3.03 Quiz: Health And Life Insurance 3

Onlines

Mar 23, 2025 · 6 min read

Table of Contents

3.03 Quiz: Health and Life Insurance 3: A Comprehensive Guide

This comprehensive guide delves deep into the complexities of health and life insurance, providing a thorough understanding of the concepts tested in a typical "3.03 Quiz" scenario. We'll cover key terms, explore different policy types, and analyze crucial considerations for making informed decisions. This in-depth exploration will equip you with the knowledge to not only ace your quiz but also navigate the world of insurance with confidence.

Understanding Health Insurance: A Deeper Dive

Health insurance is a crucial aspect of financial planning, protecting you from the potentially devastating costs of medical care. Let's break down the key components:

Types of Health Insurance Plans

Several health insurance plans exist, each with its own structure and cost implications. Understanding these differences is paramount to choosing the right plan for your needs.

-

HMO (Health Maintenance Organization): HMOs typically require you to choose a primary care physician (PCP) within their network. Referrals are usually needed to see specialists. Generally, costs are lower, but flexibility is limited.

-

PPO (Preferred Provider Organization): PPOs offer more flexibility. You can see specialists without a referral, and you can often see out-of-network providers, although at a higher cost. Premiums are usually higher than HMOs.

-

EPO (Exclusive Provider Organization): EPOs are similar to HMOs but usually offer slightly more flexibility. You typically need to stay in-network for coverage, but referrals may not always be required.

-

POS (Point of Service): POS plans blend HMO and PPO features. You choose a PCP, but you have the option to see out-of-network providers, typically at a higher cost.

-

HDHP (High Deductible Health Plan): HDHPs have high deductibles (the amount you pay out-of-pocket before insurance coverage kicks in) but lower premiums. They are often paired with a Health Savings Account (HSA), allowing pre-tax contributions to cover medical expenses.

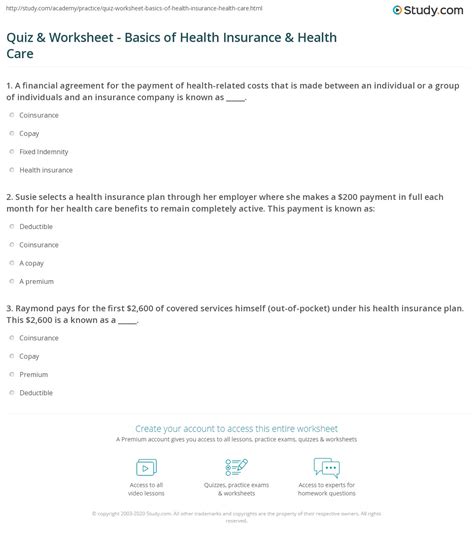

Key Terms to Know

Mastering the terminology is crucial for understanding your health insurance policy.

-

Premium: The regular payment you make to maintain your insurance coverage.

-

Deductible: The amount you pay out-of-pocket before your insurance begins to cover expenses.

-

Copay: A fixed amount you pay for a covered medical service.

-

Coinsurance: The percentage of costs you share with your insurance company after you've met your deductible.

-

Out-of-Pocket Maximum: The maximum amount you will pay out-of-pocket in a given year. Once this limit is reached, your insurance covers 100% of covered expenses.

-

Network: The group of doctors, hospitals, and other healthcare providers contracted with your insurance company.

-

Pre-existing Conditions: Medical conditions you had before your insurance coverage started. The Affordable Care Act (ACA) generally prohibits insurers from denying coverage based on pre-existing conditions.

Choosing the Right Health Plan

Selecting the best health insurance plan depends on various factors:

-

Your Budget: Consider your monthly premium payments and potential out-of-pocket expenses.

-

Your Health Needs: If you anticipate needing frequent medical care, a plan with a lower deductible and lower out-of-pocket maximum might be preferable.

-

Your Healthcare Providers: Check if your preferred doctors and hospitals are in the plan's network.

-

Your Lifestyle: Consider your need for flexibility in choosing healthcare providers.

Understanding Life Insurance: Protecting Your Future

Life insurance is a critical tool for financial security, providing a financial safety net for your loved ones in the event of your death.

Types of Life Insurance Policies

Different life insurance policies cater to varying needs and budgets.

-

Term Life Insurance: Provides coverage for a specific period (term), typically 10, 20, or 30 years. It's generally more affordable than permanent life insurance but offers no cash value.

-

Whole Life Insurance: Provides lifelong coverage and builds cash value that grows tax-deferred. It's more expensive than term life insurance but offers a savings component.

-

Universal Life Insurance: Offers flexible premiums and death benefits. It also builds cash value, but the growth rate isn't guaranteed.

-

Variable Universal Life Insurance: Similar to universal life insurance, but the cash value is invested in market-linked accounts, offering potential for higher growth but also higher risk.

Key Terms in Life Insurance

Understanding the terminology is crucial for comparing and choosing a policy.

-

Beneficiary: The person or people who will receive the death benefit.

-

Death Benefit: The amount paid to the beneficiary upon the insured's death.

-

Policy Surrender: The act of canceling a life insurance policy and receiving the cash value (if applicable).

-

Cash Value: The accumulated savings component in some permanent life insurance policies.

-

Premium: The regular payment made to maintain the policy.

Choosing the Right Life Insurance Policy

Several factors influence the choice of life insurance policy:

-

Your Financial Needs: Consider the financial needs of your dependents and the amount of coverage required to meet those needs.

-

Your Age and Health: Your age and health status affect the cost of premiums.

-

Your Budget: Balance the cost of premiums with the level of coverage you need.

-

Your Risk Tolerance: If you opt for policies with investment components, consider your risk tolerance.

Connecting Health and Life Insurance: A Holistic Approach

While distinct, health and life insurance are integral parts of a comprehensive financial plan. They address different but equally important aspects of financial security:

-

Health insurance protects against the high costs of medical care, ensuring access to treatment and preventing financial ruin due to illness or injury.

-

Life insurance provides financial protection for your loved ones in the event of your death, covering expenses like funeral costs, mortgage payments, and children's education.

Together, they form a safety net that mitigates financial risks associated with health issues and mortality.

Preparing for Your 3.03 Quiz: A Strategic Approach

To effectively prepare for your 3.03 quiz on health and life insurance, employ a multi-faceted strategy:

1. Review Key Concepts:

Thoroughly review the definitions and explanations of the key terms and concepts discussed above. Understanding these foundational elements is paramount to comprehending more complex aspects of insurance.

2. Practice with Sample Questions:

Seek out sample quizzes or practice questions that mirror the format and style of your 3.03 quiz. This hands-on experience will help you identify your areas of strength and weakness.

3. Understand Policy Differences:

Focus on understanding the nuanced differences between various health and life insurance policy types. Pay particular attention to the implications of each type for premiums, coverage, and benefits.

4. Analyze Case Studies:

Explore hypothetical scenarios that involve choosing insurance policies under various circumstances. This will improve your analytical skills and problem-solving abilities related to insurance decisions.

5. Utilize Mnemonic Devices:

Develop mnemonic devices to aid in remembering key terminology and concepts. This memory technique can prove invaluable during the quiz.

Conclusion: Beyond the Quiz

This comprehensive guide has aimed to equip you with the knowledge necessary to succeed on your 3.03 quiz. However, the real value lies in applying this understanding to make informed decisions about your own health and life insurance needs. Remember that the choice of insurance is a personal one, tailored to individual circumstances and financial goals. Consulting with a qualified insurance professional can offer invaluable guidance in navigating the complexities of this critical aspect of financial planning. Remember to periodically review and adjust your insurance coverage as your life circumstances evolve. This proactive approach ensures that you are always adequately protected against unforeseen events.

Latest Posts

Latest Posts

-

A Player Pays 15 To Play A Game

Mar 24, 2025

-

Elyse Has Worked For A Dod Agency

Mar 24, 2025

-

Intermountain Health Expects Students To Maintain High Ethical Standards

Mar 24, 2025

-

Unit 9 Transformations Homework 3 Rotations

Mar 24, 2025

-

All Quiet On The Western Front Character

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about 3.03 Quiz: Health And Life Insurance 3 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.