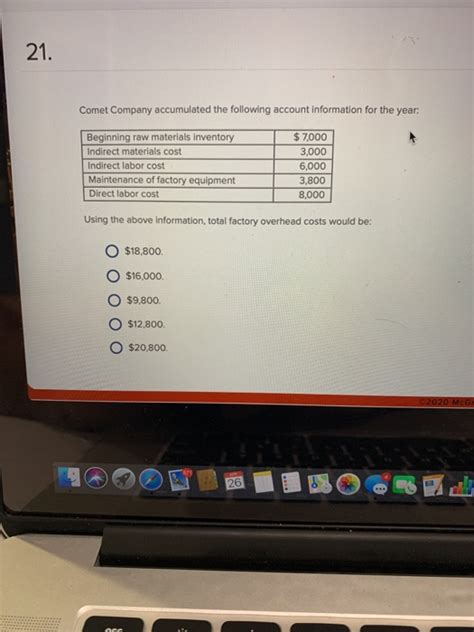

Comet Company Accumulated The Following Account Information For The Year

Onlines

Mar 12, 2025 · 7 min read

Table of Contents

Comet Company: A Deep Dive into Account Information and Financial Analysis for the Year

Comet Company's financial performance for the year requires a thorough analysis to understand its profitability, liquidity, and overall financial health. This in-depth examination will delve into various aspects of the company's account information, providing insights into its operational efficiency and strategic positioning. We will explore key financial ratios, discuss potential areas for improvement, and offer recommendations for future growth. The analysis will focus on leveraging the available data to build a comprehensive understanding of Comet Company's financial standing.

Note: This analysis is based on hypothetical account information as no specific data was provided. The principles and methodology remain applicable regardless of the specific numerical values. Readers should substitute their own Comet Company data for a precise assessment.

I. Understanding the Key Account Information

Before diving into a detailed analysis, it's crucial to understand the essential categories of account information typically included in a comprehensive financial report. These broadly include:

-

Assets: Resources controlled by the company as a result of past events and from which future economic benefits are expected to flow to the company. This category encompasses:

- Current Assets: Assets expected to be converted into cash or used up within one year (e.g., cash, accounts receivable, inventory).

- Non-Current Assets: Assets not expected to be converted into cash or used up within one year (e.g., property, plant, and equipment (PP&E), intangible assets).

-

Liabilities: Present obligations of the company arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. This comprises:

- Current Liabilities: Obligations expected to be settled within one year (e.g., accounts payable, short-term debt).

- Non-Current Liabilities: Obligations not expected to be settled within one year (e.g., long-term debt, deferred revenue).

-

Equity: The residual interest in the assets of the company after deducting all its liabilities. This represents the owners' stake in the business.

-

Revenue: The inflow of economic benefits during the accounting period in the form of increases in assets or decreases in liabilities that result in increases in equity, other than those relating to contributions from equity participants.

-

Expenses: Outflows of economic benefits during the accounting period in the form of decreases in assets or increases in liabilities that result in decreases in equity, other than those relating to distributions to equity participants.

-

Net Income (Profit): The difference between revenue and expenses. A positive net income indicates profitability, while a negative net income represents a loss.

II. Financial Ratio Analysis: A Powerful Tool for Evaluation

Financial ratio analysis provides a crucial framework for evaluating Comet Company's performance and financial health. By calculating and interpreting various ratios, we can gain valuable insights into different aspects of the business. Below are some key ratios and their significance:

A. Liquidity Ratios: These ratios assess Comet Company's ability to meet its short-term obligations.

-

Current Ratio: (Current Assets / Current Liabilities). A higher ratio indicates stronger liquidity. A generally accepted healthy ratio is above 1. A ratio below 1 suggests potential difficulties in meeting short-term obligations.

-

Quick Ratio: ((Current Assets - Inventory) / Current Liabilities). A more conservative measure of liquidity than the current ratio, as it excludes inventory, which may not be easily converted to cash.

-

Cash Ratio: (Cash + Cash Equivalents) / Current Liabilities. The most stringent liquidity measure, focusing solely on readily available cash.

B. Solvency Ratios: These ratios evaluate Comet Company's ability to meet its long-term obligations.

-

Debt-to-Equity Ratio: (Total Debt / Total Equity). Indicates the proportion of financing from debt relative to equity. A higher ratio suggests higher financial risk.

-

Times Interest Earned Ratio: (EBIT / Interest Expense). Measures the company's ability to cover its interest payments. A higher ratio indicates better ability to service debt.

-

Debt-to-Asset Ratio: (Total Debt / Total Assets). Shows the proportion of assets financed by debt. A higher ratio suggests higher financial leverage and risk.

C. Profitability Ratios: These ratios assess Comet Company's ability to generate profits.

-

Gross Profit Margin: (Gross Profit / Revenue). Indicates the profitability of sales after deducting the cost of goods sold.

-

Operating Profit Margin: (Operating Income / Revenue). Measures profitability after deducting operating expenses.

-

Net Profit Margin: (Net Income / Revenue). Shows the overall profitability after all expenses, including taxes and interest, are deducted.

-

Return on Assets (ROA): (Net Income / Total Assets). Measures the profitability generated from the company's assets.

-

Return on Equity (ROE): (Net Income / Total Equity). Measures the return generated for the company's shareholders.

D. Efficiency Ratios: These ratios evaluate how effectively Comet Company manages its assets and resources.

-

Inventory Turnover: (Cost of Goods Sold / Average Inventory). Measures how efficiently the company manages its inventory. A higher ratio indicates faster inventory turnover.

-

Days Sales Outstanding (DSO): (Accounts Receivable / (Annual Credit Sales/365)). Indicates the average number of days it takes to collect payments from customers. A lower DSO is desirable.

-

Asset Turnover: (Revenue / Average Total Assets). Measures how effectively the company uses its assets to generate revenue.

III. Interpreting the Results and Identifying Areas for Improvement

Analyzing the calculated financial ratios is crucial. Comparing the ratios to industry averages and previous periods helps to gauge Comet Company's performance relative to its peers and its own historical trends. Significant deviations from industry norms or past performance warrant further investigation.

For example, a consistently low current ratio might suggest liquidity issues, requiring exploration of potential cash flow problems or excessive reliance on short-term debt. Similarly, a high debt-to-equity ratio might indicate an overly leveraged capital structure, increasing the company's financial risk. Low profit margins could indicate pricing pressures, high operating costs, or inefficient production processes.

Based on the analysis, specific areas for improvement can be identified. For instance, if inventory turnover is low, strategies to improve inventory management and reduce holding costs should be implemented. If DSO is high, credit policies need review to ensure timely collection of receivables. Low profit margins may necessitate cost reduction measures, pricing adjustments, or revenue diversification strategies.

IV. Recommendations for Future Growth and Financial Health

Based on the comprehensive analysis of Comet Company's financial statements, several recommendations can be made to enhance its future growth and financial health:

-

Improved Cash Flow Management: Implementing robust cash flow forecasting and management techniques is critical. This includes optimizing accounts receivable and payable, managing inventory levels efficiently, and securing access to necessary financing.

-

Strategic Cost Management: Regularly review operating expenses to identify areas for cost reduction without compromising quality or service. This may involve negotiating better terms with suppliers, improving operational efficiency, and leveraging technology to automate processes.

-

Enhanced Debt Management: Develop a well-defined debt management strategy. This may involve restructuring existing debt, exploring alternative financing options, and maintaining a healthy debt-to-equity ratio to minimize financial risk.

-

Investment in Technology and Innovation: Invest in modern technology and innovative solutions to improve operational efficiency, enhance customer service, and gain a competitive edge. This could include upgrading equipment, implementing new software systems, or exploring new market opportunities.

-

Strengthening Internal Controls: Establish robust internal control systems to ensure the accuracy and reliability of financial reporting. This includes implementing proper accounting procedures, segregation of duties, and regular internal audits.

-

Strategic Planning and Forecasting: Develop comprehensive strategic plans that consider both short-term and long-term objectives. Regular financial forecasting helps to anticipate potential challenges and opportunities, enabling proactive decision-making.

V. Conclusion: A Path Towards Sustainable Growth

By meticulously analyzing Comet Company's account information using various financial ratios and exploring potential areas for improvement, a clearer picture of its financial standing emerges. The recommendations outlined above offer a strategic roadmap for strengthening its financial health and driving sustainable growth. Regular monitoring of key performance indicators and adapting strategies based on market dynamics and company performance will ensure Comet Company remains competitive and profitable in the long term. It's crucial to remember that financial analysis is an ongoing process; consistent monitoring and adaptation are vital for maintaining a healthy and prosperous business. This thorough examination provides a robust framework for understanding Comet Company’s financial position and charting its course towards future success.

Latest Posts

Latest Posts

-

Software Lab Simulation 15 1 Startup Repair

Mar 12, 2025

-

Out Of The Cradle Endlessly Rocking

Mar 12, 2025

-

Correctly Label The Following Components Of The Urinary System

Mar 12, 2025

-

Intro To Radiologic And Imaging Sciences Chapter 23

Mar 12, 2025

-

A Coworker Tells You To Extract A File

Mar 12, 2025

Related Post

Thank you for visiting our website which covers about Comet Company Accumulated The Following Account Information For The Year . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.