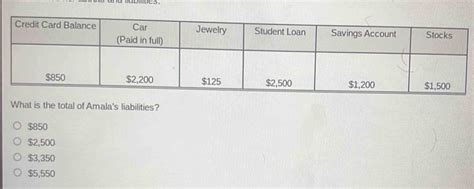

What Is The Total Of Amala's Liabilities

Onlines

Mar 22, 2025 · 6 min read

Table of Contents

What is the Total of Amala's Liabilities? A Comprehensive Guide to Understanding Liabilities in Financial Statements

Determining the total of Amala's liabilities requires a thorough understanding of financial statements and accounting principles. This isn't a simple number we can conjure; it depends entirely on the specific financial information available for Amala (be it an individual, a business, or another entity). This article will dissect the concept of liabilities, explore the types of liabilities Amala might have, and outline the process of calculating her total liabilities. We'll also look at the importance of understanding liabilities in making sound financial decisions.

Understanding Liabilities: The Foundation of Financial Health

Before delving into Amala's specific situation, let's establish a clear understanding of what liabilities are in accounting. Liabilities represent a company's or individual's financial obligations—amounts owed to others. These obligations arise from past transactions or events and require a future outflow of economic benefits. Think of them as debts. They are the flip side of the accounting equation: Assets = Liabilities + Equity. This equation signifies that everything a person or business owns (assets) is either financed by borrowing (liabilities) or by the owner's investment (equity).

Key Characteristics of Liabilities:

- Present obligation: A liability must represent a current obligation, a responsibility to pay or perform something in the future.

- Past transaction or event: The obligation stems from a past event, such as borrowing money or purchasing goods on credit.

- Probable outflow of economic benefits: It's likely the entity will have to give up resources (like cash) to settle the liability.

Types of Liabilities Amala Might Have:

Amala's liabilities can fall into various categories, each with different characteristics and implications. The specific types will depend on her financial circumstances. Let's consider some possibilities:

1. Current Liabilities: Short-Term Obligations

Current liabilities are obligations due within one year or the operating cycle, whichever is longer. These are debts that need to be settled relatively quickly. Examples for Amala might include:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit. This is a very common liability for individuals and businesses alike.

- Salaries Payable: Wages owed to employees for work performed but not yet paid. If Amala employs household staff, this could apply.

- Short-term Loans: Loans with a maturity date within one year. This could be a personal loan from a bank or credit union.

- Utilities Payable: Outstanding bills for electricity, water, gas, or internet services. These are common everyday liabilities.

- Taxes Payable: Unpaid income taxes, sales taxes, or property taxes. These are crucial to consider and meeting tax deadlines is paramount.

2. Non-Current Liabilities: Long-Term Obligations

Non-current liabilities, also known as long-term liabilities, are obligations due beyond one year. These represent debts with longer repayment periods. Examples for Amala could be:

- Mortgages Payable: A loan secured by real estate (a house, for example). This is a substantial liability for many homeowners.

- Long-term Loans: Loans with a maturity date longer than one year. This could include auto loans, business loans, or personal loans with longer repayment terms.

- Deferred Revenue: Money received for goods or services that haven't yet been provided. If Amala is in a business that requires pre-payment, this would apply.

- Bonds Payable: If Amala is involved in a business that has issued bonds to raise capital, this would be a liability.

3. Contingent Liabilities: Potential Future Obligations

Contingent liabilities are potential liabilities that may arise depending on the outcome of future events. These aren't certain obligations but are possibilities that need to be considered. For example:

- Lawsuits: If Amala is involved in a lawsuit, a potential liability exists if she loses the case and is required to pay damages.

- Guarantees: If Amala has guaranteed a loan for someone else, she could become liable if that person defaults on the loan.

- Warranties: If Amala sells products with warranties, she may have to pay for repairs or replacements if the products fail.

Calculating Amala's Total Liabilities: A Step-by-Step Approach

To calculate Amala's total liabilities, we need to gather information on all her liabilities—both current and non-current, and even consider contingent liabilities if they are probable. This information would typically be found in a balance sheet, but since we are dealing with hypothetical information about "Amala," we will work through a hypothetical example:

Hypothetical Financial Information for Amala:

- Accounts Payable: $500

- Short-term Loan: $1,000

- Mortgage Payable: $100,000

- Credit Card Debt: $2,000

- Taxes Payable: $500

- Student Loan: $15,000

Calculation:

- Sum of Current Liabilities: $500 (Accounts Payable) + $1,000 (Short-term Loan) + $2,000 (Credit Card Debt) + $500 (Taxes Payable) = $4,000

- Sum of Non-Current Liabilities: $100,000 (Mortgage Payable) + $15,000 (Student Loan) = $115,000

- Total Liabilities: $4,000 (Current Liabilities) + $115,000 (Non-Current Liabilities) = $119,000

Therefore, in this hypothetical scenario, Amala's total liabilities are $119,000.

Important Note: This is a simplified example. A real-world calculation would involve a much more detailed list of liabilities. Contingent liabilities, while not included in the total liability amount directly, should be disclosed and assessed separately as they represent potential future obligations.

The Significance of Understanding Liabilities: Financial Prudence and Decision-Making

Understanding Amala's (or anyone's) liabilities is crucial for several reasons:

- Financial Health Assessment: Knowing the total liabilities helps assess the overall financial health. A high level of liabilities relative to assets can indicate financial risk.

- Creditworthiness: Lenders assess an individual's or business's creditworthiness partly by considering their liabilities. Higher liabilities can impact the ability to secure loans or credit in the future.

- Debt Management: Understanding the different types and amounts of liabilities is essential for effective debt management strategies. This could involve prioritizing high-interest debts or exploring debt consolidation options.

- Budgeting and Financial Planning: Accurate knowledge of liabilities is fundamental for creating realistic budgets and financial plans. Failing to account for liabilities can lead to financial difficulties.

- Investment Decisions: For businesses, understanding liabilities helps in making informed investment decisions. High liabilities might limit the available funds for new ventures.

Conclusion: A Holistic View of Amala's Financial Landscape

Determining the total of Amala's liabilities is not a trivial exercise; it requires careful analysis of various financial records and a comprehensive understanding of accounting principles. The process begins with understanding the fundamental concept of liabilities, identifying the types of liabilities Amala might have (current, non-current, contingent), and then meticulously calculating the total. This comprehensive approach is crucial not only for financial reporting but also for making sound financial decisions, managing debts effectively, and maintaining financial health and stability. Remember, seeking professional financial advice is always recommended for personalized guidance.

Latest Posts

Latest Posts

-

An Example Of A Security Incident Indicator Is

Mar 23, 2025

-

Ati Active Learning Template Basic Concept

Mar 23, 2025

-

Chapter Summaries Of Lord Of The Flies

Mar 23, 2025

-

Colonoscopy With Bowel Perforation Hesi Case Study

Mar 23, 2025

-

Beyond Bigger Leaner Stronger Workout Spreadsheet

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about What Is The Total Of Amala's Liabilities . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.