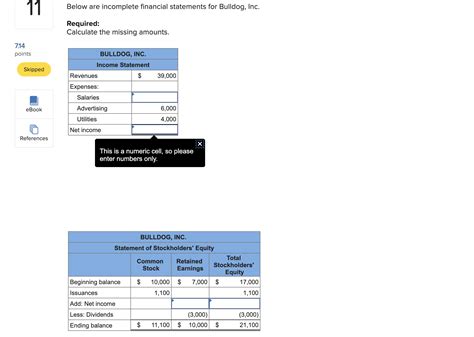

Below Are Incomplete Financial Statements For Bulldog Incorporated

Onlines

Mar 22, 2025 · 6 min read

Table of Contents

Decoding Bulldog Incorporated's Financial Health: A Comprehensive Analysis of Incomplete Statements

Bulldog Incorporated's incomplete financial statements present a puzzle, but with careful analysis, we can piece together a clearer picture of the company's financial health. This detailed analysis will delve into the potential implications of the missing data, explore various methods of estimation, and ultimately offer insights into Bulldog's profitability, liquidity, and solvency. We will use common financial ratios and analytical techniques to glean as much information as possible from the limited data provided. Remember, any conclusions drawn will be based on assumptions and estimations, underscoring the importance of complete financial reporting for accurate assessment.

The Challenge of Incomplete Financial Statements

The absence of crucial information significantly hinders a comprehensive financial evaluation. Without complete data, crucial financial ratios cannot be calculated accurately, potentially leading to misinterpretations and flawed conclusions about the company's performance. The reliability of any subsequent analysis is directly proportional to the completeness of the available data. Therefore, understanding the limitations is crucial before attempting any analysis.

Understanding the Missing Pieces: Key Financial Statements and Their Components

To effectively analyze Bulldog Incorporated, let's first identify the typical components of financial statements and assess what’s missing. A typical set includes:

-

Balance Sheet: This statement provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. Missing components could include specific asset categories (like accounts receivable, inventory, or property, plant, and equipment), liabilities (like accounts payable, long-term debt), or equity components (like retained earnings). Without these specifics, assessing the company's capital structure and financial position becomes challenging.

-

Income Statement: This statement reports a company's revenues, expenses, and net income or loss over a specific period. Missing information could pertain to revenue streams, cost of goods sold (COGS), operating expenses (selling, general, and administrative expenses – SG&A), interest expense, or tax expense. Incomplete income statement data limits our ability to assess profitability and operational efficiency.

-

Statement of Cash Flows: This statement tracks the movement of cash both into and out of a company over a specific period. Missing data could relate to cash flows from operating, investing, and financing activities. Without a complete statement, assessing the company's liquidity and its ability to meet its short-term and long-term obligations is difficult.

-

Statement of Changes in Equity: This statement details the changes in the company's equity during a period. Missing components might include details on net income, dividends paid, and any other equity transactions. This statement, alongside the balance sheet, paints a complete picture of the company's equity position.

Estimation Techniques for Missing Data

Despite the incomplete nature of Bulldog Incorporated's financial statements, several estimation techniques can be employed to fill the gaps, allowing for a more informed, albeit less precise, analysis. These techniques, however, should be used cautiously and their limitations clearly acknowledged:

-

Industry Benchmarks: Comparing Bulldog's available data to industry averages can provide insights into the potential values of missing information. This method assumes that Bulldog operates similarly to its peers, which might not always be the case.

-

Trend Analysis: If historical financial data is available, analyzing trends in existing data can help estimate missing values. This approach assumes that past trends will continue, which might not hold true given unforeseen circumstances.

-

Ratio Analysis (with caution): Certain financial ratios might be calculable even with incomplete data. These ratios, however, should be interpreted cautiously, acknowledging the limitations stemming from incomplete information.

-

Regression Analysis: Statistical techniques like regression analysis can be used to estimate missing values based on the relationship between available data points and relevant variables. The accuracy of this method depends on the quality and relevance of the available data.

Analyzing Available Data: What We Can Learn

Even with incomplete data, some key areas can still be analyzed, albeit with limitations. For example:

-

Gross Profit Margin: If revenue and COGS are available (partially or wholly), the gross profit margin can be calculated. This ratio helps in understanding the profitability of Bulldog’s core business operations. A low gross profit margin might indicate pricing pressure or inefficient production processes.

-

Current Ratio: If current assets and current liabilities are partially available, a rough estimate of the current ratio can be calculated. This ratio signifies the company’s short-term debt-paying ability. A low ratio suggests potential liquidity problems.

-

Debt-to-Equity Ratio: If total debt and total equity are partially available, an approximate debt-to-equity ratio can be calculated. This ratio helps assess Bulldog’s capital structure and its reliance on debt financing. A high ratio might indicate a high financial risk.

-

Return on Assets (ROA) and Return on Equity (ROE): These profitability ratios can be estimated if some income statement and balance sheet data are available, providing insights into the efficiency of asset and equity utilization.

-

Operating Cash Flow: If sufficient data about cash inflows and outflows are available from the statement of cash flows, the operating cash flow can be estimated. This number is fundamental in understanding the company's ability to generate cash from its core operations.

The Importance of Full Financial Disclosure

The analysis of Bulldog Incorporated's incomplete financial statements highlights the critical importance of full and transparent financial reporting. The limitations encountered underscore the difficulties in accurately assessing financial health with missing pieces of the puzzle. Investors, creditors, and other stakeholders rely on accurate and complete financial statements to make informed decisions. Incomplete data can lead to:

-

Misinformed investment decisions: Investors might overvalue or undervalue Bulldog Incorporated based on incomplete or estimated data, leading to poor investment choices.

-

Credit risk: Lenders might extend credit based on inaccurate assessments of Bulldog's financial strength, increasing their risk of loan defaults.

-

Misleading management assessments: Internal stakeholders might make incorrect strategic decisions based on flawed financial data, hindering the company's growth and profitability.

-

Regulatory non-compliance: Incomplete financial reporting can lead to non-compliance with regulatory requirements, potentially incurring penalties and reputational damage.

Conclusion: The Need for Transparency and Accuracy

While estimation techniques can provide some insights into Bulldog Incorporated's financial health, the limitations of incomplete data cannot be overstated. Accurate financial analysis requires complete and reliable financial statements. The analysis emphasizes the crucial role of transparency and accuracy in financial reporting for making informed decisions and maintaining the integrity of financial markets. Bulldog Incorporated should strive for complete disclosure to ensure accurate assessment by all stakeholders. Further investigation and disclosure of the missing data is necessary to obtain a comprehensive and reliable evaluation of its financial performance and position. The limitations presented throughout this analysis must be considered before drawing definitive conclusions. This exercise highlights the importance of comprehensive and transparent financial reporting, not only for external stakeholders but also for the effective internal management of the business.

Latest Posts

Latest Posts

-

In Addition To Monetary Information Managerial Accounting Reports Information

Mar 23, 2025

-

Nurselogic Knowledge And Clinical Judgment Beginner

Mar 23, 2025

-

You Need A Photograph To Use In A Commercial Presentation

Mar 23, 2025

-

National Junior Honor Society Letter Of Recommendation Example

Mar 23, 2025

-

Which Of The Following Is True Of Nail Care

Mar 23, 2025

Related Post

Thank you for visiting our website which covers about Below Are Incomplete Financial Statements For Bulldog Incorporated . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.