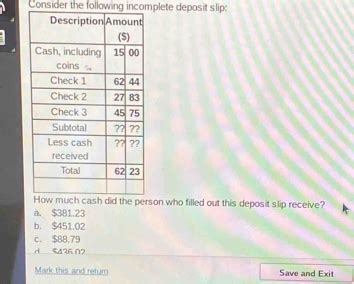

Consider The Following Incomplete Deposit Ticket

Onlines

Mar 27, 2025 · 6 min read

Table of Contents

Decoding the Incomplete Deposit Ticket: A Comprehensive Guide for Accurate Record Keeping

An incomplete deposit ticket is a recipe for disaster. It can lead to discrepancies, delays, and even disputes regarding your financial transactions. Accurate record-keeping is paramount, especially when dealing with financial matters. This article delves deep into the critical aspects of deposit tickets, exploring the potential problems arising from incomplete information and offering practical solutions for ensuring accuracy and avoiding costly mistakes. We'll analyze different types of deposit tickets, common errors, and best practices for completing them correctly.

Understanding the Purpose of a Deposit Ticket

A deposit ticket, also known as a deposit slip, acts as a formal record of a financial transaction where funds are deposited into a bank account. It serves as a crucial link between the depositor and the financial institution, providing vital information for both parties. The ticket acts as a receipt for your deposit and contains essential details used by the bank to process the transaction accurately and efficiently. The information on the ticket helps ensure that the funds are credited to the correct account and that a comprehensive audit trail is maintained.

Essential Elements of a Complete Deposit Ticket

A complete and accurate deposit ticket must contain several key pieces of information. Missing even one critical piece of information can lead to complications and delays in processing your deposit. These crucial elements include:

-

Account Number: This is arguably the most critical piece of information. The account number uniquely identifies your specific bank account. Without this, the bank cannot credit the deposit to the correct account. Double-check this number meticulously; even a single digit error can result in a significant delay.

-

Date of Deposit: This specifies the date the deposit is made. It's crucial for accurate record-keeping and reconciliation of financial transactions. Using the correct date is essential for tracking your financial activities and ensuring accurate financial reporting.

-

Depositor's Name: The name of the person or entity making the deposit should be clearly stated. This helps the bank verify the identity of the depositor and ensures that the deposit is made to the right individual or organization.

-

Amount of Deposit: This represents the total amount being deposited. This amount must be clearly indicated in both numeric and written formats to reduce the risk of errors during processing. Any discrepancies between the numerical and written amounts will lead to a delay in processing, requiring investigation and clarification.

-

Type of Deposit: This specifies the nature of the deposit, indicating whether it includes cash, checks, or a combination of both. This allows for proper processing and accountability of the various deposit items. Different types of deposits might have additional requirements or verification steps.

-

Check Details (if applicable): If checks are included in the deposit, the ticket needs to contain the following details for each check: check number, bank name, and amount. Providing this information allows for efficient tracking and processing of the checks. Missing check details can cause delays or even rejection of the deposit.

-

Signature: The depositor’s signature authenticates the deposit. This verifies the depositor’s intent and accountability for the transaction. A missing signature can cause the deposit to be rejected.

-

Currency: Always specify the currency of the deposit; this is especially crucial in international transactions. A clear indication of the currency avoids misunderstandings and delays in processing.

Common Errors in Deposit Tickets and Their Consequences

Several common errors can render a deposit ticket incomplete and potentially cause problems. These include:

-

Incorrect Account Number: This is perhaps the most frequent and damaging error. It can lead to the deposit being credited to the wrong account, causing significant financial problems for both the depositor and the recipient.

-

Missing or Incorrect Date: This can create inconsistencies in financial records and make reconciliation challenging. It can also complicate the audit trail and complicate the process of tracking your transactions.

-

Discrepancies between Written and Numeric Amounts: This immediately flags a potential error and necessitates further investigation and verification by the bank, leading to delays in processing the deposit.

-

Missing Check Details: Incomplete information about checks included in the deposit can cause processing delays and potentially even lead to the rejection of the entire deposit.

-

Missing or Illegible Signature: Without a proper signature, the bank might refuse the deposit, requiring the depositor to return and correct the omission.

Best Practices for Completing Deposit Tickets

To avoid the pitfalls of incomplete or inaccurate deposit tickets, adhering to these best practices is recommended:

-

Double-check all information: Carefully verify each piece of information on the deposit ticket before submitting it to the bank. A small mistake can have significant consequences.

-

Use a pen, not pencil: Ensure the information is clear, legible, and permanent; pencil entries can smudge or fade, making the information difficult to read.

-

Keep a copy of the deposit ticket: Maintain a personal record of the deposit ticket for your own accounting and reconciliation purposes.

-

Understand the bank’s requirements: Be aware of any specific requirements or guidelines your bank might have regarding deposit tickets.

-

Use the correct deposit ticket: Different banks may have different deposit tickets for various account types. Use the appropriate ticket to avoid confusion and processing issues.

-

Maintain organized records: Keep your deposit tickets in a safe place, well-organized and easily accessible. This ensures efficient tracking and convenient access to crucial financial documentation when needed.

Types of Deposit Tickets

Deposit tickets vary depending on the financial institution and the type of account. While the core information remains consistent, some variations exist:

-

Standard Deposit Ticket: This is the most common type used for depositing cash and checks into regular checking and savings accounts.

-

Mobile Deposit Ticket: Many banks offer mobile deposit services, eliminating the need for physical deposit tickets. However, the information requirements remain similar.

-

Business Deposit Ticket: Businesses often use specialized deposit tickets that accommodate larger deposits and multiple checks, usually requiring more detailed information.

Advanced Considerations: Electronic Deposits and Reconciliation

The rise of electronic banking has significantly changed how deposits are made. Online banking and mobile apps often automate the deposit process, minimizing the use of physical deposit tickets. However, even with electronic deposits, it is crucial to review and reconcile the electronic records to ensure accuracy and identify any potential errors. Maintaining clear and detailed records, whether physical or electronic, remains a vital aspect of managing your finances efficiently. Regular reconciliation ensures that your bank statements match your internal records, identifying any discrepancies promptly.

The Importance of Accuracy and Prevention of Fraud

Accuracy in completing deposit tickets is not just about smooth transactions; it also plays a crucial role in fraud prevention. Incomplete or inaccurate information can create loopholes that fraudulent individuals might exploit. By ensuring all information is accurate and complete, you significantly reduce the risk of fraud and protect your financial assets. This careful attention to detail significantly improves the overall security of your financial transactions.

Conclusion: Mastering Deposit Ticket Accuracy

In conclusion, a thorough understanding of deposit tickets and the importance of accuracy in completing them is crucial for anyone managing their finances. Paying close attention to detail and following the best practices outlined in this article can prevent costly errors, delays, and potential disputes. While technology has streamlined the deposit process, the need for accurate record-keeping and attention to detail remains paramount. Proactive measures and meticulous attention to detail can significantly reduce the risk of encountering problems and ensure smooth and accurate financial transactions. Accurate and complete deposit tickets contribute to efficient financial management, accurate record-keeping, and enhanced security.

Latest Posts

Latest Posts

-

The Operating Principle Of Float Type Carburetors Is Based On The

Mar 31, 2025

-

Cellular Respiration Escape Room Answer Key

Mar 31, 2025

-

What Are Larger Data Rooms Also Known As

Mar 31, 2025

-

What Statement Regarding Ethical Climates Is True

Mar 31, 2025

-

Summary Of The Short Story A And P

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Consider The Following Incomplete Deposit Ticket . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.