Which Statement Regarding The Change Of Beneficiary Provision Is True

Onlines

Mar 12, 2025 · 6 min read

Table of Contents

Which Statement Regarding the Change of Beneficiary Provision is True? A Comprehensive Guide

Changing a beneficiary on a policy, account, or asset can seem straightforward, but the specifics vary widely depending on the type of instrument involved. Understanding the nuances of beneficiary designation and the process for altering them is crucial for ensuring your wishes are carried out after your passing. This comprehensive guide will explore the intricacies of beneficiary changes, clarifying common misconceptions and providing a detailed overview of the process across various financial instruments.

Understanding Beneficiary Designations

A beneficiary is the individual or entity designated to receive assets or benefits upon the death of the account holder or policy owner. This designation bypasses the probate process, meaning the assets are transferred directly to the beneficiary without the need for court intervention. This is a significant advantage, saving time and potential legal fees for your loved ones. However, the rules and procedures for changing beneficiaries differ substantially depending on the type of account or policy.

Types of Beneficiary Designations:

- Primary Beneficiary: This individual or entity receives the assets first.

- Contingent Beneficiary: This individual or entity receives the assets if the primary beneficiary predeceases the account holder or is otherwise unable to receive the benefits.

- Per Capita: This designation divides the assets equally among the surviving beneficiaries.

- Per Stirpes: This designation divides the assets based on lineage, with the deceased beneficiary's share passing to their heirs.

- Trust: Assets can be left to a trust, which provides further control over how the assets are distributed and managed.

The choice of beneficiary designation is crucial and should reflect your personal circumstances and wishes. It's recommended to seek legal counsel to ensure your selections align with your goals.

The Truth About Changing Beneficiary Provisions: Debunking Common Myths

Many misconceptions surround changing beneficiary designations. Let's address some common myths:

Myth 1: Simply telling someone they're your beneficiary is sufficient.

Truth: This is absolutely false. Verbal declarations are insufficient. A legal and formal change must be made through the appropriate channels for the specific account or policy. Failure to do so can lead to unintended consequences, with assets potentially passing to an outdated beneficiary.

Myth 2: Updating your will automatically changes your beneficiaries.

Truth: This is another misconception. Your will dictates the distribution of your remaining assets after debts and taxes are settled. However, beneficiary designations on specific accounts and policies override your will. These assets pass directly to the designated beneficiary, regardless of your will's instructions. Therefore, both your will and beneficiary designations must be updated to reflect your current wishes.

Myth 3: It's impossible to change a beneficiary after a certain point.

Truth: While the process may vary, changing a beneficiary is typically possible as long as you retain control over the account or policy. There might be specific deadlines or requirements depending on the institution and the type of instrument involved. However, the ability to change a beneficiary is generally maintained until death or incapacity, barring any specific contractual restrictions.

Myth 4: Changing beneficiaries is a complex and arduous process.

Truth: While the process may require some paperwork and patience, it's generally not overly complicated. Most institutions provide clear instructions and forms for updating beneficiary information. The level of complexity will depend on the type of account or policy and the institution managing it.

The Process of Changing Beneficiary Information: A Step-by-Step Guide

The steps for changing beneficiary information vary depending on the type of account or policy. However, the general process usually involves these steps:

- Identify the Institution: Determine the institution managing the account or policy (bank, insurance company, brokerage firm, etc.).

- Locate the Necessary Forms: Contact the institution to request the appropriate forms for changing beneficiary information. These forms are often available online as well.

- Complete the Forms Accurately: Fill out the forms completely and accurately. Ensure all information, including the new beneficiary's name, address, date of birth, and social security number (if applicable), is correct. Any errors could delay or prevent the update.

- Gather Required Documentation: You may need to provide supporting documentation such as a copy of the new beneficiary's identification and possibly a notarized signature.

- Submit the Forms and Documentation: Submit the completed forms and documentation to the institution using the designated method (mail, in-person, or online).

- Confirmation of Change: Request confirmation of the updated beneficiary information from the institution in writing to ensure the change has been processed correctly. Keep a copy of all submitted documentation for your records.

Specific Examples: Changing Beneficiaries for Different Account Types

Here's a breakdown of the process for various financial instruments:

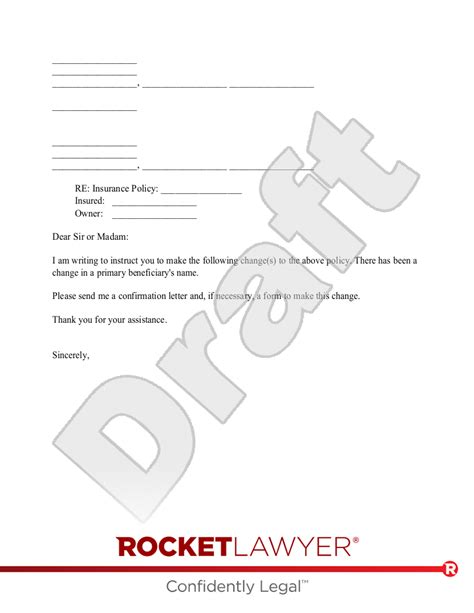

Life Insurance Policies:

Changing the beneficiary on a life insurance policy usually involves contacting the insurance company and completing a beneficiary change form. This form typically requires the policy number, the current and new beneficiary's information, and your signature. Some companies may require notarization.

Retirement Accounts (401(k), IRA, etc.):

The process for changing beneficiaries on retirement accounts varies depending on the plan sponsor. Contact the plan administrator or the institution managing your account for the necessary forms and instructions. They will provide specific guidance on the necessary documentation and process.

Bank Accounts:

Changing the beneficiary on a bank account often involves completing a beneficiary designation form at your bank branch. It typically requires the account number, the new beneficiary's information, and your signature.

Brokerage Accounts:

The process for changing beneficiaries on brokerage accounts is similar to that of bank accounts. Contact your brokerage firm to obtain the necessary forms and instructions for updating beneficiary information.

Legal Considerations and Implications

Changing beneficiary information can have significant legal ramifications. It’s essential to understand the implications of your actions and seek legal advice if necessary.

- Estate Planning: Beneficiary designations should be coordinated with your overall estate plan, including your will and trust documents. Inconsistent designations can lead to complications and disputes.

- Tax Implications: Changes to beneficiary designations may impact the tax implications of your estate. Consulting a tax professional is advisable to understand the potential tax consequences.

- Divorce: Beneficiary designations may be subject to change in divorce proceedings. Ensure that your beneficiary information reflects your current marital status and any relevant court orders.

Conclusion: The Importance of Regularly Reviewing and Updating Beneficiary Designations

Regularly reviewing and updating your beneficiary information is a critical aspect of responsible financial planning. It ensures that your assets are distributed according to your wishes, protects your loved ones, and avoids potential legal and financial complications. Failure to update beneficiary designations can have significant consequences, potentially leading to unintended distribution of your assets. By understanding the process and addressing any misconceptions, you can proactively protect your family's future and ensure your wishes are carried out. Don't hesitate to seek professional guidance from a legal or financial advisor to ensure your beneficiary designations are accurate, up-to-date, and aligned with your overall estate plan. Taking the time to properly manage your beneficiary designations demonstrates foresight and provides peace of mind for you and your loved ones.

Latest Posts

Latest Posts

-

Their Eyes Are Watching God Symbols

Mar 13, 2025

-

Apex Innovations Nihss Group A Answers

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about Which Statement Regarding The Change Of Beneficiary Provision Is True . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.