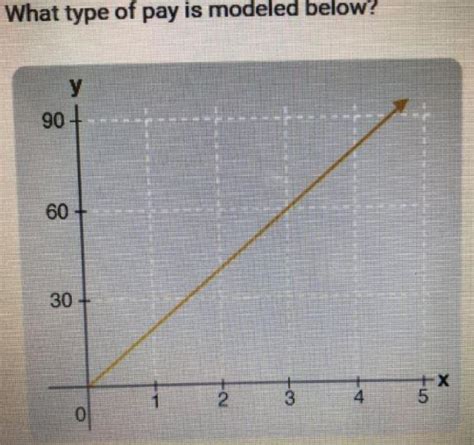

What Type Of Pay Is Modeled Below

Onlines

Mar 17, 2025 · 6 min read

Table of Contents

Deconstructing Payroll Structures: Understanding the Model Behind Your Compensation

Understanding your pay structure is crucial for financial planning, negotiating salary increases, and ensuring you're fairly compensated for your work. Payroll models can be complex, varying significantly across industries and even within the same company. This article will delve into the intricacies of various payroll structures, helping you decipher the model presented in your specific payslip (which you'll need to provide for a fully customized analysis – this article will cover the types of models, not the specifics of one without data). We'll explore common compensation components, discuss potential hidden costs, and offer strategies for maximizing your earnings.

Understanding the Basics: Components of a Payroll Structure

Before we dive into specific models, let's lay the groundwork by defining the core components typically found in most payroll structures:

1. Gross Pay: The Total Earnings Before Deductions

This is the total amount you earn before any deductions are made. This includes your base salary, overtime pay, bonuses, commissions, and any other allowances or payments.

2. Net Pay (Take-Home Pay): Your Actual Earnings After Deductions

This is the amount you actually receive in your bank account. Net pay is calculated by subtracting all deductions from your gross pay.

3. Deductions: What's Taken Out of Your Gross Pay

Deductions can include:

- Taxes: Federal, state, and local income taxes are usually the largest deductions. The amount withheld depends on your filing status, income level, and the tax laws in your area.

- Social Security and Medicare Taxes (FICA): These are payroll taxes that fund Social Security and Medicare benefits. Both the employer and employee contribute.

- Health Insurance Premiums: If your employer offers health insurance, your contribution will be deducted from your gross pay.

- Retirement Plan Contributions: If you participate in a 401(k), 403(b), or other retirement plan, your contributions will be deducted.

- Other Deductions: This category can include things like union dues, loan repayments, garnishments, and charitable donations.

Common Payroll Models: A Comprehensive Overview

Numerous payroll models exist, each with its unique features and implications for employees. Let's explore some of the most prevalent:

1. Hourly Wage: Simple and Straightforward

This model pays employees based on the number of hours they work. It's common in industries where working time fluctuates, such as retail, hospitality, and construction. Overtime pay, usually at a rate of 1.5 times the regular hourly wage, is typically mandated for hours exceeding a certain threshold (often 40 hours per week).

Advantages: Simplicity, transparency, easy to calculate.

Disadvantages: Earnings can be unpredictable if hours are inconsistent, no guarantee of a consistent income stream.

2. Salary: A Fixed Monthly or Annual Income

This model pays employees a fixed amount, regardless of the number of hours worked. This is common for office jobs, management roles, and professional positions.

Advantages: Predictable income, provides financial stability.

Disadvantages: Can feel unfair if workload significantly increases without corresponding compensation, fewer opportunities for extra earnings.

3. Commission-Based Pay: Earning Based on Sales or Performance

This model pays employees a percentage of their sales or based on achieving specific performance targets. This is common in sales, real estate, and brokerage industries.

Advantages: High earning potential based on performance, incentivizes sales and performance.

Disadvantages: Income can fluctuate significantly depending on sales performance, can be stressful and unpredictable.

4. Hybrid Models: Combining Different Payment Structures

Many companies use hybrid models that combine elements of different pay structures. For example, a salesperson might receive a base salary plus commission, or an hourly employee might receive bonuses based on performance metrics. These offer a blend of stability and performance-based incentives.

Advantages: Offers balance between stable income and performance-based rewards.

Disadvantages: Can be more complex to understand and calculate.

5. Piece-Rate Pay: Payment Based on Output

In this model, employees are paid for each unit of output they produce. This is prevalent in manufacturing, agriculture, and other industries where production can be easily measured.

Advantages: Direct link between output and compensation, encourages productivity.

Disadvantages: Can lead to pressure to prioritize quantity over quality, might not account for other tasks beyond direct production.

6. Contract Work: Project-Based Compensation

This model involves paying individuals for completing specific projects or tasks. The payment is usually a lump sum or based on deliverables. Freelancers, consultants, and independent contractors often work under this model.

Advantages: Flexibility, control over working hours and projects.

Disadvantages: No benefits, inconsistent income, less job security.

Decoding Your Payslip: Identifying Your Payroll Model

To definitively determine the specific payroll model governing your compensation, you need to meticulously examine your payslip. Key elements to focus on include:

- Pay Rate: Is it hourly, salary, commission-based, or piece-rate?

- Hours Worked: If applicable, are your hours tracked and reflected in your gross pay?

- Commission or Bonus Information: Are there sections detailing commissions earned or bonuses received?

- Deductions: Understand the breakdown of all deductions to accurately assess your net pay.

- Payment Frequency: Is your pay weekly, bi-weekly, semi-monthly, or monthly?

Beyond the Basics: Hidden Costs and Potential Pitfalls

Understanding your gross pay is only half the battle. To truly assess your compensation, you must consider potential hidden costs and factors that can impact your overall take-home pay. These include:

- Employer-Sponsored Benefits: While many employers offer benefits like health insurance, retirement plans, and paid time off, these aren’t reflected in your gross pay. It's important to evaluate the overall value of these benefits when comparing compensation packages.

- Tax Implications: Tax laws can be complex, and understanding your tax bracket is essential. Consult a tax professional if you need help navigating these complexities.

- Deductible Expenses: Certain expenses might be tax-deductible, potentially lowering your overall tax burden. This is particularly relevant for self-employed individuals or those with significant business-related expenses.

- Potential for Bonuses or Incentives: Does your role include the possibility of bonuses, commissions, or other incentives? Factoring these potential earnings into your overall compensation is crucial for long-term financial planning.

Maximizing Your Earnings: Strategies and Considerations

Once you have a thorough grasp of your current payroll model and its components, you can proactively work towards maximizing your earnings and financial well-being. Strategies include:

- Negotiating Your Salary: Thorough research and understanding of your worth within the job market is crucial for negotiating a fair salary. Knowing the prevalent payroll models in your industry and comparable compensation packages can strengthen your negotiating position.

- Improving Performance: For commission-based or performance-based models, focusing on exceeding targets and consistently delivering high-quality work is paramount for maximizing your income.

- Upskilling and Continuing Education: Enhancing your skills and acquiring new certifications can make you a more valuable asset and potentially lead to higher pay.

- Financial Planning: Budgeting, investing, and seeking financial advice can help you make the most of your earnings and plan for your financial future.

Conclusion: Empowering Yourself Through Payroll Knowledge

Understanding your payroll structure is not simply about deciphering numbers on your payslip; it’s about gaining control over your financial well-being. By grasping the intricacies of different payroll models, considering hidden costs, and actively pursuing strategies to maximize your earnings, you can navigate your career with greater confidence and secure a brighter financial future. Remember, this article provides a general overview. To gain a comprehensive understanding of your specific payroll model, carefully analyze your payslip and seek professional guidance if needed.

Latest Posts

Latest Posts

-

You Seem Pleased To Have Successfully Whored Yourself Manacled

Mar 17, 2025

-

Muchas Ninas Jovenes Han Estado A Dieta Terrible

Mar 17, 2025

-

Examples Of Public Data Collected By Law From Physicians Include

Mar 17, 2025

-

Alcohol And Its Effects On The Body Worksheet Answers

Mar 17, 2025

-

An Ioc Occurs When What Metric Exceeds Its Normal Bounds

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about What Type Of Pay Is Modeled Below . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.