When Supplies Are Purchased On Credit It Means That

Onlines

Mar 20, 2025 · 6 min read

Table of Contents

When Supplies Are Purchased on Credit: A Comprehensive Guide

Purchasing supplies on credit is a common practice for businesses of all sizes. It offers a flexible way to manage cash flow and acquire the necessary resources for operations. However, understanding the implications of credit purchases is crucial for maintaining sound financial health. This article delves into the intricacies of purchasing supplies on credit, explaining what it means, its advantages and disadvantages, the accounting treatment, and best practices for managing credit accounts.

What Does "Purchased on Credit" Mean?

When supplies are purchased on credit, it signifies that the buyer doesn't pay for the goods or services at the time of purchase. Instead, they receive the supplies and agree to pay the supplier at a later date, typically within a specified timeframe outlined in the credit terms. This arrangement establishes a debtor-creditor relationship, where the buyer (the debtor) owes money to the supplier (the creditor). The supplier essentially extends a short-term loan to the buyer. The agreement usually includes an invoice detailing the purchased items, the total amount due, and the payment due date.

Key aspects of purchasing on credit:

- Deferred Payment: The most defining feature is the delay in payment. The buyer receives immediate access to the supplies but defers payment until a later date.

- Credit Terms: These terms specify the payment period (e.g., net 30, meaning payment is due within 30 days), any discounts for early payment, and penalties for late payment.

- Creditworthiness: Suppliers assess the buyer's creditworthiness before extending credit. This involves checking the buyer's credit history and financial stability.

- Interest Charges (Potentially): While some credit purchases offer a grace period without interest, others might accrue interest if payment isn't made within the stipulated timeframe.

Advantages of Purchasing Supplies on Credit

Purchasing supplies on credit provides several significant benefits for businesses:

1. Improved Cash Flow Management: This is arguably the most compelling advantage. By delaying payments, businesses can maintain a healthy cash flow, ensuring sufficient funds for other operational expenses like payroll, rent, and marketing. This is particularly beneficial for startups or businesses experiencing temporary cash shortages.

2. Access to Necessary Supplies: Credit allows businesses to acquire essential supplies immediately, even if they lack the immediate funds. This ensures uninterrupted operations and prevents delays in production or service delivery.

3. Building Business Relationships: Establishing credit accounts with reputable suppliers can strengthen business relationships, potentially leading to better pricing, preferential treatment, and extended credit terms over time. A strong credit history demonstrates reliability and trustworthiness.

4. Potential for Discounts: Many suppliers offer early payment discounts (e.g., 2/10, net 30, meaning a 2% discount if paid within 10 days, otherwise the full amount is due within 30 days). Taking advantage of these discounts can significantly reduce the overall cost of supplies.

5. Increased Purchasing Power: Credit enables businesses to purchase larger quantities of supplies, potentially benefiting from bulk discounts and economies of scale. This can be particularly advantageous for businesses with seasonal demands or those anticipating future growth.

Disadvantages of Purchasing Supplies on Credit

While credit offers numerous benefits, it also carries potential downsides:

1. Interest Charges: Late payments can result in significant interest charges, increasing the overall cost of supplies and negatively impacting profitability. Careful tracking of payment due dates is essential to avoid these penalties.

2. Debt Accumulation: Overreliance on credit can lead to accumulating debt, putting a strain on the business's financial health. Effective budgeting and credit management are crucial to prevent this.

3. Damaged Credit Rating: Consistent late payments can severely damage a business's credit rating, making it difficult to secure future credit or loans. This can significantly hinder future growth and expansion plans.

4. Potential for Disputes: Disputes can arise regarding invoices, payment amounts, or delivery issues. Maintaining clear communication and documentation is essential to resolve such disputes efficiently.

5. Loss of Early Payment Discounts: Failing to take advantage of early payment discounts negates a potential cost-saving opportunity. Proper cash flow management and efficient accounting practices are necessary to ensure timely payments.

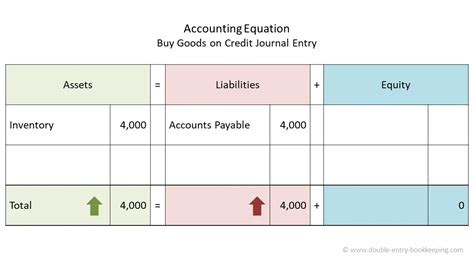

Accounting Treatment of Supplies Purchased on Credit

The accounting treatment for supplies purchased on credit involves two key accounts:

- Supplies: This asset account reflects the value of supplies acquired.

- Accounts Payable: This liability account represents the amount owed to suppliers.

When supplies are purchased on credit, the following journal entry is recorded:

- Debit Supplies: Increases the asset account, reflecting the increase in the value of supplies.

- Credit Accounts Payable: Increases the liability account, reflecting the increase in the amount owed to the supplier.

For example, if supplies worth $1,000 are purchased on credit, the journal entry would be:

Debit Supplies $1,000

Credit Accounts Payable $1,000

When the payment is made to the supplier, the following journal entry is recorded:

- Debit Accounts Payable: Decreases the liability account, reflecting the reduction in the amount owed.

- Credit Cash: Decreases the asset account (cash), reflecting the outflow of cash to pay the supplier.

For example, if the $1,000 payment is made, the journal entry would be:

Debit Accounts Payable $1,000

Credit Cash $1,000

Best Practices for Managing Credit Accounts

Effective management of credit accounts is crucial for maintaining a healthy financial position. Here are some best practices:

1. Track Payment Due Dates: Maintain a detailed record of all invoices, including payment due dates. Use a calendar or accounting software to set reminders for upcoming payments.

2. Negotiate Favorable Credit Terms: Don't hesitate to negotiate better credit terms with suppliers, potentially securing longer payment periods or early payment discounts.

3. Prioritize Payments: Prioritize payments to avoid late payment fees and damage to your credit rating. Consider paying invoices with the shortest payment periods first.

4. Monitor Credit Utilization: Keep track of your outstanding credit balances to ensure you don't exceed your credit limits. Avoid overextending your credit capacity.

5. Use Accounting Software: Utilize accounting software to automate invoice processing, track payments, and generate financial reports. This improves accuracy and efficiency in managing credit accounts.

6. Maintain Good Communication with Suppliers: Maintain open communication with suppliers to address any invoice discrepancies or payment issues promptly.

7. Regularly Review Credit Reports: Review your business's credit report periodically to identify any errors and ensure your creditworthiness remains strong.

8. Budget Effectively: Develop a comprehensive budget that incorporates anticipated expenses and accurately reflects your capacity for handling credit payments.

Conclusion

Purchasing supplies on credit can be a valuable tool for businesses to manage cash flow and acquire necessary resources. However, it's crucial to understand both the advantages and disadvantages. By implementing effective credit management strategies, businesses can leverage the benefits of credit while mitigating the risks, ensuring financial stability and sustainable growth. Careful planning, disciplined accounting practices, and maintaining open communication with suppliers are key to successful credit management. Remember that responsible credit usage is vital for long-term financial health and business success.

Latest Posts

Latest Posts

-

What Is The Best Evaluation Of The Evidence Lola Provides

Mar 21, 2025

-

If G Is The Midpoint Of Fh Find Fg

Mar 21, 2025

-

Apes 2020 Practice Exam 1 Mcq

Mar 21, 2025

-

5 4 Calculating Properties Of Solids Answers

Mar 21, 2025

-

Knowledge Drill 2 4 National Agencies And Regulations

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about When Supplies Are Purchased On Credit It Means That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.