Ngpf Compare Auto Loans Answer Key

Onlines

Mar 22, 2025 · 5 min read

Table of Contents

Decoding the NGPF Compare Auto Loans Activity: A Comprehensive Guide

The Next Gen Personal Finance (NGPF) Compare Auto Loans activity is a valuable tool for understanding the intricacies of auto loan financing. This guide will provide a comprehensive walkthrough of the activity, explaining the key concepts, offering detailed solutions, and equipping you with the knowledge to navigate the world of auto loans effectively. While we won't provide a direct "answer key," we will provide the methodology and reasoning behind finding the optimal auto loan, enabling you to confidently tackle similar scenarios.

Understanding the Core Concepts

Before diving into the specifics of the NGPF activity, it’s crucial to grasp the foundational elements of auto loan comparisons:

1. Interest Rate:

This is the cost of borrowing money. A lower interest rate translates to lower overall interest paid over the loan term. Factors influencing interest rates include your credit score, the loan term, and the type of vehicle. A higher credit score generally leads to a lower interest rate.

2. Loan Term:

This represents the length of time you have to repay the loan. Longer loan terms typically result in lower monthly payments but higher total interest paid. Shorter loan terms mean higher monthly payments but lower overall interest costs.

3. Loan Amount:

This is the principal amount borrowed to purchase the vehicle. The loan amount directly influences both your monthly payments and the total interest paid.

4. Monthly Payment:

This is the fixed amount you pay each month towards the loan principal and interest. The calculation involves the loan amount, interest rate, and loan term.

5. Total Interest Paid:

This is the cumulative amount of interest paid over the life of the loan. It represents the additional cost beyond the principal loan amount.

Analyzing Auto Loan Offers in the NGPF Activity

The NGPF activity presents you with several auto loan offers, each with varying interest rates, loan terms, and consequently, monthly payments and total interest paid. To effectively compare these offers, you need a systematic approach:

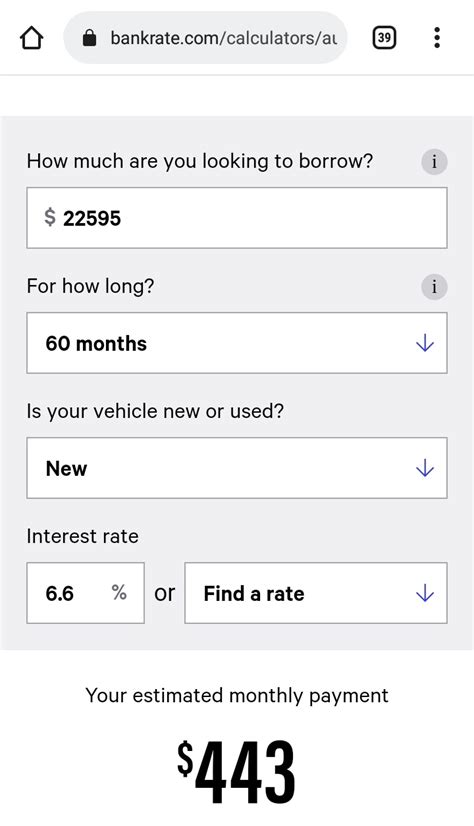

1. Calculate Monthly Payments:

While the activity likely provides monthly payments, understanding how they're calculated is crucial. You can use online calculators or the following formula (though a financial calculator or spreadsheet software is recommended for accuracy):

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Number of Months (Loan Term in years * 12)

2. Compare Total Interest Paid:

This is a critical factor in determining the best loan option. A lower total interest paid signifies a more cost-effective loan. Calculate this by subtracting the principal loan amount from the total amount repaid (monthly payment * number of months).

3. Consider the "True Cost":

While monthly payments might seem attractive, focus on the total cost. A lower monthly payment with a significantly higher total interest paid might appear cheaper initially but becomes more expensive in the long run.

4. Analyze the Impact of Credit Score:

The NGPF activity might illustrate how your credit score affects the interest rate offered. A higher credit score generally results in lower interest rates, leading to significant savings over the life of the loan. This highlights the importance of maintaining a good credit history.

5. Evaluate Loan Term Implications:

Compare the impact of different loan terms. A longer term reduces monthly payments, but increases the total interest paid. A shorter term increases monthly payments but significantly reduces the total interest paid. The optimal choice depends on your financial situation and priorities.

Beyond the Numbers: Qualitative Factors to Consider

While the NGPF activity focuses on quantitative aspects, remember that several qualitative factors play a vital role in selecting an auto loan:

1. Lender Reputation:

Choose a reputable and trustworthy lender. Research their customer reviews and ensure they're licensed and compliant with relevant regulations.

2. Loan Terms and Conditions:

Carefully read the loan agreement to understand all the terms and conditions, including prepayment penalties, late payment fees, and other charges.

3. Customer Service:

A lender with excellent customer service can make the entire process smoother and more manageable.

4. Pre-approval:

Getting pre-approved for an auto loan before shopping for a car can give you a clearer picture of your budget and strengthens your negotiating position with dealerships.

Strategies for Effective Auto Loan Management

After securing an auto loan, effective management is key to avoiding financial pitfalls:

1. Budgeting:

Incorporate your monthly auto loan payment into your budget to ensure it aligns with your overall financial plan.

2. Timely Payments:

Make timely payments to avoid late payment fees and damage to your credit score. Set up automatic payments to avoid missing deadlines.

3. Extra Payments:

Consider making extra payments whenever possible to reduce the principal amount and accelerate loan repayment, saving on interest costs.

4. Refinancing:

If interest rates decline significantly after securing your loan, explore refinancing options to potentially lower your monthly payments or shorten the loan term.

The NGPF Activity: A Stepping Stone to Financial Literacy

The NGPF Compare Auto Loans activity serves as an excellent introduction to the complexities of auto loan financing. By understanding the underlying concepts and applying the analytical approach described above, you can make informed decisions and avoid costly mistakes. Remember that the goal is not just to find the "right answer" in the activity but to develop the financial literacy to navigate real-world auto loan scenarios confidently. This exercise provides a valuable foundation for making responsible and financially sound decisions in your future financial endeavors. The skills honed in this activity extend far beyond auto loans; they’re applicable to various financial situations, from mortgages and student loans to personal debt management. The focus on comparing different options and understanding the long-term implications of financial choices is an invaluable lesson for responsible financial management.

Conclusion:

While this guide doesn't provide the specific answers to the NGPF Compare Auto Loans activity, it equips you with the tools and knowledge to confidently approach and solve similar problems. Remember that understanding the interplay between interest rates, loan terms, and total cost is essential. By developing a systematic approach and considering both quantitative and qualitative factors, you can become a more informed and effective consumer of financial products. This enhanced financial literacy will serve you well throughout your life, empowering you to make responsible and well-informed financial decisions. The NGPF activity is a valuable stepping stone on this journey towards greater financial independence.

Latest Posts

Latest Posts

-

Unit 5 Relationships In Triangles Homework 5 Answer Key

Mar 22, 2025

-

Why Was The Liquid In The Can Free Of Microbes

Mar 22, 2025

-

What Is The Total Of Amalas Liabilities

Mar 22, 2025

-

Awareness Of Positive Expectations Can Actually Improve Performance On Tasks

Mar 22, 2025

-

A Los Pacientes Con Dolor De Cabeza Puedes Decirles

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Ngpf Compare Auto Loans Answer Key . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.