Aetna Claim Benefit Specialist Virtual Job Tryout Answers

Onlines

Mar 31, 2025 · 6 min read

Table of Contents

Aetna Claim Benefit Specialist Virtual Job Tryout: Ace Your Answers

Landing a virtual job as an Aetna Claim Benefit Specialist is a fantastic opportunity, offering flexibility and the chance to contribute to a major healthcare provider. However, the virtual job tryout is a crucial hurdle. This comprehensive guide provides you with the knowledge and strategies to ace your Aetna Claim Benefit Specialist virtual job tryout answers, significantly increasing your chances of success. We'll cover common questions, helpful tips, and strategies for showcasing your skills and experience effectively.

Understanding the Aetna Claim Benefit Specialist Role

Before diving into potential questions, let's solidify our understanding of the role. An Aetna Claim Benefit Specialist is responsible for processing and adjudicating healthcare claims, ensuring accuracy and compliance with company policies and regulations. This involves:

- Claims Processing: Reviewing incoming claims for completeness and accuracy, identifying discrepancies, and taking appropriate action.

- Benefit Verification: Confirming eligibility and benefits for members, accurately interpreting plan provisions, and communicating with members and providers.

- Payment Processing: Ensuring timely and accurate payment of claims to providers.

- Customer Service: Addressing member and provider inquiries, resolving issues, and providing excellent customer support.

- Compliance: Adhering to all relevant regulations, maintaining accurate records, and contributing to a compliant and efficient claims processing environment.

Common Questions and Effective Answers

The virtual job tryout will likely test your knowledge, skills, and experience relevant to the role. Let's anticipate some common questions and craft strong, insightful answers:

1. "Describe your experience with claims processing and adjudication."

This is a foundational question. Your answer should highlight:

- Specific examples: Don't just say you processed claims. Quantify your experience. "I processed an average of 150 claims per day with a 98% accuracy rate."

- Software proficiency: Mention any claims processing software you're familiar with (e.g., FACETS, Optum). "I'm proficient in FACETS, and I'm comfortable navigating complex claim workflows within the system."

- Problem-solving skills: Discuss how you handled complex or unusual claims. "I once identified a coding error that resulted in a significant underpayment. By investigating the issue, I corrected the coding and ensured the provider received the appropriate reimbursement."

- Attention to detail: Emphasize your accuracy and meticulousness. "I am meticulous in my work, ensuring each claim is reviewed thoroughly to prevent errors and ensure compliance with regulations."

2. "Explain your understanding of healthcare benefits and plan provisions."

This question tests your knowledge of health insurance intricacies. Demonstrate your understanding by:

- Defining key terms: Show your familiarity with terms like copay, deductible, coinsurance, and Explanation of Benefits (EOB).

- Illustrative examples: Use examples to clarify your understanding. "For instance, understanding a member's deductible and out-of-pocket maximum is crucial in determining their responsibility for a claim."

- Plan variations: Discuss your knowledge of different types of health plans (e.g., HMO, PPO, POS). "I understand the differences between various plan types and how these differences impact benefit coverage."

- Regulations and compliance: Mention your awareness of relevant healthcare regulations and compliance requirements. "I am familiar with HIPAA regulations and understand the importance of protecting member information."

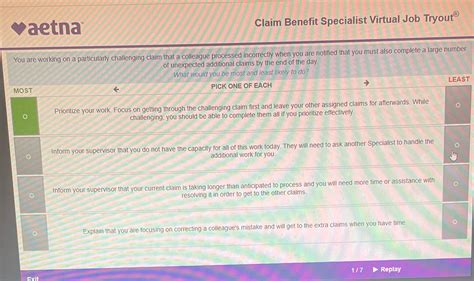

3. "How do you handle difficult or stressful situations in a fast-paced environment?"

This assesses your ability to manage pressure and remain effective under challenging circumstances. Emphasize:

- Prioritization and organization: Show how you prioritize tasks and manage your workload effectively. "I prioritize claims based on urgency and complexity, using task management tools to stay organized and meet deadlines."

- Problem-solving approach: Describe your systematic approach to resolving problems. "When faced with a challenging claim, I systematically investigate the issue, gather necessary information, and collaborate with other team members as needed to find a resolution."

- Stress management techniques: Briefly mention strategies you use to cope with stress. "I find that taking short breaks and prioritizing self-care helps me stay focused and productive even under pressure."

- Positive attitude: Highlight your ability to maintain a positive attitude even when dealing with difficult situations. "I maintain a positive and solution-oriented approach even when facing challenging situations, focusing on finding the best outcome for both the member and the company."

4. "Describe your customer service experience and your ability to communicate effectively with members and providers."

Excellent communication is critical. Show your skills by:

- Specific examples: Use concrete examples of how you've effectively communicated with customers in the past. "I once helped a frustrated member understand a complex billing issue by patiently explaining the process and providing clear, concise information."

- Active listening: Highlight your ability to actively listen and understand the needs of others. "I am a strong active listener and I ensure I fully understand the issue before responding."

- Different communication methods: Mention your proficiency in various communication channels (e.g., phone, email, written correspondence). "I am comfortable communicating through various channels, ensuring the most appropriate method is used based on the situation."

- Empathy and professionalism: Emphasize your empathy and professionalism in handling member and provider interactions. "I approach every interaction with empathy and professionalism, aiming to resolve issues efficiently and build strong relationships."

5. "Why are you interested in this position at Aetna?"

This is your chance to showcase your interest in Aetna and the role. Research Aetna's mission and values beforehand. Highlight:

- Company values: Show you align with Aetna's values. "Aetna's commitment to providing quality healthcare resonates with my personal values."

- Career goals: Explain how this position aligns with your career aspirations. "This role aligns perfectly with my long-term goal of advancing my career in healthcare administration."

- Specific aspects: Mention specific aspects of the role or company that appeal to you. "The opportunity to work remotely while contributing to a significant healthcare provider like Aetna is incredibly appealing."

- Enthusiasm: Express your genuine enthusiasm for the opportunity. "I am excited about the opportunity to contribute my skills and experience to Aetna's mission of improving people's health."

Tips for Success in Your Virtual Job Tryout

- Practice your answers: Rehearse your responses to common questions beforehand. This will help you feel more confident and deliver your answers smoothly.

- Prepare your environment: Ensure you have a quiet and professional workspace free from distractions. A clean, well-lit background is essential.

- Dress professionally: Even though it's a virtual tryout, dress professionally to maintain a professional demeanor.

- Test your technology: Check your internet connection, microphone, and webcam to ensure they are working correctly.

- Be punctual: Log in a few minutes early to avoid any technical glitches or delays.

- Be yourself: Be authentic and let your personality shine through. Authenticity builds rapport and shows you are a good fit for the team.

- Ask thoughtful questions: At the end, ask insightful questions about the role, the team, or the company. This demonstrates your interest and initiative.

- Send a thank-you note: After the tryout, send a thank-you email to the interviewer reiterating your interest and highlighting key points from your conversation.

Advanced Strategies for Standing Out

To truly stand out from other candidates, consider these advanced strategies:

- STAR Method: Structure your answers using the STAR method (Situation, Task, Action, Result) to provide concrete examples of your skills and experience.

- Quantifiable results: Whenever possible, quantify your accomplishments using numbers and metrics to showcase your impact.

- Research the company thoroughly: Demonstrate your understanding of Aetna’s business model, recent news, and competitive landscape.

- Showcase soft skills: Highlight soft skills such as teamwork, communication, problem-solving, and adaptability. These skills are highly valued in any customer-facing role.

- Tailor your answers: Tailor your responses to the specific requirements and responsibilities outlined in the job description.

By diligently preparing and implementing these strategies, you significantly improve your chances of acing your Aetna Claim Benefit Specialist virtual job tryout and securing this rewarding opportunity. Remember, preparation is key to success. Good luck!

Latest Posts

Latest Posts

-

Green Wave Company Plans To Own And Operate

Apr 02, 2025

-

Classify Each Histogram Using The Appropriate Descriptions

Apr 02, 2025

-

Which Main Storage Molecule Would Be Produced From Eating Spaghetti

Apr 02, 2025

-

Summary Of Act 1 Scene 3 Othello

Apr 02, 2025

-

A Technician Is Explaining The Difference Between

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Aetna Claim Benefit Specialist Virtual Job Tryout Answers . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.