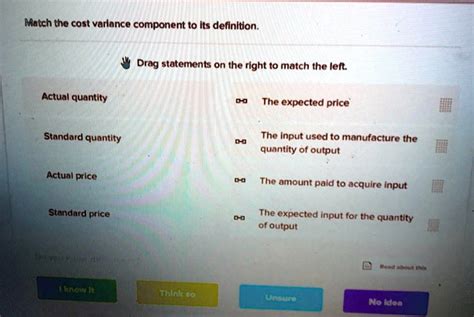

Match The Cost Variance Component To Its Definition.

Onlines

Mar 12, 2025 · 7 min read

Table of Contents

Match the Cost Variance Component to its Definition: A Comprehensive Guide

Understanding cost variances is crucial for effective cost management and profitability. This guide delves into the various components of cost variance, providing clear definitions and illustrating their application. Mastering this knowledge allows businesses to pinpoint areas for improvement, enhance operational efficiency, and ultimately boost their bottom line.

What is Cost Variance?

Cost variance is the difference between the actual cost incurred and the planned or budgeted cost for a specific activity, project, or product. It's a key performance indicator (KPI) used to measure the effectiveness of cost control within an organization. Analyzing cost variances helps identify deviations from the budget, allowing for corrective action and improved future planning. A positive variance indicates that costs are lower than expected (favorable), while a negative variance signifies higher-than-expected costs (unfavorable).

Key Components of Cost Variance: A Detailed Breakdown

Cost variances are often categorized into several key components, each offering insights into specific areas of cost deviation. These components provide a granular view, enabling precise identification of the root causes behind cost overruns or underspends. Here's a breakdown of the major components:

1. Direct Material Variance

This variance focuses on the difference between the actual cost of direct materials used and the standard cost of those materials. It's further broken down into two primary components:

-

Material Price Variance: This measures the difference in cost due to variations in the price paid for the materials compared to the standard or budgeted price. Formula: (Actual Price - Standard Price) x Actual Quantity. A positive variance indicates a lower-than-expected price, while a negative variance indicates a higher price.

-

Material Usage Variance: This component quantifies the difference in cost stemming from variations in the quantity of materials used compared to the standard quantity allowed for the actual production output. Formula: (Actual Quantity - Standard Quantity) x Standard Price. A positive variance suggests less material was used than expected, while a negative variance indicates excessive material usage.

Example: A furniture manufacturer budgeted for $10/unit for wood (standard price) and planned to use 5 units per chair (standard quantity). However, they purchased wood at $12/unit (actual price) and used 6 units per chair (actual quantity).

- Material Price Variance: ($12 - $10) x (6 units x number of chairs produced) = Unfavorable Variance

- Material Usage Variance: (6 - 5) x ($10 x number of chairs produced) = Unfavorable Variance

Analyzing these variances separately helps pinpoint whether the cost overrun was due to expensive materials or inefficient material usage.

2. Direct Labor Variance

Similar to material variance, direct labor variance examines the difference between the actual direct labor cost and the standard direct labor cost. It is also decomposed into two main components:

-

Labor Rate Variance: This measures the difference in cost stemming from variations in the actual hourly wage rate paid compared to the standard or budgeted hourly rate. Formula: (Actual Rate - Standard Rate) x Actual Hours. A positive variance shows a lower-than-expected labor rate, while a negative variance reflects higher labor rates.

-

Labor Efficiency Variance: This component measures the difference in cost due to variations in the actual labor hours worked compared to the standard labor hours allowed for the actual production output. Formula: (Actual Hours - Standard Hours) x Standard Rate. A positive variance indicates fewer hours were worked than expected, while a negative variance points to more hours worked than anticipated.

Example: A construction company budgeted for a labor rate of $25/hour (standard rate) and planned for 100 hours (standard hours) for a specific task. However, they paid $30/hour (actual rate) and the task took 120 hours (actual hours).

- Labor Rate Variance: ($30 - $25) x 120 hours = Unfavorable Variance

- Labor Efficiency Variance: (120 - 100) x $25/hour = Unfavorable Variance

3. Variable Overhead Variance

Variable overhead costs fluctuate with production volume. The variance here compares the actual variable overhead costs to the standard or budgeted variable overhead costs. It's typically broken down into:

-

Variable Overhead Spending Variance: This measures the difference between the actual variable overhead costs and the budgeted variable overhead costs based on the actual production volume. Formula: Actual Variable Overhead - (Standard Variable Overhead Rate x Actual Hours). A positive variance means lower-than-expected costs, while a negative variance indicates higher costs.

-

Variable Overhead Efficiency Variance: This component assesses the difference in variable overhead costs arising from variations in the actual production volume (or activity level) compared to the standard or budgeted production volume. Formula: (Actual Hours - Standard Hours) x Standard Variable Overhead Rate. A positive variance implies lower activity than expected, while a negative variance suggests higher activity than anticipated.

4. Fixed Overhead Variance

Fixed overhead costs remain relatively constant regardless of production volume. The variance analysis here contrasts actual fixed overhead costs with budgeted fixed overhead costs. This is often broken down into:

-

Fixed Overhead Budget Variance: This measures the difference between the actual fixed overhead costs incurred and the budgeted fixed overhead costs. Formula: Actual Fixed Overhead - Budgeted Fixed Overhead. A positive variance represents lower-than-expected costs, while a negative variance shows higher costs.

-

Fixed Overhead Volume Variance: This component assesses the difference between the budgeted fixed overhead costs and the applied fixed overhead costs. The applied fixed overhead is based on the actual production volume and the predetermined fixed overhead rate. This variance reflects the impact of production volume on fixed overhead absorption. Formula: Budgeted Fixed Overhead - Applied Fixed Overhead. A positive variance is favorable, while a negative variance is unfavorable.

5. Sales Price Variance

This variance analyzes the difference between the actual selling price achieved and the standard or budgeted selling price. It is calculated as:

Formula: (Actual Selling Price - Standard Selling Price) x Actual Sales Quantity. A positive variance indicates higher prices than anticipated, while a negative variance reflects lower prices than expected.

6. Sales Volume Variance

This variance examines the difference in revenue due to variations in actual sales volume compared to the planned sales volume. It’s crucial to understand the impact of sales volume on profitability. It’s calculated as:

Formula: (Actual Sales Quantity - Standard Sales Quantity) x Standard Selling Price. A positive variance reflects higher sales than expected, while a negative variance indicates lower sales than anticipated.

Analyzing and Interpreting Cost Variances

Analyzing cost variances isn't merely about calculating the numerical differences; it's about understanding the underlying reasons for those differences. A thorough investigation is required to identify the root causes of both favorable and unfavorable variances. This investigation frequently involves:

- Investigating Material Price Variances: Analyzing market conditions, supplier relationships, and purchasing strategies.

- Investigating Material Usage Variances: Examining production processes, material handling, and quality control procedures.

- Investigating Labor Rate Variances: Reviewing wage rates, employee skills, and union negotiations.

- Investigating Labor Efficiency Variances: Evaluating production processes, employee training, machine efficiency, and work scheduling.

- Investigating Overhead Variances: Reviewing cost allocation methods, production efficiency, and fixed cost control.

Effective variance analysis requires a systematic approach. This often involves:

- Collection of Accurate Data: Ensure data accuracy from various sources (production, accounting, purchasing).

- Comparison to Standards: Compare actual results to pre-determined standards or budgets.

- Identification of Significant Variances: Focus on the most significant variances that materially impact profitability.

- Investigation of Root Causes: Conduct thorough investigations to determine the underlying reasons behind the variances.

- Corrective Actions: Implement corrective actions to prevent similar variances from recurring in the future.

- Reporting and Communication: Clearly communicate the findings and recommended actions to relevant stakeholders.

Using Cost Variance Analysis for Improved Decision Making

Cost variance analysis is a valuable tool for improved decision making in various aspects of business operations:

- Production Planning: Identify inefficiencies in production processes and improve resource allocation.

- Pricing Strategies: Adjust pricing based on changes in material costs or labor rates.

- Supplier Selection: Evaluate supplier performance and negotiate better prices.

- Process Improvement: Identify areas for process optimization to reduce costs.

- Performance Evaluation: Assess the performance of different departments or individuals.

- Budgeting and Forecasting: Improve the accuracy of future budgets and forecasts based on past performance.

Conclusion

Understanding and effectively utilizing cost variance analysis is a cornerstone of effective cost management. By meticulously tracking, analyzing, and interpreting the various components of cost variances, businesses can gain crucial insights into their operational efficiency, identify areas for improvement, enhance profitability, and ultimately, achieve sustainable growth. The detailed breakdown and illustrative examples provided in this comprehensive guide will equip you with the knowledge to effectively analyze cost variances and make data-driven decisions that will contribute to a healthier bottom line. Remember that consistent application of this knowledge, combined with continuous monitoring and improvement, will lead to a more robust and profitable business model.

Latest Posts

Latest Posts

-

Hesi Case Studies Heart Failure With Atrial Fibrillation

Mar 13, 2025

-

4 04 Quiz Buying Clothes And Shopping 2

Mar 13, 2025

-

Traffic School Questions And Answers Pdf

Mar 13, 2025

-

1 7 Infinite Limits And Limits At Infinity Homework

Mar 13, 2025

-

Europe Crack The Code Answer Key

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about Match The Cost Variance Component To Its Definition. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.