Which Of The Following Best Describes A Contingent Beneficiary

Onlines

Mar 18, 2025 · 5 min read

Table of Contents

Which of the Following Best Describes a Contingent Beneficiary?

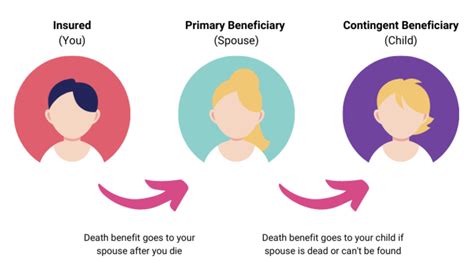

Understanding beneficiary designations is crucial for ensuring your assets are distributed according to your wishes after your passing. While primary beneficiaries receive assets first, contingent beneficiaries step in if the primary beneficiary is unable or unwilling to inherit. This article delves deep into the definition and implications of contingent beneficiaries, exploring various scenarios and clarifying common misconceptions.

Defining a Contingent Beneficiary: The Backup Plan

A contingent beneficiary is a secondary recipient designated to receive assets or benefits if the primary beneficiary predeceases the grantor (the person establishing the beneficiary designation), is deemed legally incapable of inheriting, or refuses the inheritance. Think of them as a backup plan, ensuring that your assets don't end up in probate court or distributed according to default laws of intestacy. This is fundamentally different from a primary beneficiary, who receives the assets unless specific conditions are met.

Key Characteristics of Contingent Beneficiaries

- Secondary Recipient: Their role is secondary; they only inherit if the primary beneficiary cannot or does not.

- Conditional Inheritance: Their inheritance is contingent upon a specific event or condition, typically the death or incapacity of the primary beneficiary.

- Multiple Contingent Beneficiaries: You can designate multiple contingent beneficiaries, often in a specific order of succession. For example, you might name a spouse as the primary beneficiary, your children as contingent beneficiaries, and then your parents as a final fallback.

- Protection Against Unforeseen Circumstances: They provide a safety net against unforeseen circumstances, ensuring your assets are distributed according to your wishes even if unexpected events occur.

Scenarios Illustrating Contingent Beneficiaries

Let's examine some practical scenarios to illustrate the importance of contingent beneficiaries:

Scenario 1: The Predeceased Primary Beneficiary

John names his wife, Mary, as the primary beneficiary of his life insurance policy. He names his daughter, Sarah, as the contingent beneficiary. If Mary passes away before John, Sarah would inherit the life insurance proceeds. If both Mary and Sarah predecease John, the policy proceeds would typically revert to John's estate, to be distributed according to his will or the rules of intestacy.

Scenario 2: The Incapacitated Primary Beneficiary

Jane designates her son, Michael, as the primary beneficiary of her retirement account. She names her brother, David, as the contingent beneficiary. If Michael becomes legally incapacitated before Jane's death and is unable to manage his finances, David would likely inherit the account. The specifics of incapacitation and legal processes will vary depending on jurisdiction and the terms of the specific plan document.

Scenario 3: The Refusal of Inheritance

David names his niece, Emily, as the primary beneficiary of his trust fund. He names his nephew, Tom, as the contingent beneficiary. If Emily refuses the inheritance for any reason, the assets would then pass to Tom. The reasons for refusal can be varied and personal; it's vital to have a contingency plan.

Types of Accounts and Instruments Where Contingent Beneficiaries Are Applicable

Contingent beneficiary designations are commonly used with various financial instruments and accounts. These include:

- Life Insurance Policies: Protecting your loved ones in case of your death, it is crucial to specify primary and contingent beneficiaries.

- Retirement Accounts (401(k), IRA): Ensuring your retirement savings are passed on as you intend.

- Trust Funds: Offering sophisticated control over asset distribution with several layers of beneficiary designations.

- Bank Accounts: While less common than with other instruments, some banks allow for contingent beneficiaries on specific accounts.

- Annuities: Providing a stream of income, it's important to consider who receives the remaining funds.

The Importance of Proper Documentation and Legal Counsel

When designating beneficiaries, accurate and clear documentation is paramount. Ambiguity can lead to disputes and protracted legal battles. Key considerations include:

- Legal Name and Accurate Information: Ensure that all beneficiary information is entirely accurate, including full legal names, addresses, and social security numbers.

- Specific Language: Use precise language in the beneficiary designation documents to avoid potential misunderstandings. Consult legal counsel for complex situations.

- Periodic Review: Life changes significantly; review and update your beneficiary designations regularly. Major life events like marriage, divorce, birth, or death necessitate reassessment.

- Jurisdictional Considerations: Laws governing beneficiary designations vary across jurisdictions. Consulting with legal counsel in your area can provide certainty.

Common Mistakes to Avoid

Several common mistakes can undermine the effectiveness of contingent beneficiary designations:

- Failing to Name Contingent Beneficiaries: This leaves your assets vulnerable to probate or unexpected distribution.

- Using Outdated Information: Changes in family circumstances can render the existing beneficiary information obsolete. Regularly updating information avoids problems.

- Ambiguous Language: Vague or unclear language in the beneficiary designation documents can lead to legal disputes. Be specific and concise.

- Not Seeking Legal Advice: For complex situations or substantial assets, it is beneficial to consult an estate planning attorney.

Beyond the Basics: Advanced Considerations

For more complex situations, further considerations might apply:

- Per Capita vs. Per Stirpes: These terms define how assets are distributed among multiple beneficiaries. Per capita means equally among surviving beneficiaries, while per stirpes means according to family lines, inheriting through deceased beneficiaries' descendants.

- Class Gifts: This allows for distribution to a group of individuals, such as "my children," without specifying each individual's name.

- Trusts: Trusts offer greater control and flexibility in distributing assets. A trustee manages the trust assets according to its terms.

Conclusion: Planning for the Unexpected with Contingent Beneficiaries

Designating contingent beneficiaries is a crucial part of comprehensive estate planning. It ensures your assets are distributed according to your wishes, protecting your loved ones from unforeseen circumstances. While the concept is relatively straightforward, accurate documentation and regular review are essential to avoid potential complications. Remember that by taking the time to understand and implement appropriate beneficiary designations, you provide peace of mind, knowing your wishes will be followed. Seeking professional legal advice is always recommended for complex situations or significant assets, ensuring your estate plan aligns perfectly with your objectives and preferences. By proactively planning, you secure a future for your beneficiaries and avoid potential conflicts or legal battles.

Latest Posts

Latest Posts

-

The Most Popular Linux Platform For Mobile Phones Is

Mar 18, 2025

-

Abel Ramos Es Un Escritor Maduro De Fama Internacional

Mar 18, 2025

-

Which Of The Following Statements About Secondary Production Is False

Mar 18, 2025

-

Group A Nih Stroke Scale Answers

Mar 18, 2025

-

Relias Core Mandatory Part 3 Answers

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Best Describes A Contingent Beneficiary . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.