Manager Must Not Interpert Variances In Isolation From Each Other

Onlines

Mar 03, 2025 · 6 min read

Table of Contents

Managers Must Not Interpret Variances in Isolation From Each Other

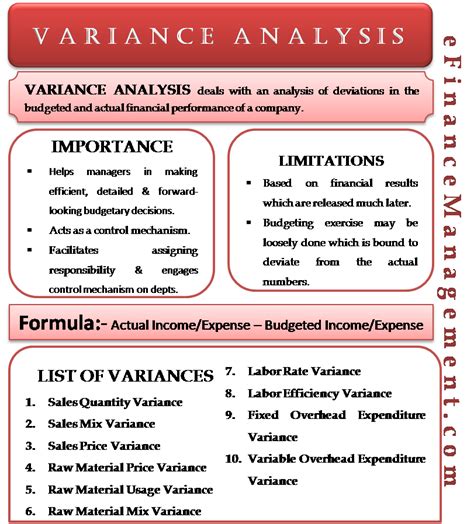

Analyzing variances is a crucial aspect of managerial accounting. It provides valuable insights into a company's performance, allowing managers to identify areas for improvement and make data-driven decisions. However, a common mistake is interpreting variances in isolation. This approach can lead to inaccurate conclusions and ineffective corrective actions. Effective variance analysis requires a holistic view, considering the interconnectedness of different variances and the underlying business context. This article explores why managers must avoid interpreting variances in isolation and provides a framework for a more comprehensive and insightful analysis.

The Pitfalls of Isolated Variance Analysis

Interpreting variances in isolation means looking at each variance independently, without considering how it might relate to or be influenced by other variances. This approach is fraught with potential errors:

1. Misleading Conclusions:

Consider a scenario where sales volume is lower than budgeted, resulting in a negative sales volume variance. A manager focusing solely on this variance might conclude that weak marketing or poor product demand is the culprit. However, if a simultaneous analysis reveals a significant unfavorable materials price variance and a favorable labor rate variance, the picture changes. The lower sales volume might be a consequence of higher prices, forcing customers to reduce purchases. The favorable labor rate variance, achieved through reduced staffing, could also have negatively impacted sales volume through a decline in customer service. Analyzing these variances in isolation masks the underlying cause-and-effect relationships.

2. Ineffective Corrective Actions:

Acting on isolated variances can lead to ineffective or even counterproductive actions. For instance, focusing solely on an unfavorable labor efficiency variance might lead to a decision to reduce staff or implement stricter timekeeping measures. However, if an unfavorable materials price variance is also present, perhaps due to a supplier issue, this action might be inappropriate. Addressing the supplier problem could improve materials cost and, in turn, improve labor efficiency by reducing wasted time and effort. Addressing the issue from an isolated variance perspective could lead to short-sighted solutions.

3. Ignoring Synergistic Effects:

Variances rarely occur in a vacuum. They often interact and influence each other. For example, a favorable price variance for raw materials might be offset by an unfavorable materials yield variance if the cheaper materials are of inferior quality and lead to higher waste. Ignoring these synergistic effects prevents a complete understanding of the underlying issues.

4. Overlooking Systemic Problems:

Analyzing variances in isolation prevents the identification of systemic problems affecting multiple areas of the business. For example, a poor overall market performance might lead to unfavorable variances in multiple areas—sales volume, sales price, and perhaps even production efficiency—that are only connected in a systemic manner. By focusing on individual variances without the broader picture, the manager fails to recognize and address the systemic issues at play.

A Holistic Approach to Variance Analysis

A more effective approach involves analyzing variances holistically, considering their interrelationships and the broader context. This requires a multi-faceted strategy:

1. Simultaneous Analysis of Multiple Variances:

Managers must analyze multiple variances simultaneously to identify potential relationships and causal links. This involves examining variances from different areas of the business—sales, production, materials, labor, overhead—to understand the interconnectedness of performance across departments. For example, a significant unfavorable direct materials price variance should prompt an examination of labor and production variances to see if it impacts them.

2. Understanding the Underlying Business Context:

Variances should not be interpreted in isolation from the broader business environment. Economic conditions, competitor actions, changes in customer demand, and technological advancements can all influence performance and contribute to variances. A deep understanding of the business context is crucial to accurately interpret the variances' significance and develop effective responses. This also involves analyzing market research, industry trends, and competitive analysis to identify external factors that may have influenced the variances.

3. Using a Variance Analysis Framework:

A structured variance analysis framework is essential for a comprehensive and organized approach. This framework should include the following steps:

- Define Objectives: Clearly define the objectives of the analysis and identify the key performance indicators (KPIs) to be tracked.

- Establish Budgets: Develop realistic and achievable budgets for different aspects of the business.

- Collect Data: Gather accurate and reliable data on actual performance.

- Calculate Variances: Calculate the difference between budgeted and actual results for each KPI.

- Analyze Variances: Analyze the variances in a holistic manner, considering the interrelationships between different variances and the underlying business context.

- Identify Root Causes: Investigate the root causes of significant variances. This requires a combination of qualitative and quantitative analysis.

- Develop Corrective Actions: Develop appropriate corrective actions based on the identified root causes.

- Monitor and Review: Regularly monitor and review the effectiveness of corrective actions.

4. Employing Advanced Analytical Techniques:

Advanced analytical techniques, such as regression analysis and data mining, can reveal complex relationships between variances that are not readily apparent through simple visual inspection. These methods enable more precise identification of causal factors and development of targeted corrective strategies.

Case Study: Illustrating the Importance of Holistic Analysis

Let's consider a manufacturing company that experiences an unfavorable sales volume variance. Analyzing it in isolation might lead to conclusions about insufficient marketing efforts. However, a holistic analysis reveals the following:

- Unfavorable Sales Volume Variance: Sales were significantly below budget.

- Unfavorable Materials Price Variance: The cost of raw materials increased unexpectedly due to supply chain disruptions.

- Unfavorable Labor Rate Variance: Wage increases led to higher labor costs.

- Favorable Labor Efficiency Variance: Improved production processes resulted in higher output per labor hour.

An isolated analysis might lead to increased marketing spending. However, a holistic analysis reveals that the primary issue is the significant increase in materials and labor costs. Increased marketing might marginally improve sales but would not address the core profitability problem. The effective response would be to renegotiate contracts with suppliers, explore alternative material sources, and potentially re-engineer products to use less expensive materials. Addressing the fundamental cost issues will improve profitability and long-term sustainability.

Beyond Financial Variances: Expanding the Scope

The principle of holistic analysis extends beyond purely financial variances. It's critical to consider operational, customer satisfaction, and even employee satisfaction metrics. For example, an increase in customer complaints might be linked to a decline in product quality, which could be traced back to issues in production efficiency or materials quality.

Conclusion: Embracing a Systems Thinking Approach

Interpreting variances in isolation is a recipe for inaccurate conclusions and ineffective actions. A comprehensive approach demands simultaneous analysis of multiple variances, considering the business context, employing a structured framework, and using advanced analytical techniques. The key is to move beyond simple variance calculations and embrace a systems thinking approach, recognizing the interconnectedness of various business processes and the intricate interplay of different factors. This holistic analysis empowers managers to make more informed decisions, improve operational efficiency, and achieve sustainable business growth. By taking this broader perspective, organizations can transform variance analysis from a simple compliance exercise into a powerful tool for strategic decision-making and continuous improvement.

Latest Posts

Latest Posts

-

To Determine The Purpose Of Your Message You First Need

Mar 04, 2025

-

Where Are You Permitted To Use Classified Data

Mar 04, 2025

-

The Following Inforamtion Pertain To Amigo Corp

Mar 04, 2025

-

Steven Roberts Mental Health Counselor Oregon Npi Number

Mar 04, 2025

-

Which Of The Following Accurately Describes Metadata

Mar 04, 2025

Related Post

Thank you for visiting our website which covers about Manager Must Not Interpert Variances In Isolation From Each Other . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.