Based On The Industry-low Industry-average And Industry-high Values

Onlines

Mar 10, 2025 · 6 min read

Table of Contents

Understanding Industry Benchmarks: Low, Average, and High Values

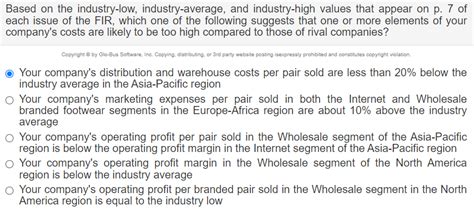

Analyzing industry benchmarks—specifically the low, average, and high values—is crucial for businesses seeking to understand their competitive landscape, identify areas for improvement, and set realistic goals. These benchmarks provide a comparative framework, allowing companies to gauge their performance against their peers and understand where they stand within the market. This in-depth analysis will explore how to identify, interpret, and utilize these benchmark values to make strategic business decisions.

Defining Industry Benchmarks: Low, Average, and High

Before delving into the application of these benchmarks, let's clearly define each value:

-

Industry Low: This represents the lowest performance level observed among businesses within a specific industry. It highlights the minimum acceptable level of performance and can indicate potential areas of significant inefficiency or underperformance. Understanding the industry low helps companies avoid falling behind and identify potential pitfalls.

-

Industry Average: This represents the mean performance across all businesses in the industry. It's a common point of comparison, providing a baseline measure of typical performance. While useful as a benchmark, relying solely on the average can be misleading, as it masks the range of performance within the industry.

-

Industry High: This signifies the best performance level achieved by any business within the industry. It showcases the potential for excellence and inspires businesses to strive for improvement. Analyzing the high-performing companies can reveal best practices and strategies for boosting performance.

Identifying Industry Benchmarks: Data Sources and Methodology

Identifying reliable industry benchmarks requires a strategic approach to data gathering and analysis. Here are some key sources and methodologies:

Data Sources:

-

Industry Reports and Publications: Reputable market research firms and industry-specific publications often publish detailed reports containing benchmark data. These reports usually segment data based on company size, geographic location, and other relevant factors.

-

Government Databases: Government agencies may compile and release industry-specific data, offering insights into various economic indicators and performance metrics.

-

Trade Associations: Professional trade associations within specific industries frequently collect and share data among their members, providing access to valuable benchmarks.

-

Competitive Analysis: Conducting thorough research on competitors can unveil valuable insights into their performance. Analyzing publicly available financial statements, press releases, and industry news can help estimate competitor benchmarks.

-

Internal Data: Your own company's historical performance data provides a crucial internal benchmark for measuring progress and improvement over time.

Methodology:

-

Define Key Performance Indicators (KPIs): The first step is to identify the relevant KPIs for your industry. These will vary depending on the specific sector. Examples include revenue, profit margins, customer satisfaction, market share, employee turnover, and operational efficiency.

-

Data Collection and Cleaning: Once the KPIs are defined, collect data from the sources mentioned above. Ensure data consistency and accuracy through thorough cleaning and validation.

-

Statistical Analysis: Use statistical methods (e.g., mean, median, mode, standard deviation) to calculate the industry low, average, and high values for each KPI. The choice of statistical measure depends on the data distribution and the specific research question.

-

Benchmark Segmentation: Consider segmenting the data based on relevant factors like company size, geographic location, or product/service offerings to gain a more nuanced understanding of the benchmarks within specific sub-sectors.

-

Regular Updates: Industry benchmarks are dynamic. Regular updates and analysis are crucial to maintain the relevance and accuracy of your benchmarking efforts.

Interpreting and Utilizing Industry Benchmarks

Once the industry low, average, and high values are identified, understanding their implications is vital.

Identifying Strengths and Weaknesses:

-

Comparing against the Average: This provides a quick overview of your company's overall performance. Above average suggests potential strengths, while below average indicates areas for improvement.

-

Analyzing the Gap between Performance and the High: Understanding the gap between your company's performance and the industry high reveals the potential for improvement and provides targets for future goals.

-

Examining the Distance from the Low: This helps to identify potential risks and areas where performance needs immediate attention to avoid falling below the minimum acceptable level.

Strategic Decision-Making:

-

Setting Realistic Goals: Industry benchmarks provide a data-driven foundation for establishing realistic and achievable goals. Setting goals that align with industry best practices enhances the likelihood of success.

-

Resource Allocation: Benchmark data can inform strategic resource allocation. Understanding where your company lags behind the industry average or high can guide investment in areas needing improvement.

-

Competitive Advantage: Identifying areas where your company outperforms the industry average or high highlights your competitive advantage. Leveraging these strengths can help you attract customers and maintain market leadership.

Continuous Improvement:

-

Identifying Best Practices: Analyze the strategies and practices of high-performing companies within the industry to identify best practices that can be adapted and implemented.

-

Process Optimization: Compare your internal processes against industry benchmarks to identify inefficiencies and areas for optimization.

-

Innovation and Development: Understanding the industry high encourages innovation and development. By analyzing the cutting-edge approaches of top performers, companies can drive progress and remain competitive.

Examples of Industry Benchmarks Across Different Sectors

The application of industry benchmarks varies across sectors. Let's consider a few examples:

Retail Sector:

- KPI: Customer Acquisition Cost (CAC)

- Industry Low: $10

- Industry Average: $50

- Industry High: $20 A retailer with a CAC of $70 needs significant improvement in marketing and customer acquisition strategies.

Technology Sector:

- KPI: Employee Retention Rate

- Industry Low: 60%

- Industry Average: 75%

- Industry High: 90% A tech company with a 65% retention rate should investigate causes of employee turnover and implement retention strategies.

Manufacturing Sector:

- KPI: Production Efficiency (units produced per employee hour)

- Industry Low: 2 units/hour

- Industry Average: 5 units/hour

- Industry High: 8 units/hour A manufacturer producing 3 units/hour needs to assess bottlenecks and optimize its production processes.

These examples highlight the diverse applications of industry benchmarks and how they inform strategic decisions across different business areas.

Limitations and Considerations

While industry benchmarks are valuable, it's crucial to acknowledge their limitations:

-

Data Availability and Reliability: Accessing accurate and comprehensive data can be challenging, especially for smaller or less-established industries.

-

Industry Segmentation: Using broad industry averages without considering relevant segmentations can lead to inaccurate comparisons.

-

External Factors: External factors beyond a company's control (e.g., economic downturns, regulatory changes) can significantly impact performance and distort benchmark comparisons.

-

Overreliance on Benchmarks: While valuable, benchmarks shouldn't be the sole driver of strategic decisions. Other factors like long-term vision and internal capabilities must be considered.

Conclusion

Understanding and effectively utilizing industry benchmarks—the low, average, and high values—is paramount for companies seeking sustainable growth and market leadership. By carefully identifying relevant KPIs, gathering reliable data, and interpreting the results strategically, businesses can gain a clearer picture of their competitive position, identify areas for improvement, and set realistic goals. Remember that continuous monitoring and adaptation are key to staying ahead in a dynamic market. The insights gleaned from benchmarking should inform, but not dictate, strategic decision-making, ensuring a balanced approach that combines data-driven insights with visionary leadership.

Latest Posts

Latest Posts

-

Pogil Answer Key Selection And Speciation

Mar 10, 2025

-

Curso De Ortografia Pdf Con Respuestas

Mar 10, 2025

-

What Is Opsec Select All That Apply

Mar 10, 2025

-

Alienation Is Defined By The Text As

Mar 10, 2025

-

How Do The Lost Boys React To Wendys Mothering

Mar 10, 2025

Related Post

Thank you for visiting our website which covers about Based On The Industry-low Industry-average And Industry-high Values . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.