Agent Jennings Makes A Presentation On Medicare

Onlines

Mar 28, 2025 · 6 min read

Table of Contents

Agent Jennings Makes a Presentation on Medicare: Demystifying the System for Seniors

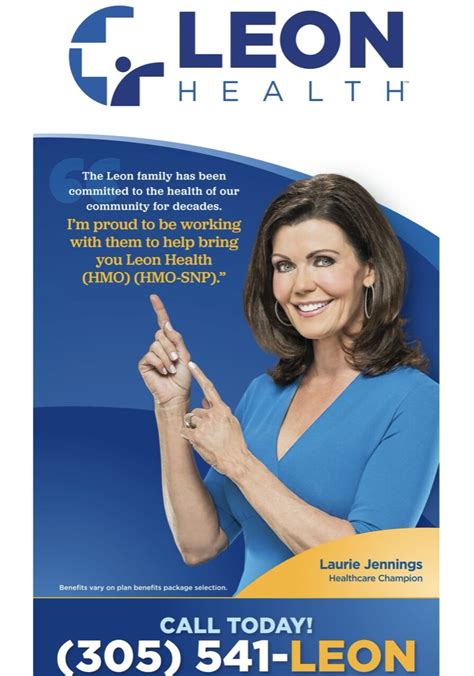

Navigating the complexities of Medicare can feel like traversing a dense jungle. For seniors and their families, understanding the intricacies of Part A, Part B, Part D, and Medigap plans can be incredibly daunting. That's where knowledgeable insurance agents, like Agent Jennings, step in to provide clarity and guidance. This article delves into a hypothetical presentation Agent Jennings might deliver, covering key aspects of Medicare to empower seniors with the information they need to make informed decisions.

Understanding the Basics: What is Medicare?

Agent Jennings begins her presentation by establishing a foundational understanding of Medicare. She emphasizes that Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, as well as younger people with certain disabilities and end-stage renal disease (ESRD). She stresses that it's not just one program but a collection of several parts, each with its own coverage and costs.

Key Components of Medicare:

-

Part A (Hospital Insurance): Agent Jennings explains that Part A primarily covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare. She highlights that many beneficiaries receive Part A with no monthly premium, having qualified through their work history. However, she clarifies that there are copayments and deductibles associated with these services.

-

Part B (Medical Insurance): This section focuses on Part B, which covers doctor visits, outpatient care, medical supplies, and preventive services. Agent Jennings stresses the importance of understanding that Part B requires a monthly premium, the amount of which depends on income. She explains how the premium is deducted from Social Security benefits and how income-related monthly adjustment amounts (IRMAA) can impact the cost for higher-income beneficiaries.

-

Part C (Medicare Advantage): Agent Jennings clarifies that Medicare Advantage plans, also known as Part C, are offered by private companies approved by Medicare. She details the all-in-one nature of these plans, which often combine Part A, Part B, and often Part D coverage into a single plan. She emphasizes that while they can offer extra benefits like vision, hearing, and dental, they also come with network restrictions, meaning beneficiaries must see doctors within the plan's network. She highlights the need to carefully consider the plan's network adequacy for their healthcare needs.

-

Part D (Prescription Drug Insurance): This segment dives deep into Part D, which covers prescription medications. Agent Jennings explains the different phases of the Part D drug coverage: deductible, initial coverage, coverage gap, and catastrophic coverage. She emphasizes the importance of understanding the formulary (list of covered drugs) of each plan, and cautions against the potential for significant cost increases during the coverage gap if a beneficiary doesn't carefully select their plan. She details the different plan options, including stand-alone Part D plans and plans integrated with Medicare Advantage.

Navigating the Enrollment Process: A Step-by-Step Guide

Agent Jennings devotes a significant portion of her presentation to the enrollment process, highlighting the importance of timing and understanding the different enrollment periods.

Key Enrollment Periods:

-

Initial Enrollment Period (IEP): She explains that the IEP begins three months before an individual turns 65, includes the month they turn 65, and ends three months after. Missing the IEP can result in penalties.

-

Annual Enrollment Period (AEP): This is the period (October 15 – December 7) during which beneficiaries can change their Medicare Advantage or Part D plans, or switch between Original Medicare and a Medicare Advantage plan. She highlights the significance of carefully reviewing plan options each year, as plans change annually.

-

Special Enrollment Period (SEP): Agent Jennings clarifies that SEPs are available under specific circumstances, such as moving out of a plan's service area or losing other health coverage. She stresses the importance of understanding the specific reasons that qualify for a SEP.

Choosing the Right Plan: Factors to Consider

The core of Agent Jennings' presentation focuses on helping seniors make informed plan choices. She emphasizes that there is no one-size-fits-all answer and that the optimal plan depends on individual health needs, prescription drug usage, budget, and lifestyle.

Key Factors to Consider:

-

Healthcare Needs: Agent Jennings underscores the importance of considering current and anticipated healthcare needs. She advises beneficiaries to analyze their utilization of healthcare services – doctor visits, hospitalizations, and prescription medications – to determine the level of coverage needed.

-

Prescription Drug Costs: For those with significant prescription drug costs, she emphasizes the importance of carefully evaluating the formularies of different Part D plans. She suggests tools for comparing prescription drug costs across different plans and the need to account for potential changes to medication and formularies.

-

Budgetary Considerations: Agent Jennings underscores the financial aspects of Medicare, discussing premiums, deductibles, copayments, and coinsurance. She advises beneficiaries to factor these costs into their budgets and highlights potential resources for assistance with Medicare expenses for low-income individuals.

-

Network Adequacy: For those considering Medicare Advantage plans, she stresses the importance of checking the plan's provider network to ensure that their preferred doctors and specialists are included.

Understanding Medigap Policies: Supplemental Coverage

Agent Jennings introduces Medigap policies (Medicare Supplement Insurance) as a way to fill the gaps in Original Medicare coverage (Parts A & B). She explains that these are private insurance policies that can help pay for expenses not covered by Original Medicare, such as copayments, deductibles, and coinsurance. She highlights the importance of selecting a reputable insurance company and carefully comparing plans to find the best coverage.

Addressing Common Questions and Concerns

The final part of Agent Jennings' presentation is dedicated to addressing common questions and concerns about Medicare. This interactive segment allows seniors to actively participate and receive tailored advice.

Common Questions:

- What if I change jobs after I enroll in Medicare? Agent Jennings clarifies the implications of employment changes on Medicare enrollment.

- Can I still see my current doctor if I switch plans? She clarifies network considerations for various plan types.

- What if I need long-term care? She explains how Medicare and other forms of coverage approach long-term care needs.

- How can I get help paying for Medicare? She addresses resources available to those needing financial assistance with Medicare.

- What are the penalties for late enrollment? She underscores the importance of enrolling during the appropriate enrollment periods.

Conclusion: Empowering Seniors with Knowledge

Agent Jennings concludes her presentation by emphasizing the importance of proactive planning and utilizing available resources. She highlights the value of seeking personalized advice from a qualified insurance agent to navigate the complexities of Medicare and choose a plan that best meets their individual needs and circumstances. She encourages the audience to ask questions and to utilize the various tools and resources available to them. By demystifying Medicare, Agent Jennings empowers seniors to make informed decisions and secure their healthcare future with confidence. She emphasizes the ongoing need for review and potential changes to their plans as their needs and circumstances evolve. Regular review is crucial to optimizing their Medicare coverage and maintaining financial health in retirement.

Latest Posts

Latest Posts

-

The Guest Summary By Albert Camus

Mar 31, 2025

-

The Great Gatsby Student Workbook Answer Key Pdf

Mar 31, 2025

-

Statement Of Cash Flows For Snowdrop A Limited Company

Mar 31, 2025

-

What Page Does Juror 10 Talk About African Americnas

Mar 31, 2025

-

Rosario De San Judas Tadeo Completo Pdf

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Agent Jennings Makes A Presentation On Medicare . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.