Z Owns A Disability Income Policy

Onlines

Mar 14, 2025 · 6 min read

Table of Contents

Z Owns a Disability Income Policy: A Comprehensive Guide

Owning a disability income policy is a crucial step in financial planning, especially for individuals like Z who want to protect their income stream against the unforeseen event of a disabling illness or injury. This comprehensive guide explores the intricacies of disability income insurance, focusing on the benefits, considerations, and potential challenges Z might face. We'll delve into policy specifics, claim processes, and strategies for maximizing the value of this vital financial safety net.

Understanding Disability Income Insurance

Disability income insurance, a cornerstone of comprehensive financial planning, offers a vital safety net against the devastating financial impact of a disabling illness or injury. Unlike health insurance which focuses on medical expenses, disability insurance replaces a portion of your income if you become unable to work due to a covered disability. This allows you to maintain your standard of living and meet financial obligations while you recover. For Z, understanding the nuances of this policy is crucial for maximizing its benefits.

Types of Disability Income Policies

Several types of disability income policies cater to various needs and budgets. Understanding these distinctions is essential for Z to make an informed decision.

-

Individual Disability Income Insurance: This is a policy purchased independently and tailored to Z's specific needs and risk profile. It offers greater flexibility in coverage options but typically comes with a higher premium than group policies.

-

Group Disability Income Insurance: Often offered through employers, these policies provide a more affordable option but usually offer less comprehensive coverage and flexibility than individual policies. Z should carefully review the terms and conditions of any group policy offered through their workplace.

-

Short-Term Disability Insurance: This covers temporary disabilities, typically lasting a few months. Z might need to supplement this with a long-term policy for more extensive coverage.

-

Long-Term Disability Insurance: This provides income replacement for extended periods, often years, covering disabilities that prevent Z from working for an extended duration. This is typically the most comprehensive type of disability insurance.

Key Features of Z's Disability Income Policy

Z's specific policy will detail crucial features impacting coverage and benefits. These typically include:

-

Benefit Period: This defines the length of time Z can receive benefits, ranging from a few months to lifetime coverage. Longer benefit periods generally result in higher premiums.

-

Elimination Period: This is the waiting period before benefits begin. A shorter elimination period means quicker access to benefits but results in a higher premium. Z needs to carefully consider their financial resources during this waiting period.

-

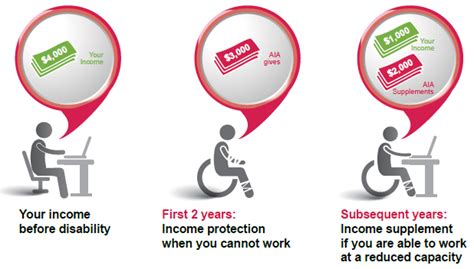

Benefit Amount: This represents the percentage of Z's pre-disability income the policy will replace. The higher the percentage, the higher the premium.

-

Definition of Disability: This is a critical aspect determining eligibility for benefits. Policies typically use either an "own occupation" or "any occupation" definition. "Own occupation" is generally more favorable to the insured, providing benefits if Z is unable to perform the duties of their specific job. "Any occupation" defines disability as the inability to perform any occupation for which Z is reasonably suited by education, training, and experience.

-

Partial Disability Benefit: Some policies provide benefits for partial disabilities, where Z can still work but at a reduced capacity.

-

Residual Disability Benefit: This covers situations where Z's income is reduced due to a disability, even if they can still work part-time.

-

Inflation Protection: This provision adjusts benefit payments to account for inflation, ensuring the benefits retain their purchasing power over time. This is a crucial feature for long-term disability policies.

Claiming Benefits Under Z's Disability Income Policy

Filing a claim under Z's disability income policy requires careful attention to detail and adherence to the policy's specific procedures. The process typically involves:

-

Notification: Z must promptly notify their insurance company of their disability. The sooner the notification, the better.

-

Documentation: Comprehensive medical documentation from treating physicians is crucial to support the claim. This may include medical records, diagnostic tests, and physician statements.

-

Claim Form Completion: Z will need to accurately complete the claim forms provided by the insurance company, providing all necessary information and documentation.

-

Review and Approval: The insurance company will review Z's claim and supporting documentation. This process can take several weeks or even months.

-

Appeal Process: If Z's claim is denied, they have the right to appeal the decision. This process usually involves submitting additional documentation and potentially engaging legal counsel.

Potential Challenges Z Might Face

Despite the financial security offered by disability income insurance, Z might encounter several challenges:

-

Claim Denials: Insurance companies may deny claims due to insufficient documentation, pre-existing conditions, or disputes over the definition of disability. A strong case built on clear medical evidence is crucial to mitigate this risk.

-

Long Processing Times: Claim processing can be lengthy and frustrating, creating financial hardship for Z during the waiting period.

-

Policy Exclusions: Policies may exclude certain conditions or disabilities from coverage. Z should carefully review the policy's exclusions before purchasing it.

-

Changes in Income or Occupation: Changes to Z's income or occupation may affect the benefit amount and eligibility for coverage.

-

Premiums: Disability insurance premiums can be substantial. Z needs to weigh the cost against the potential financial protection it offers.

Maximizing the Value of Z's Disability Income Policy

To fully leverage the protection of their disability income policy, Z should:

-

Regularly Review the Policy: Understanding the terms, conditions, and coverage details is vital. Periodic reviews help ensure the policy remains relevant to Z's circumstances.

-

Maintain Accurate Records: Keeping meticulous records of medical treatments, appointments, and communication with the insurance company is essential for supporting a claim.

-

Seek Professional Advice: Consulting with a financial advisor can provide personalized guidance on choosing the right policy and managing the claims process. A disability lawyer can also prove invaluable in case of a claim denial.

-

Consider Supplemental Insurance: Supplementing disability income insurance with other forms of protection, such as savings, investments, and long-term care insurance, strengthens overall financial resilience.

-

Stay Informed about Policy Changes: Insurance companies may periodically make changes to policy terms. Staying informed about these changes is crucial.

Conclusion

For Z, possessing a disability income policy is a proactive step towards safeguarding financial well-being. Understanding the intricacies of their specific policy, navigating the claims process effectively, and proactively addressing potential challenges are vital. By diligently managing their policy and seeking expert advice when needed, Z can maximize the value of this crucial financial safety net and protect their financial future from the potentially devastating consequences of disability. Proactive financial planning, including disability insurance, is an investment in peace of mind and financial security. The importance of a well-understood and properly managed disability income policy cannot be overstated in protecting one's long-term financial health and well-being. Z's proactive decision to secure this policy demonstrates sound financial planning, a critical element in navigating life's uncertainties.

Latest Posts

Latest Posts

-

Symbolisms In A Good Man Is Hard To Find

Mar 14, 2025

-

Sample Recommendation Letter For National Junior Honor Society

Mar 14, 2025

-

Unit 8 Formative Assessment Common Core Algebra 1 Answer Key

Mar 14, 2025

-

The Accompanying Diagram Represents The Market For Violins

Mar 14, 2025

-

Copy Pq To The Line With An Endpoint At R

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Z Owns A Disability Income Policy . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.