Mini Practice Set 1 Accounting Answers

Onlines

Mar 21, 2025 · 6 min read

Table of Contents

Mini Practice Set 1 Accounting Answers: A Comprehensive Guide

Are you struggling with your accounting mini practice set? Don't worry, you're not alone! Many students find these practice sets challenging, but mastering them is crucial for understanding core accounting principles. This comprehensive guide will walk you through a typical mini practice set 1, providing detailed answers and explanations to help you solidify your understanding. We'll cover common scenarios, problem-solving techniques, and essential accounting concepts to boost your confidence.

Understanding the Purpose of Mini Practice Sets

Before diving into the answers, let's understand why mini practice sets are so important. They're designed to test your understanding of fundamental accounting principles in a practical setting. Unlike theoretical questions, practice sets require you to apply your knowledge to real-world scenarios, simulating the tasks you'll encounter in an actual accounting role. Successfully completing these sets builds crucial skills like:

- Journalizing Transactions: Accurately recording financial transactions in the general journal.

- Posting to Ledgers: Transferring journal entries to the general ledger accounts.

- Preparing Trial Balances: Ensuring the debits and credits in the general ledger balance.

- Preparing Financial Statements: Creating the income statement, balance sheet, and statement of cash flows.

- Analyzing Financial Data: Interpreting the information presented in financial statements.

Mastering these skills is essential for success in accounting, regardless of your chosen specialization.

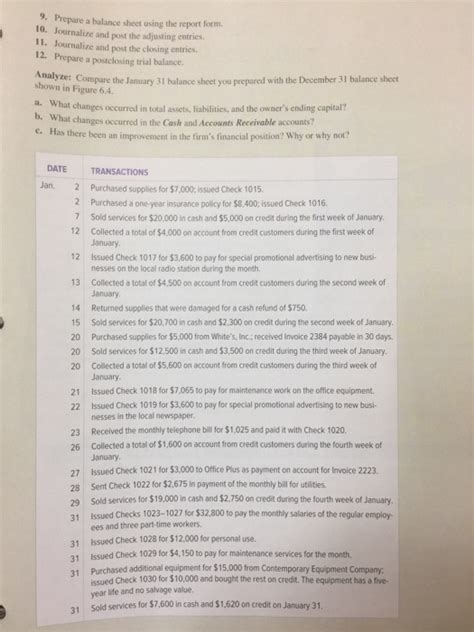

Common Scenarios in Mini Practice Set 1

Mini Practice Set 1 typically covers basic accounting concepts. The specific transactions and accounts used might vary depending on your textbook or instructor, but common scenarios include:

- Opening Entries: Recording the initial balances of assets, liabilities, and equity at the beginning of the accounting period.

- Sales Transactions: Recording sales on credit and cash sales, including sales taxes (if applicable).

- Purchases of Inventory: Recording purchases of goods for resale, considering both cash and credit purchases.

- Cash Payments: Recording payments for expenses like rent, utilities, salaries, and supplies.

- Adjusting Entries: Making end-of-period adjustments for items like depreciation, prepaid expenses, accrued expenses, and unearned revenue.

Step-by-Step Solution: A Sample Mini Practice Set

Let's work through a sample mini practice set. Keep in mind that this is a simplified example, and your actual practice set might be more complex. We’ll focus on the process and explain the logic behind each step.

Scenario: ABC Company started business on January 1, 20XX, with the following transactions:

- Jan 1: Invested $10,000 cash in the business.

- Jan 5: Purchased equipment for $3,000 cash.

- Jan 10: Purchased supplies for $500 on account.

- Jan 15: Provided services to customers for $2,000 cash.

- Jan 20: Paid $300 for rent expense.

- Jan 25: Received $1,000 from customers on account.

- Jan 31: Paid salaries of $800.

Step 1: Journal Entries

We'll record each transaction in a general journal, using debits and credits to follow the accounting equation (Assets = Liabilities + Equity).

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| Jan 1 | Cash | $10,000 | |

| Owner's Equity (Capital) | $10,000 | ||

| Investment of cash by owner | |||

| Jan 5 | Equipment | $3,000 | |

| Cash | $3,000 | ||

| Purchase of equipment | |||

| Jan 10 | Supplies | $500 | |

| Accounts Payable | $500 | ||

| Purchase of supplies on account | |||

| Jan 15 | Cash | $2,000 | |

| Service Revenue | $2,000 | ||

| Cash received from services | |||

| Jan 20 | Rent Expense | $300 | |

| Cash | $300 | ||

| Payment of rent | |||

| Jan 25 | Cash | $1,000 | |

| Accounts Receivable | $1,000 | ||

| Cash received from accounts receivable | |||

| Jan 31 | Salaries Expense | $800 | |

| Cash | $800 | ||

| Payment of salaries |

Step 2: Posting to Ledger Accounts

Next, we post the debit and credit amounts from the journal entries to the respective ledger accounts. This organizes the transactions by account. Each account will show a running balance. (Note: This step is omitted for brevity but is a crucial part of the process).

Step 3: Trial Balance

After posting to the ledger, we prepare a trial balance to ensure the debits and credits are equal. This is a vital step in verifying the accuracy of your work. A trial balance lists all accounts with their debit or credit balances. The total debits must equal the total credits.

Step 4: Preparing Financial Statements

Using the information from the trial balance, we create the financial statements:

-

Income Statement: Shows the revenues and expenses for the period, resulting in the net income or net loss.

-

Balance Sheet: Shows the assets, liabilities, and equity at a specific point in time.

Step 5: Analyzing the Financial Statements

Finally, analyze the financial statements to assess the company's financial performance and position. This includes calculating key ratios and interpreting the data to understand trends and potential issues.

Advanced Concepts and Potential Complications

While Mini Practice Set 1 typically focuses on basic transactions, more advanced concepts might be introduced, including:

- Depreciation: The systematic allocation of the cost of an asset over its useful life.

- Accrued Expenses: Expenses incurred but not yet paid (e.g., salaries payable, interest payable).

- Prepaid Expenses: Expenses paid in advance (e.g., prepaid rent, prepaid insurance).

- Unearned Revenue: Revenue received but not yet earned (e.g., advance payments from customers).

- Inventory Management: Using methods like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out) to account for the cost of goods sold.

These concepts add layers of complexity but are essential for a thorough understanding of accounting. Properly handling these adjustments is crucial for creating accurate financial statements.

Troubleshooting Common Mistakes

Students often make common mistakes when working on mini practice sets. Some of the most frequent errors include:

- Incorrect Journal Entries: Double-checking debits and credits is essential. Every transaction must follow the fundamental accounting equation.

- Errors in Posting: Carefully transfer entries from the journal to the ledger accounts. Any posting error will affect the trial balance and subsequent financial statements.

- Omitting Adjusting Entries: Failure to make necessary adjusting entries will result in inaccurate financial statements.

- Misunderstanding Account Classifications: Ensure you correctly classify accounts as assets, liabilities, equity, revenues, or expenses.

By carefully reviewing your work and understanding the underlying principles, you can minimize these errors.

Tips for Success

- Understand the Accounting Equation: This is the foundation of accounting: Assets = Liabilities + Equity. Every transaction must keep this equation balanced.

- Practice Regularly: The more you practice, the better you'll become at applying accounting principles.

- Use a Textbook or Online Resources: Consult your accounting textbook or reputable online resources for additional explanations and examples.

- Seek Help When Needed: Don't hesitate to ask your instructor or classmates for help if you're struggling with specific concepts.

- Break Down Complex Problems: If a problem seems overwhelming, break it down into smaller, manageable parts.

By following these tips and diligently working through the practice set, you'll build a strong understanding of accounting fundamentals and improve your problem-solving skills. Remember, practice is key! The more you work through these exercises, the more confident and proficient you'll become in accounting. Good luck!

Latest Posts

Latest Posts

-

A Shipmate Is Acting Depressed And Mentions

Mar 22, 2025

-

Ricardo Y Emilia Traer Un Pastel Su Prima

Mar 22, 2025

-

Lesson 14 Analyzing Word Choice Answer Key

Mar 22, 2025

-

Complete This Vocabulary Exercise Relating To Enzymes

Mar 22, 2025

-

Ngpf Compare Auto Loans Answer Key

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Mini Practice Set 1 Accounting Answers . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.