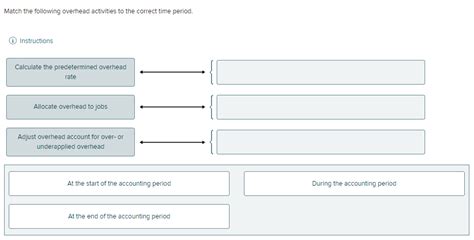

Match The Following Overhead Activities To The Correct Time Period.

Onlines

Mar 14, 2025 · 6 min read

Table of Contents

Match the Following Overhead Activities to the Correct Time Period: A Comprehensive Guide

Understanding overhead activities and their allocation across different time periods is crucial for accurate financial reporting, effective cost management, and informed decision-making. This comprehensive guide will delve into various overhead activities and match them to their appropriate timeframes, providing a clear understanding of their impact on business operations. We'll explore the nuances of different accounting periods, the importance of accurate allocation, and strategies for optimizing overhead management.

Understanding Overhead Activities

Before matching activities to specific time periods, let's define what constitutes an overhead activity. Overhead activities are indirect costs that support the overall operation of a business but aren't directly traceable to specific products or services. These costs are essential for the business to function but are not directly involved in the production process itself. Examples include:

Common Overhead Activities and Their Timeframes:

-

Rent: Typically allocated monthly or annually, depending on the lease agreement. This is a recurring cost that remains relatively consistent over time unless the lease terms change. Monthly allocation is generally preferred for better cost control and reporting.

-

Salaries of Administrative Staff: These salaries are usually expensed monthly, reflecting the regular payroll cycle. Accurate tracking of hours worked and salaries is crucial for proper monthly allocation.

-

Utilities (Electricity, Water, Gas): These costs are often billed monthly and should be allocated accordingly. Fluctuations in utility costs should be monitored and anticipated for accurate budgeting.

-

Depreciation of Fixed Assets: This is a non-cash expense that spreads the cost of an asset over its useful life. Depreciation is usually calculated and allocated annually or monthly using various methods such as straight-line or accelerated depreciation. Understanding the chosen depreciation method is vital for accurate financial reporting.

-

Insurance Premiums: These premiums are usually paid annually or semi-annually and allocated accordingly. Prudent planning and accurate allocation ensure consistent coverage and cost management.

-

Property Taxes: Typically paid annually, these taxes are usually accrued monthly to reflect the ongoing expense throughout the year. Consistent monthly accrual ensures accurate financial reporting and smoother cash flow.

-

Maintenance and Repairs: These costs are often unpredictable and can occur at any time. While they might be initially recorded when the expense is incurred, their impact on the overall budget and profitability is better understood when analyzed across longer periods, such as quarterly or annually. Careful tracking and categorization of maintenance and repair expenses are critical for effective cost control and future planning.

-

Marketing and Advertising: These expenses can be incurred at various times depending on campaigns and strategies. Allocation can be monthly, quarterly, or annually, depending on the nature and timing of the campaigns. A detailed breakdown of marketing and advertising spending by campaign, channel, and time period is essential for performance measurement and ROI analysis.

-

Research and Development: R&D expenses are often spread over multiple periods, sometimes spanning several years. Accurate allocation requires careful tracking and may necessitate the use of specific accounting methods to match expenses to the periods they benefit. Proper allocation and reporting of R&D expenses are critical for compliance and accurate financial reporting.

-

Professional Fees (Legal, Consulting): These fees are incurred as needed and are typically allocated to the period in which the services are rendered. Careful documentation of the services provided and their corresponding costs is crucial for accurate allocation.

-

Travel and Entertainment: These expenses can fluctuate widely and are typically allocated to the period in which they are incurred. Careful expense tracking and reporting are critical for managing costs and ensuring compliance with company policies.

Matching Overhead Activities to Accounting Periods

The time period to which an overhead activity is allocated depends largely on the company's accounting cycle and the nature of the activity itself. Common accounting periods include:

-

Monthly: This is the most common period for many overhead activities, offering frequent monitoring and control. Monthly allocation provides timely insights into cost performance and allows for quicker adjustments if needed.

-

Quarterly: This period is suitable for summarizing and analyzing trends in overhead costs. Quarterly reporting provides a broader perspective than monthly reporting, enabling better identification of seasonal patterns or longer-term trends.

-

Annually: Annual allocation is typical for activities with fixed costs or those that are not easily broken down into smaller periods, such as annual insurance premiums or property taxes. Annual reporting provides a holistic view of the year's performance and is necessary for tax purposes.

Choosing the Right Allocation Period:

The selection of the appropriate allocation period should align with the company's specific needs and the nature of the overhead activity. Factors to consider include:

- Frequency of incurrence: Activities incurred regularly (e.g., rent, salaries) are better suited for monthly allocation.

- Predictability of costs: Predictable costs can be allocated more accurately over longer periods.

- Management reporting requirements: The frequency of management reports should influence the allocation period.

- Accounting standards: Compliance with relevant accounting standards is crucial.

Accurate Allocation: The Cornerstone of Effective Overhead Management

Accurate allocation of overhead costs is not merely a bookkeeping exercise; it's crucial for several reasons:

-

Accurate Financial Reporting: Misallocation can lead to inaccurate financial statements, potentially misleading stakeholders and hindering informed decision-making.

-

Effective Cost Control: By accurately tracking and analyzing overhead costs, businesses can identify areas for improvement and cost reduction.

-

Pricing Decisions: Accurate overhead allocation is essential for determining accurate product or service costs and setting competitive prices.

-

Performance Evaluation: Proper allocation facilitates performance evaluation by providing a clearer picture of the efficiency and effectiveness of various departments and activities.

-

Budgeting and Forecasting: Accurate historical data on overhead costs is vital for creating realistic budgets and forecasts.

Optimizing Overhead Management: Strategies and Best Practices

Effective overhead management requires a strategic approach that includes:

-

Regular Monitoring and Analysis: Continuously monitor and analyze overhead costs to identify trends, outliers, and potential areas for improvement.

-

Cost Reduction Strategies: Implement strategies to reduce overhead costs, such as negotiating better rates with vendors, improving operational efficiency, and automating processes.

-

Technology Adoption: Leverage technology such as accounting software and data analytics tools to streamline overhead management and enhance accuracy.

-

Process Improvement: Regularly review and optimize business processes to identify and eliminate inefficiencies that contribute to higher overhead costs.

-

Benchmarking: Compare overhead costs to industry benchmarks to identify areas where improvements can be made.

-

Effective Communication and Collaboration: Establish clear communication channels and foster collaboration among departments to ensure everyone is aware of overhead cost targets and strategies.

Conclusion

Matching overhead activities to the correct time period is a fundamental aspect of accurate financial reporting and effective cost management. By understanding the nature of different overhead activities and selecting appropriate allocation periods, businesses can gain valuable insights into their cost structure, make informed decisions, and optimize their operations for enhanced profitability. Continuous monitoring, analysis, and strategic implementation of cost-reduction strategies are crucial for maintaining efficient overhead management and achieving sustainable business growth. Remember, accurate and timely allocation is not just about compliance; it’s about gaining a competitive edge through informed decision-making and enhanced resource management.

Latest Posts

Latest Posts

-

Feudal Japan Samurai And Weapons Webquest

Mar 14, 2025

-

For What Can Training Exercises Serve As Surrogate

Mar 14, 2025

-

Correctly Label The Following Anatomical Features Of The Stomach

Mar 14, 2025

-

11 3 7 Configure Tcp Ip Settings On Windows 10

Mar 14, 2025

-

Final Exam For Is 100 C

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Match The Following Overhead Activities To The Correct Time Period. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.