptions, and sensitivity analysis. Practice building simple models and gradually increasing complexity.

7. Error Handling: Master the use of error handling functions like IFERROR, ISERROR, and #N/A handling techniques. This is crucial for creating robust and reliable models. Knowing how to troubleshoot and correct errors effectively is a highly valued skill.

Effective Study Strategies for the Exam

To successfully navigate the Wall Street Prep Excel Crash Course exam, a structured approach is vital. Here are some effective strategies:

- Practice, Practice, Practice: The key to mastering Excel is consistent practice. Work through numerous practice problems, focusing on areas where you feel less confident. The more you practice, the more comfortable you will become with the different functions and techniques.

- Break Down Complex Problems: Don't get overwhelmed by complex problems. Break them down into smaller, manageable steps. This will make the problem seem less daunting and help you identify the specific functions and techniques required.

- Understand the Underlying Logic: Don’t just memorize formulas; understand their underlying logic. This will enable you to adapt them to different scenarios and troubleshoot issues more effectively.

- Utilize the Wall Street Prep Resources: Take full advantage of the study materials provided by Wall Street Prep, including practice questions and videos.

- Time Management: Practice working under time pressure. This will help you manage your time effectively during the exam.

- Review and Revise: Regularly review the concepts and techniques you've learned. This will reinforce your understanding and help you retain the information.

Beyond the Exam: Applying Excel Skills in Finance

Passing the Wall Street Prep Excel Crash Course exam is just the first step. Your true mastery will be demonstrated in your ability to apply these skills in real-world finance scenarios. Think about how you can use your newfound skills in:

- Financial Modeling: Building complex financial models for valuation, forecasting, and scenario planning.

- Data Analysis: Analyzing financial data to identify trends, risks, and opportunities.

- Investment Analysis: Using Excel to perform discounted cash flow analysis, comparable company analysis, and other valuation techniques.

- Portfolio Management: Tracking and analyzing investment portfolios using Excel.

- Reporting and Presentation: Creating clear and concise reports and presentations using Excel's charting and visualization capabilities.

Conclusion: Mastering Excel for a Successful Finance Career

The Wall Street Prep Excel Crash Course provides a robust foundation for aspiring finance professionals. By focusing on a comprehensive understanding of core concepts, employing effective study strategies, and dedicating sufficient practice time, you can confidently conquer the exam and leverage your Excel expertise to excel in your finance career. Remember, this is not just about passing a test; it's about building a valuable skillset that will be crucial throughout your professional journey. Good luck!

Latest Posts

Latest Posts

-

War Of The Worlds Book Characters

Mar 25, 2025

-

Agent J Takes An Application And Initial Premium

Mar 25, 2025

-

Chapter 12 Summary Things Fall Apart

Mar 25, 2025

-

Which Of The Following Statements About Personal Selling Is Correct

Mar 25, 2025

-

Answers For Ics 100 Final Exam

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about Wall Street Prep Excel Crash Course Exam Answers . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.