Which Statement Regarding Insurable Risks Is Not Correct

Onlines

Apr 05, 2025 · 6 min read

Table of Contents

Which Statement Regarding Insurable Risks Is Not Correct? Demystifying Insurance Fundamentals

Understanding insurance is crucial for protecting yourself and your assets from unforeseen events. However, not every risk is insurable. This article delves into the characteristics of insurable risks and identifies common misconceptions, ultimately answering the question: Which statement regarding insurable risks is not correct? We'll explore the core principles of insurance, analyze several statements about insurable risks, and pinpoint the inaccurate one, providing clear explanations and examples along the way.

The Fundamentals of Insurable Risks

Before we tackle the incorrect statement, let's establish the fundamental criteria that define an insurable risk:

-

Large Number of Homogeneous Exposures: Insurers need a large pool of similar risks to predict losses accurately. This principle of diversification allows them to spread the risk across many policyholders, mitigating the impact of individual claims. For example, insuring thousands of homes against fire damage is more predictable than insuring a single, uniquely valuable structure.

-

Accidental and Unintentional Losses: The loss must be accidental and outside the policyholder's control. Deliberate acts of self-harm or intentional destruction are generally not covered by insurance. The element of chance is paramount.

-

Determinable and Measurable Losses: The insurer must be able to determine if a loss has occurred and quantify its value. This requires clear definitions of covered events and methods for assessing damages. For instance, property damage assessments are relatively straightforward, while the valuation of lost business income can be more complex.

-

Economically Feasible Premiums: The cost of insurance (premium) must be affordable for the policyholder and profitable for the insurer. If the likelihood of a loss is too high, or the potential cost of a loss is too substantial, the premium may become unaffordable or the insurer may not be able to profit.

-

Exclusion of Catastrophic Hazards: Insurers typically avoid risks that could cause widespread losses from a single event. This is because the potential financial burden of a catastrophe could overwhelm the insurer's capacity. Think of widespread events like major earthquakes or hurricanes impacting a large number of policyholders simultaneously.

Analyzing Statements Regarding Insurable Risks

Now let's examine several statements about insurable risks and identify the one that is incorrect.

Statement 1: Insurable risks must be predictable. This statement is correct. Insurers rely on statistical analysis and historical data to predict the likelihood and severity of losses. The more predictable a risk, the easier it is to calculate appropriate premiums.

Statement 2: A high probability of loss makes a risk more insurable. This statement is incorrect. While insurers need a large number of similar risks, a high probability of loss (meaning a very likely event) makes a risk less insurable. The premiums would be prohibitively high, making it economically unfeasible for both the insurer and the insured. Think about a situation where almost everyone in a group is guaranteed to experience a loss – there’s no pooling of risk, making it uninsurable.

Statement 3: Losses must be independently caused for a risk to be insurable. This statement is correct. Insurers need to avoid situations where a single event could trigger many claims simultaneously. For example, a flood would impact many homeowners simultaneously, making it a less insurable risk due to its systemic nature.

Statement 4: Insurable risks must be subject to both large and small losses. This statement is partially correct, but with nuance. While it's true that some losses will be larger than others, the statement is too broad. The important factor isn't the size of individual losses, but the predictability of the overall loss distribution across a large number of insured units. A consistent pattern of relatively small losses is much more insurable than infrequent catastrophic losses, even if the average cost is the same.

Statement 5: The risk must be financially significant to the insured. This statement is partially correct. While the financial significance is a factor in the insured's decision to purchase insurance, it doesn't define the insurability of the risk itself. A small loss to an individual can still be insurable if it fits the criteria outlined above. The insurer is more concerned with the overall pool of risk and the ability to predict losses accurately.

Statement 6: Moral hazard increases the insurability of a risk. This statement is incorrect. Moral hazard refers to the increased likelihood of loss due to changes in behavior after insurance is purchased. For example, someone with fire insurance might be less careful with fire safety than someone without. Moral hazard makes a risk less insurable because it increases the unpredictability of losses.

Statement 7: All risks are insurable. This statement is unequivocally incorrect. Many risks are uninsurable due to the previously discussed principles. Risks with high probabilities of loss, those subject to catastrophic events, or those involving intentional acts are examples. Certain risks are simply too unpredictable or too costly to insure profitably.

Why Statement 2 is the Most Incorrect

We've analyzed several statements, but Statement 2: "A high probability of loss makes a risk more insurable" is the most fundamentally incorrect. A high probability suggests that a loss is almost certain. This violates the core principle of risk pooling and prediction upon which insurance relies. Insurers thrive on a balance – enough instances of loss to cover claims, yet a sufficiently low probability that individual claims don't overwhelm their resources. A high probability negates this balance, rendering the risk economically uninsurable.

Further Considerations: Uninsurable Risks and Risk Management

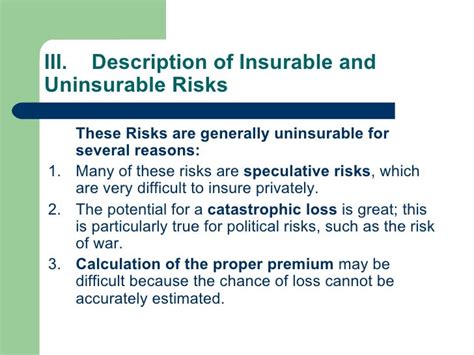

Even with careful analysis, some risks remain uninsurable. These often fall into categories such as:

- Catastrophic events: Events impacting a large number of insured individuals simultaneously, such as widespread pandemics or nuclear events.

- Speculative risks: Risks involving possibilities of gain or loss, such as investing in the stock market. These are generally not covered by insurance, as they involve conscious decision-making and the potential for profit.

- Risks with immeasurable losses: Situations where the extent of loss is difficult or impossible to quantify, such as reputational damage or emotional distress (though some insurance policies offer limited coverage in specific circumstances).

- Intentional acts: Deliberate actions leading to losses are typically excluded.

The inability to insure some risks highlights the importance of risk management. This involves actively identifying, assessing, and mitigating potential losses through various strategies, such as preventative measures, diversification, and careful planning.

Conclusion: Understanding Insurable Risk for Better Protection

Understanding the characteristics of insurable risks is fundamental to obtaining effective insurance coverage. Choosing the right insurance requires a clear understanding of the principles involved, recognizing that not all risks are insurable. While insurance provides a vital safety net, it's not a solution for all potential losses. A combined approach of insurance and proactive risk management offers the strongest protection against unforeseen events. Remembering the key principles—large number of homogeneous exposures, accidental losses, determinable losses, economically feasible premiums, and avoidance of catastrophic hazards—will empower you to make informed decisions and better understand your protection needs. Remember, the inaccurate statement highlighting the relationship between high probability of loss and insurability serves as a powerful reminder of the subtle yet crucial distinctions in assessing and managing risk effectively.

Latest Posts

Latest Posts

-

3 5 Answer Key Activity 3 5 Applied Statistics

Apr 05, 2025

-

Individuals In What Age Group Seek Orthodontic Care

Apr 05, 2025

-

Which Statement Is True Regarding Roles In Quickbooks Online Accountant

Apr 05, 2025

-

Genetics Practice Problems Pedigree Tables Answer Key

Apr 05, 2025

-

Which Of The Following Exemplifies A Personality Trait

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about Which Statement Regarding Insurable Risks Is Not Correct . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.