Can You Calculate Pcib In Ms Project

Onlines

Mar 15, 2025 · 6 min read

Table of Contents

Can You Calculate PCIB in MS Project? Understanding and Implementing Planned Cost of Investment Baseline

Microsoft Project doesn't directly offer a built-in calculation for Planned Cost of Investment Baseline (PCIB). However, you can effectively calculate and manage this crucial metric within the project management software using various techniques and workarounds. This comprehensive guide explores what PCIB is, why it's important, and provides step-by-step methods for calculating and tracking it within MS Project, equipping you with the tools to effectively monitor your project's financial performance.

Understanding Planned Cost of Investment Baseline (PCIB)

Before diving into the calculations, let's clarify the concept of PCIB. The Planned Cost of Investment Baseline (PCIB) represents the total planned cost associated with a project or investment at its inception. This includes all anticipated expenditures, covering everything from initial setup and resource acquisition to ongoing operational costs throughout the project's lifecycle. It serves as a fundamental benchmark against which actual costs are compared to assess project performance and financial health.

Key Differences from Other Cost Baselines:

It's crucial to differentiate PCIB from other cost baselines commonly used in project management:

-

Budget at Completion (BAC): This represents the total approved budget for the project. While similar to PCIB, the BAC might not encompass all investment-related costs, potentially excluding certain indirect expenses or long-term operational overheads associated with the project's eventual outcome.

-

Planned Value (PV): PV refers to the budgeted cost of work scheduled to be completed by a specific point in time. It's a dynamic metric that changes as the project progresses. PCIB, on the other hand, remains relatively static, representing the initial, overall investment plan.

-

Earned Value (EV): EV reflects the value of the work completed to date, based on the budgeted cost of that work. It is used in conjunction with PV and AC (Actual Cost) to calculate various performance indicators. PCIB serves as a broader context for interpreting these performance measures.

Why is PCIB Important for Project Management?

Tracking PCIB is essential for several reasons:

-

Financial Planning & Control: PCIB provides a clear picture of the total financial commitment associated with the project. This allows for better resource allocation, budgeting, and financial forecasting.

-

Performance Monitoring: Comparing actual costs against the PCIB helps identify potential cost overruns or areas where savings can be realized. Early detection of variances allows for proactive corrective actions.

-

Investment Justification: PCIB serves as a key element in the justification of the project. It demonstrates the overall investment needed to achieve the project goals, enabling better decision-making and securing necessary funding.

-

Stakeholder Communication: A well-defined PCIB facilitates transparent communication with stakeholders regarding the project's financial implications and progress. It helps manage expectations and builds confidence.

-

Return on Investment (ROI) Assessment: By comparing the project's eventual outcome with the PCIB, you can accurately calculate the ROI and evaluate the project's overall success from a financial perspective.

Calculating PCIB in MS Project: A Practical Approach

While MS Project doesn't directly compute PCIB, we can leverage its features to create a comprehensive calculation and monitoring system:

Method 1: Utilizing Custom Fields and Calculations

-

Define Cost Categories: Begin by meticulously categorizing all anticipated costs associated with your project. This might include:

- Direct Costs: Labor, materials, equipment.

- Indirect Costs: Project management overhead, administrative expenses, facility costs.

- Contingency Reserves: Funds allocated to cover unforeseen expenses.

- Long-Term Operational Costs: Costs associated with the project's ongoing operation after completion (if applicable).

-

Create Custom Fields: In MS Project, navigate to the "Fields" section and create custom number fields for each cost category identified above. For instance, you might create fields like "DirectLaborCost," "MaterialCost," "OverheadCost," etc.

-

Populate Custom Fields: For each task within your project plan, input the corresponding cost values into the respective custom fields. This requires careful estimation and planning based on your project's scope and resource requirements.

-

Calculate Total PCIB: Create another custom number field, "PCIB," and use a formula to sum the values across all cost category fields. The formula might look something like this (adjust field names as needed):

[DirectLaborCost] + [MaterialCost] + [OverheadCost] + [ContingencyReserves] + [LongTermOperationalCosts] -

Tracking and Reporting: Use MS Project's reporting features to generate charts and tables showing the PCIB, allowing for easy comparison with actual costs (tracked through the standard cost fields in MS Project) as the project progresses.

Method 2: Leveraging External Spreadsheets

-

Detailed Cost Breakdown: Create a detailed spreadsheet listing all anticipated project costs, categorized as outlined in Method 1. This spreadsheet should be comprehensive and include all potential expenses.

-

Import Data into MS Project: While you can't directly import calculated PCIB, you can import individual cost categories into custom fields created in MS Project (as described in Method 1).

-

Link Spreadsheet to MS Project (Advanced): For more advanced users, it's possible to link the spreadsheet directly to MS Project using VBA (Visual Basic for Applications) scripting. This allows for real-time updates in the MS Project fields based on changes in the spreadsheet. However, this approach requires significant programming expertise.

-

Manual Calculation and Updates: If a direct link isn't feasible, manually update the PCIB value in MS Project based on the total from your spreadsheet as the project evolves.

Monitoring and Analyzing PCIB in MS Project

Once you have implemented your chosen method for calculating PCIB, regularly monitor and analyze the data to track your project's financial performance:

-

Cost Variance Analysis: Compare actual costs (AC) against the PCIB. A positive variance indicates cost overruns, while a negative variance suggests cost savings.

-

Schedule Variance Analysis: While PCIB doesn't directly relate to schedule, analyzing schedule variances can indirectly impact cost performance. Delays might lead to increased costs.

-

Regular Reporting: Generate regular reports summarizing PCIB, actual costs, and cost variances. Visual aids like charts and graphs can effectively communicate this information to stakeholders.

-

Proactive Mitigation: If significant cost variances arise, proactively investigate the causes and implement appropriate corrective actions to mitigate further deviations.

Advanced Techniques and Considerations

-

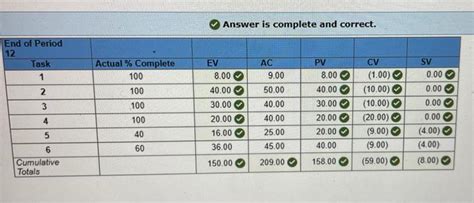

Earned Value Management (EVM): Integrate PCIB into your EVM system. By comparing EV (Earned Value), PV (Planned Value), and AC (Actual Cost), you can gain a more nuanced understanding of your project's performance against the initial investment plan.

-

Risk Management: Incorporate potential risks and their financial impacts into the PCIB calculation. This might involve creating contingency reserves for potential cost overruns.

-

Software Integrations: Explore integrations with other financial management software to streamline the process of data entry and reporting.

Conclusion: Mastering PCIB for Effective Project Financial Control

Calculating and tracking PCIB within MS Project, although not a direct function, is achievable through careful planning, custom field utilization, and potentially external spreadsheet integration. By implementing these strategies, you gain the necessary insights to effectively manage your project's financial performance, enhance stakeholder communication, and improve overall project success. Remember to continuously monitor, analyze, and adapt your approach based on evolving project needs and circumstances. Through meticulous planning and diligent tracking of your PCIB, you’ll be well-equipped to navigate the financial landscape of your projects and achieve your desired outcomes.

Latest Posts

Latest Posts

-

Which Statement Best Defines What Compatibility Is

Mar 15, 2025

-

Triangle Congruence Review Maze Answer Key

Mar 15, 2025

-

You Arrive At The Scene Of An Apparent Death

Mar 15, 2025

-

All Of The Following Are Guidelines For Expressing Emotions Except

Mar 15, 2025

-

The Masque Of The Red Death Quotes

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Can You Calculate Pcib In Ms Project . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.